- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology, Inc. (NASDAQ:MU) seems to be an Expensive Company whose Products are in High Demand

Micron Technology, Inc. (NASDAQ:MU) shareholders are probably feeling somewhat confused, since its shares are quite volatile these last few days. We wanted to take a closer look at the big picture and see if there is value for shareholders at current levels.

In their last report, Micron Technology beat revenue expectations by 2.1%, recording sales of US$7.4b. Statutory earnings per share (EPS) came in at US$1.52, some 4.6% short of analyst estimates. As you can see in the chart below, they made a revenue recovery in the past 2 quarters and are posting results in-line with expectations.

In their forward outlook, they stress that mobile unit sales are expected to have high growth, driven by an expected doubling in 5G units for the 2021 calendar year. They also expect DRAM growth to be somewhat 20%, driven by supply shortages, and not organic growth - This is partly why the growth rate can stagnate after the short term demand is met withing 3 years.

Keep in mind that their DRAM products account for 73% of revenue, and their NAND products account for 24%. This means that DRAM is the main driver of revenue and will be subject to fluctuating demand in the industry.

View our latest analysis for Micron Technology

Taking into account the latest results, the consensus forecast from Micron Technology's 30 analysts is for revenues of US$37.0b in 2022, which would reflect a huge 45% improvement in sales compared to the last 12 months.

Per-share earnings are expected to soar 212% to US$11.52.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates.

The analysts are definitely expecting Micron Technology's growth to accelerate, with the forecast 35% annualized growth to the end of 2022 ranking favorably alongside historical growth of 8.0% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 8.5% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Micron Technology is expected to grow much faster than its industry.

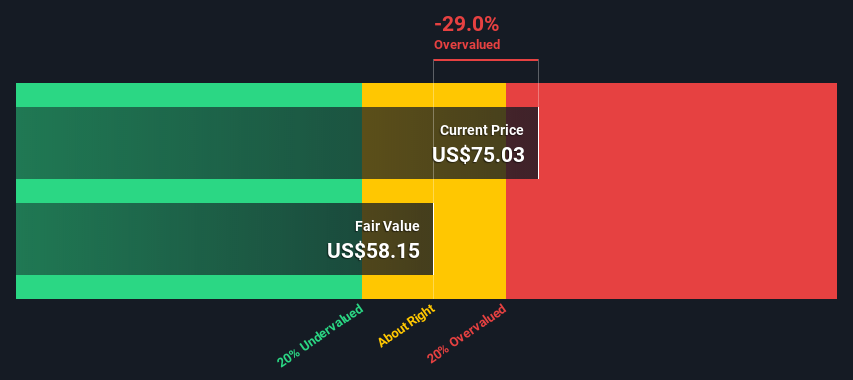

When looking at a company, it is important to put things into perspective. We do that by taking all future estimates, margins, risk, past performance, and calculating an intrinsic value for the stock. This gives investors a rough feeling of how much cash is behind each share, and is a great way to see if we are close to what the business is worth long term when investing. Our DCF calculator is a very rough estimate of intrinsic value and not a suggestion to buy or sell a security.

This is quite informative, as it shows that the stock is still expensive, even with the high performance and positive future estimates. It also shows investors possibilities for monitoring significant price changes, since a large drop may turn an overvalued stock to undervalued by our rough estimates.

The Bottom Line

Micron has had a great run, and will probably grow even more on the wave of the chip shortage crisis. The stock seems expensive by our rough estimates, but is the type of company that is in a growing industry with high margins and high demand for products.

The company is expanding, investing and further developing their products for a possible stronger uptake in Electrical vehicles, Healthcare, and Edge computing.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Micron Technology going out to 2023, and you can see them free on our platform here..

You should always think about risks though. Case in point, we've spotted 1 warning sign for Micron Technology you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives