- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

A Fresh Look at Micron Technology (MU) Valuation After High-Bandwidth Memory Demand Sparks Guidance Upgrade

Reviewed by Simply Wall St

Micron Technology (MU) just hit a new 52-week high after announcing a sharp ramp-up in high-bandwidth memory (HBM3E) production to meet powerful demand from major AI players like Nvidia and AMD. The recent upgrade to its fourth quarter guidance, driven by rising DRAM prices, resilient execution, and momentum in AI memory, has investors looking closely at whether this is the beginning of a new phase for Micron or simply a reaction to a red-hot sector. A streak of earnings beats and a wave of upward earnings estimate revisions are further fueling optimism around the stock’s near-term prospects.

All of this comes as Micron’s share price has surged more than 56% over the past year, with record-breaking performance in recent months. Supply agreements with industry giants and positive institutional sentiment have pushed momentum higher. Policy tailwinds like U.S. chip subsidies and new trade restrictions have also added to the company’s competitive strengths. Revenue and net income have both grown double digits year-over-year, reinforcing a stronger foundation heading into the next earnings cycle.

This raises a practical question for investors: is Micron’s recent rally signaling an opportunity to buy in, or is the market already pricing in the company’s future growth story?

Most Popular Narrative: 10% Undervalued

According to the most widely followed narrative, Micron Technology is undervalued by around 10 percent, with analysts projecting a fair value above its current market price.

Explosive growth in AI and data center applications is driving robust, sustained demand for advanced DRAM and high-bandwidth memory (HBM). This has resulted in improved pricing power, strengthening bit growth forecasts, and long-term revenue tailwinds for Micron.

Want to understand what is fueling this big upside call? Analysts are anchoring their price target on ambitious growth in high-value memory, expanding margins, and bold future profit projections. The financial leaps they are expecting might surprise you. Curious to see the numbers and the method behind this bullish valuation?

Result: Fair Value of $150.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition among global memory giants and unpredictable shifts in DRAM and NAND markets could quickly change Micron’s growth trajectory.

Find out about the key risks to this Micron Technology narrative.Another View: Discounted Cash Flow Model

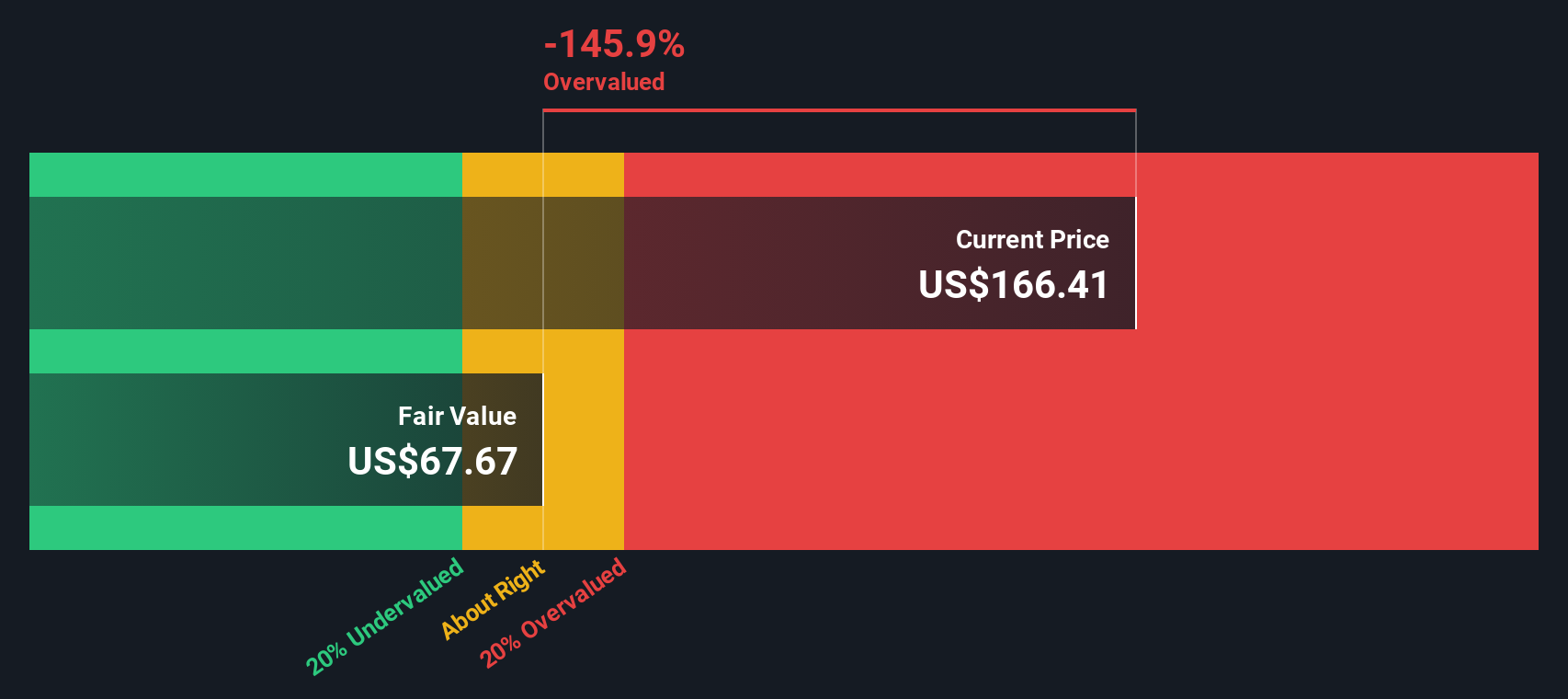

Taking a look at our DCF model, the story shifts. This approach suggests Micron’s current share price is actually above its estimated fair value. This raises doubts about how much future growth is already factored in. Which perspective better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Micron Technology Narrative

If you see things differently or want to dig into Micron’s numbers yourself, you can quickly craft your own view in just a few minutes. Do it your way

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Unlock your potential by targeting stocks that fit your strategy. Don’t let great investments slip past you when powerful tools are right at your fingertips. With Simply Wall Street’s screener, you can:

- Capture unlikely winners as you spot penny stocks with strong financials defying expectations with impressive financial strength.

- Fuel your portfolio’s growth and harness the momentum in next-generation tech by targeting companies at the forefront of artificial intelligence through AI penny stocks.

- Secure overlooked value by seeking out stocks trading below their true worth using our platform’s access to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026