- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

There's Reason For Concern Over Marvell Technology, Inc.'s (NASDAQ:MRVL) Massive 29% Price Jump

Marvell Technology, Inc. (NASDAQ:MRVL) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

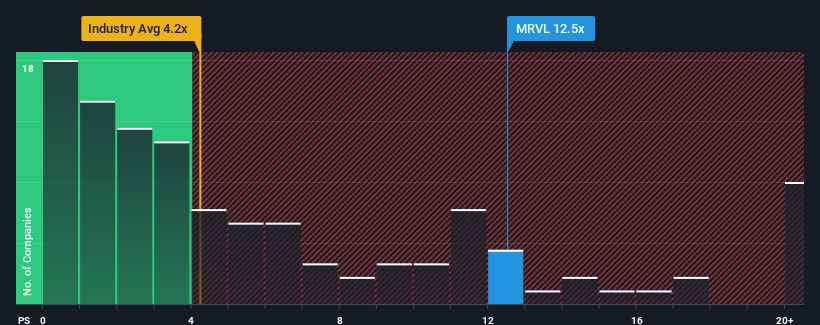

After such a large jump in price, Marvell Technology's price-to-sales (or "P/S") ratio of 12.5x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 4.2x and even P/S below 1.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Marvell Technology

How Has Marvell Technology Performed Recently?

Marvell Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Marvell Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Marvell Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Marvell Technology would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.9%. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 24% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 25% per year, which is not materially different.

With this information, we find it interesting that Marvell Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has lead to Marvell Technology's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Marvell Technology currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Marvell Technology with six simple checks on some of these key factors.

If you're unsure about the strength of Marvell Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives