- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (NasdaqGS:MRVL) Reports US$200 Million Income Despite 26% Stock Slide

Reviewed by Simply Wall St

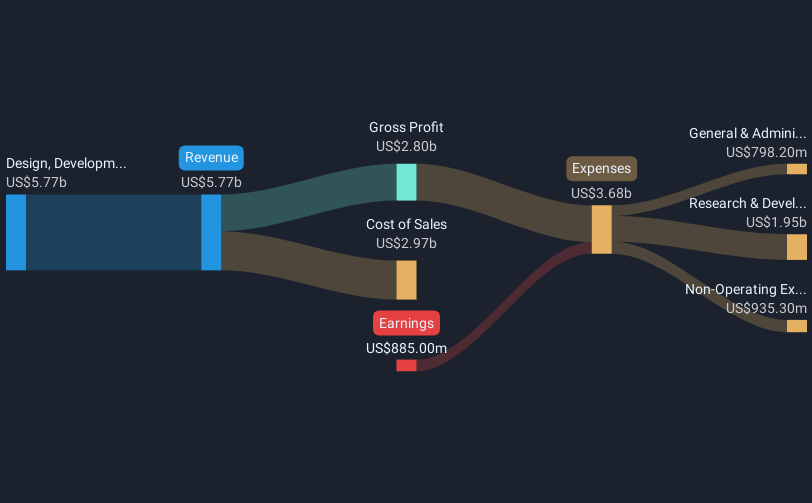

Marvell Technology (NasdaqGS:MRVL) recently reported positive fourth-quarter results, with a year-over-year rise in sales and a return to profitability, shifting from a net loss to a net income of USD 200 million. Despite this, the company experienced a significant price move of 26% last week. This shift coincided with broader market turbulence, as economic uncertainties and new tariffs impacted investor sentiment, contributing to the Nasdaq Composite's 4% drop, its worst since 2022. Marvell's optimistic revenue and earnings guidance for the first quarter and fiscal year 2026 couldn't shield it from the market's broader negativity. Highlighting their product innovations, such as the introduction of 2nm silicon IP for AI and cloud infrastructure, was overshadowed by the market's focus on immediate macroeconomic concerns. Therefore, the stock's price movement is reflective of external market conditions and investor reactions rather than fundamental company performance.

Take a closer look at Marvell Technology's potential here.

The last five years have been transformative for Marvell Technology, resulting in a total shareholder return of 257.33%, which underscores the value returned to investors despite the company's recent underperformance compared to the US Semiconductor industry and broader market over the past year. Throughout this period, Marvell has navigated market volatility by adopting strategic growth initiatives, including its expanded collaboration with AWS, which positions it well within the data center semiconductor space. This partnership reflects the company's aim to enhance its service offerings and fortify its market position.

Product innovations, particularly in the realm of advanced semiconductor technologies, have seen Marvell at the forefront of industry developments. The launch of the Aquila coherent-lite DSP and the introduction of Marvell Ara highlight its commitment to technological advancements. Alongside, Marvell has consistently rewarded its investors through quarterly dividends and strategic share buybacks, reflecting its continued focus on enhancing shareholder value even in challenging market conditions.

- Unlock the insights behind Marvell Technology's valuation and discover its true investment potential

- Gain insight into the risks facing Marvell Technology and how they might influence its performance—click here to read more.

- Have a stake in Marvell Technology? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives