- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (NasdaqGS:MU) Sees 27% Weekly Price Drop As AI Memory Solutions Announced

Reviewed by Simply Wall St

Micron Technology (NasdaqGS:MU) experienced a price move of 27% in the past week, coinciding with significant events such as its AI memory solutions announcement and the restructuring of its credit agreement. However, the broader market turmoil, with the Nasdaq entering bear market territory and other chipmakers like Nvidia and Broadcom facing declines due to escalating global trade tensions, overshadowed these developments. The semiconductor sector, including Micron, was particularly affected by China's retaliatory tariffs, pushing Micron's performance lower as market sentiment weighed heavily on technology stocks amid economic uncertainties.

The recent developments at Micron Technology, such as the AI memory solutions announcement and credit restructuring, have a potential to positively impact the company's market position. The introduction of advanced technology like HBM and partnerships with major players like NVIDIA are expected to bolster Micron's revenue and earnings forecasts. Increasing market demand for AI-related memory products could further enhance Micron's revenue growth potential. However, broader market turmoil from factors like global trade tensions and China's tariffs could continue to influence investor sentiment adversely.

Micron's shares enjoyed a total return of 43.51% over the past five years, reflecting growth driven by its strategic initiatives and product innovations. However, over the past year, it underperformed the US Semiconductor industry and the US market by returning less than both sectors. This past year underperformance might reflect short-term pressures that overshadow longer-term growth prospects.

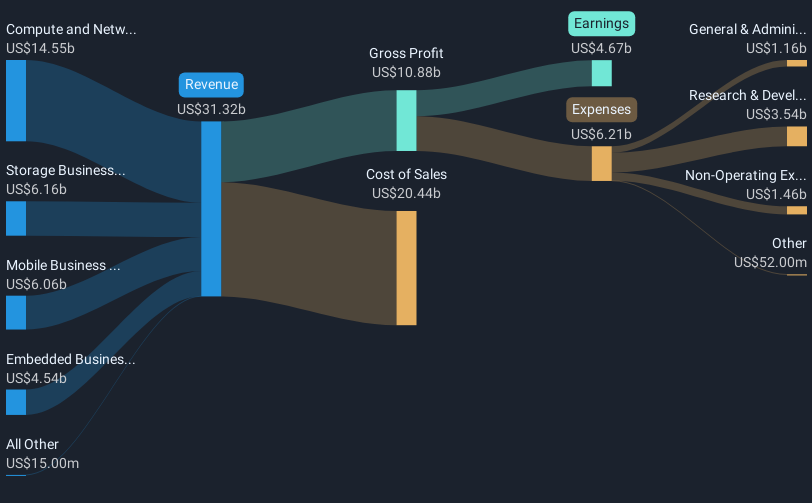

With the current share price at US$88.71, the consensus analyst price target of US$129.07 suggests a potential upside. Achieving this target relies on Micron's ability to meet the forecasted revenue of US$45.2 billion and earnings in the billions, amid growth opportunities highlighted by recent news. As analysts anticipate annual revenue growth, successful implementation of technological advancements and effective cost management will be crucial to improve margins and earnings potential, navigating through emerging challenges.

Examine Micron Technology's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Micron Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Mainland China, rest of the Asia Pacific, Hong Kong, Japan, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives