- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell (MRVL) EPS Surge Reinforces Bullish AI Profitability Narrative Despite Valuation Questions

Reviewed by Simply Wall St

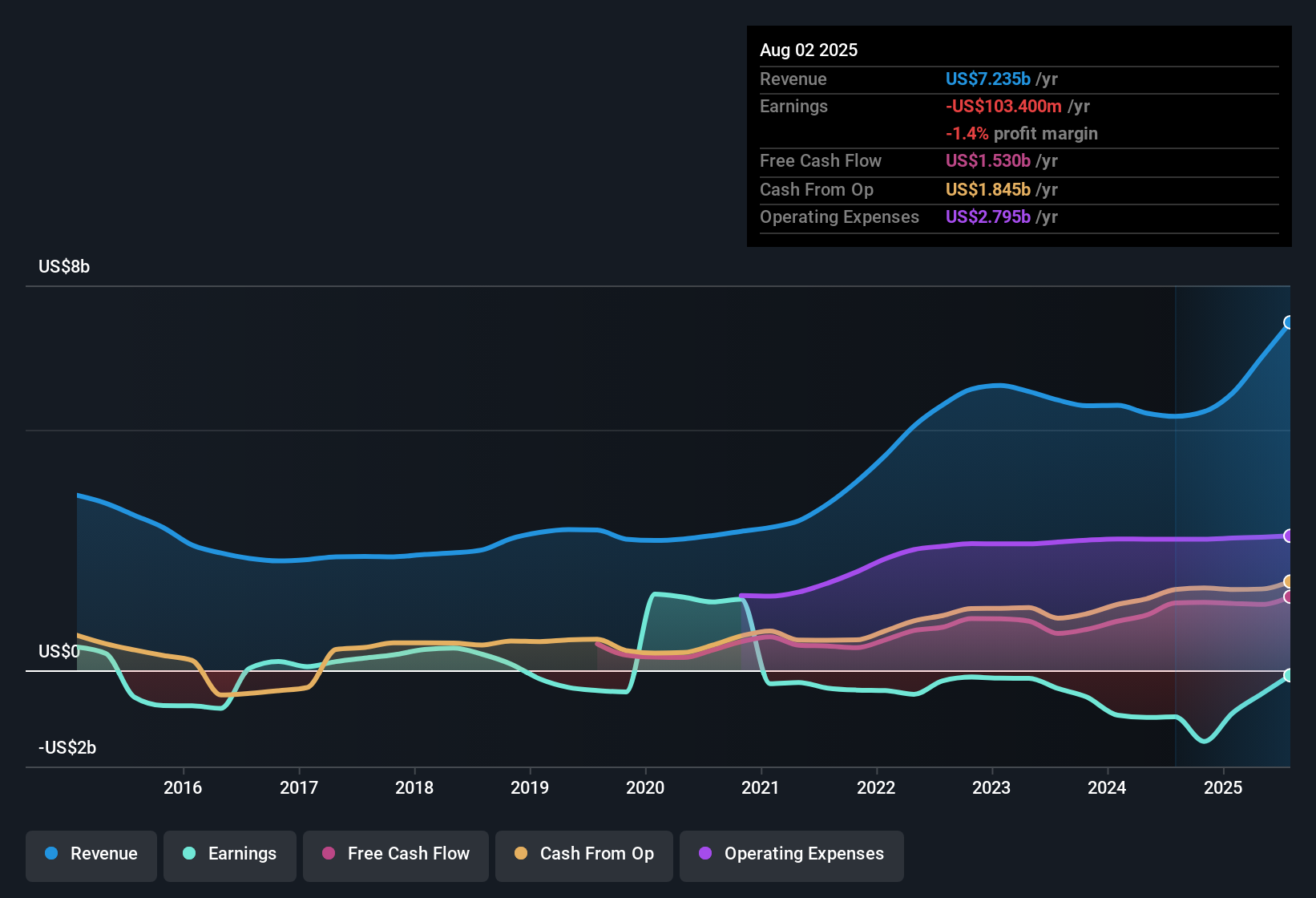

Marvell Technology (MRVL) has turned in a punchy Q3 2026 print, with revenue of about $2.1 billion and basic EPS of $2.22, while net income (excluding extra items) came in at $1.9 billion as the latest marker of its profitability turnaround. The company has seen revenue move from $1.52 billion in Q3 2025 to $2.07 billion in Q3 2026 alongside a swing in net income from a loss of $676.3 million to a $1.9 billion profit, setting up a quarter where margins look materially healthier and far more scalable for investors watching the story unfold.

See our full analysis for Marvell Technology.With the headline numbers on the table, the next step is to line these results up against the dominant narratives around Marvell to see which stories the data backs up and which ones start to look a bit stretched.

See what the community is saying about Marvell Technology

From -$1.5 Billion LTM Loss To $2.5 Billion Profit

- On a trailing twelve month basis, net income went from a loss of about $1.5 billion a year ago to a profit of roughly $2.5 billion now, while revenue over the same window rose from $5.4 billion to $7.8 billion.

- Analysts’ consensus view ties this sharp profitability swing to Marvell’s wins in custom data center silicon and networking, but also flags that heavy exposure to large AI and cloud projects can make these gains more volatile.

- The move from negative TTM EPS of about -$1.7 a year ago to positive $2.9 today backs the idea that operating leverage from higher margin data center and networking products is starting to show up in the bottom line.

- At the same time, the consensus narrative highlights that reliance on a concentrated set of data center customers means these higher profits are more sensitive to any pullback in hyperscaler spending.

Revenue Growing Faster Than Earnings

- Revenue is forecast to grow about 18.6 percent per year, while earnings are expected to grow more slowly at roughly 5.5 percent per year, suggesting future sales expansion could outpace net income growth.

- Supporters of the bullish narrative point to this strong top line outlook and improving profit margins as proof that Marvell’s AI and cloud positioning can keep driving the story, even if near term earnings growth looks more modest than revenue growth.

- Consensus assumptions that margins improve from a recent negative level to the low 20s by around 2028 lean on the idea that today’s high research and development spending on custom silicon and optical networking will be spread over a much larger revenue base.

- However, the same bullish narrative also acknowledges that large, “lumpy” custom projects could make that path bumpy, because delays or design losses for just a few big customers would show up quickly in earnings growth figures.

Mixed Signals From P/E And DCF Fair Value

- Marvell trades on a price to earnings ratio of 34.9 times, below the US semiconductor average of 36.2 times and far below the peer average of 72.1 times, yet the latest DCF fair value of about $91.69 sits under the current share price of $100.23.

- Bears focus on this gap between the share price and DCF fair value, and on the five year annual earnings decline of 6.6 percent, as reasons to question how much of the profitability recovery is already priced in.

- Valuation data shows the stock at a premium to its own modeled DCF fair value even after the business has turned profitable on a trailing twelve month basis, which skeptics argue leaves less margin for error if growth slows.

- That five year negative earnings trend, combined with a current valuation that still leans on strong future growth, gives bears ammunition to argue that investors are paying up in advance for AI and cloud demand that must keep delivering.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Marvell Technology on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to dig into the data, frame your own long term view, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Marvell Technology.

See What Else Is Out There

Despite a sharp profitability rebound, Marvell still faces slower projected earnings growth than revenue, exposure to lumpy AI projects, and a share price above modeled fair value.

If those trade offs feel uncomfortable, use our these 921 undervalued stocks based on cash flows today to focus on candidates where valuations look more reasonable relative to their growth and earnings trajectories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026