- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (MRVL) Expands Cloud Security With Microsoft Azure Collaboration

Reviewed by Simply Wall St

Marvell Technology's (MRVL) recent partnership expansion with Microsoft highlights the company’s strategic focus on cloud security, notably contributing to its 25% price increase over the last quarter. While major indexes like the S&P 500 and Nasdaq faced slumps, Marvell's announcement of providing its LiquidSecurity HSMs for Microsoft Azure Cloud HSM services may have bolstered investor confidence, setting it apart in a sluggish tech market. Executive changes, such as Rajiv Ramaswami's appointment to the board, and new product launches like the UALink offering also reinforced Marvell's market position amidst broader challenging conditions.

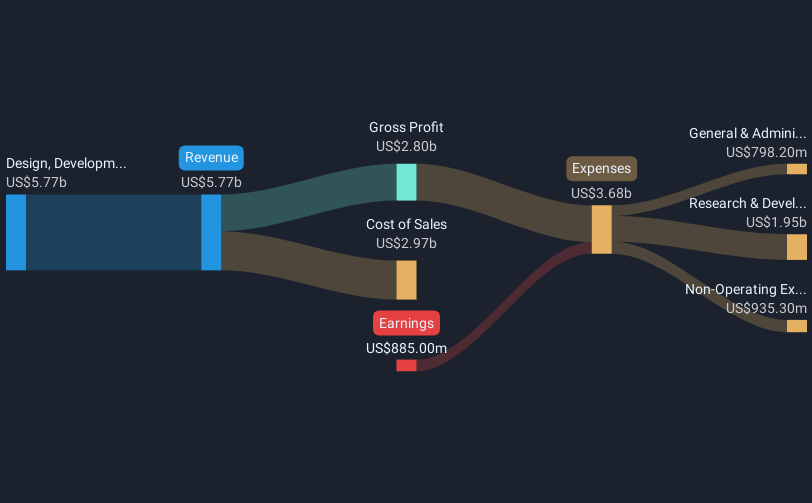

The recent expansion of Marvell Technology's partnership with Microsoft, particularly the integration of LiquidSecurity HSMs into Microsoft Azure Cloud HSM services, could have significant implications for Marvell's future revenue and earnings forecasts. By fortifying its standing in cloud security, Marvell is potentially positioning itself to capture a larger share of the rapidly growing AI and data center markets. Analysts anticipate this move might drive enhancements in Marvell’s revenue streams and profit margins, aligning with their expectations of a 16.4% annual growth in revenue over the next few years. This aligns with their revenue target of $11.8 billion by 2028 as demand for high-performance products continues to expand.

Over a longer period, Marvell's total return, incorporating both share price and dividends, climbed 125.83% over the past five years, providing a strong backdrop to its recent developments. However, in the last year, Marvell underperformed compared to both the US semiconductor industry, which returned 32.4%, and the broader US market, which had a 15.8% return. With its current share price at $76.74, the 25% increase over the last quarter coupled with the analyst price target of $90.31 suggests optimism among investors. This target represents a 12.2% upside potential from its current valuation, indicating a positive outlook if the anticipated growth in AI demand and technological advancements are realized as expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives