- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

This is why Micron Technology's (NASDAQ:MU) Balance Sheet is Well Structured

When assessing the future potential of a company such as Micron Technology, Inc. ( NASDAQ:MU ), investors benefit from knowing the quality of the foundation upon which the company can grow. In our case, that foundation is going to be Micron's balance sheet, and we are going to see if the company is ready to grow even more for shareholders.

There are multiple components of the balance sheet that are worth looking at, such as debt, equity and liquid assets. These can tell us if the company can service its obligations successfully and if it has anything left over to invest in its business.

Check out our latest analysis for Micron Technology

What Is Micron Technology's Debt?

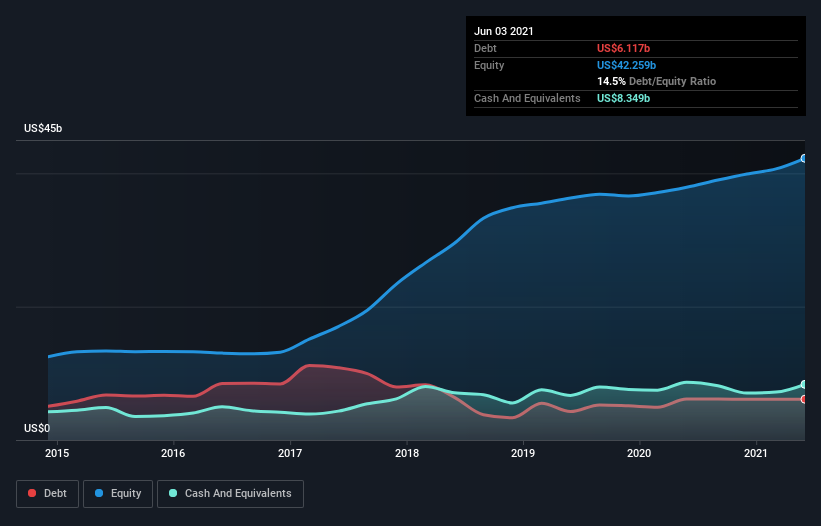

As you can see below, Micron Technology had US$6.12b of debt, at June 2021 , which is about the same as the year before. This shows consistency on the part of the company, indicating that it does not need much more long term debt and that should the need arise, they have some room left to get financing.

Its balance sheet shows it holds US$8.35b in cash, so it actually has US$2.23b net cash.

Micron is also not aggressive in financing, and the last two financing events for Micron were:

- May 14th, a revolving credit extension with HSBC for US$2.5b

- A shelf registration of 35 million new common shares. Note, shelf registrations are practically issuance of new shares that the company can sell at a later point in time. Companies use this approach to raise finances from equity

Turning to the overall picture of debt, cash and equity, we can see that Micron is quite the stable and balanced company.

You can click the chart for greater detail.

A Look At Micron Technology's Liabilities

The latest balance sheet data shows that Micron Technology had liabilities of US$5.46b due within a year, and liabilities of US$8.22b falling due after that. Offsetting this, it had US$8.35b in cash and US$4.23b in receivables that were due within 12 months. So, its liabilities total US$1.10b more than the combination of its cash and short-term receivables.

Having regard to Micron Technology's size, it seems that its liquid assets are well-balanced with its total liabilities. So while it's hard to imagine that the US$83.3b company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, Micron Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Micron Technology grew its EBIT by 103% over twelve months. If maintained, that growth will make the debt even more manageable in the years ahead.

Summing up

Micron has net cash of US$2.23b, and room to expand debt financing should the need arise. This gives investors some breathing room when watching the company.

Micron's market cap also allows the company to raise financing from equity, which means the company can raise even more cash if it needs to invest in capital projects. Last year's 103% year-on-year EBIT growth also assures that the company is potentially heading for more growth.

So is Micron Technology's debt a risk? It doesn't seem so to us.

Not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Micron Technology you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet .

Simply Wall St Analyst, Goran Damchevski holds a position in Micron Technology, Inc. ( NASDAQ:MU ). This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success