- United States

- /

- Chemicals

- /

- NasdaqCM:SLSN

US Market's Undiscovered Gems October 2025

Reviewed by Simply Wall St

As of October 2025, the U.S. stock market has shown resilience with major indices like the Dow Jones Industrial Average and S&P 500 setting new records, despite mixed performances and economic uncertainties stemming from a government shutdown. In this dynamic environment, identifying promising small-cap stocks can be particularly rewarding as these companies often offer unique growth opportunities that larger firms may not provide.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Solesence (SLSN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solesence, Inc. is a science-driven company that develops, manufactures, and sells an integrated family of technologies in the United States with a market capitalization of $284.04 million.

Operations: Solesence generates revenue primarily from its Specialty Chemicals segment, which accounts for $64.42 million.

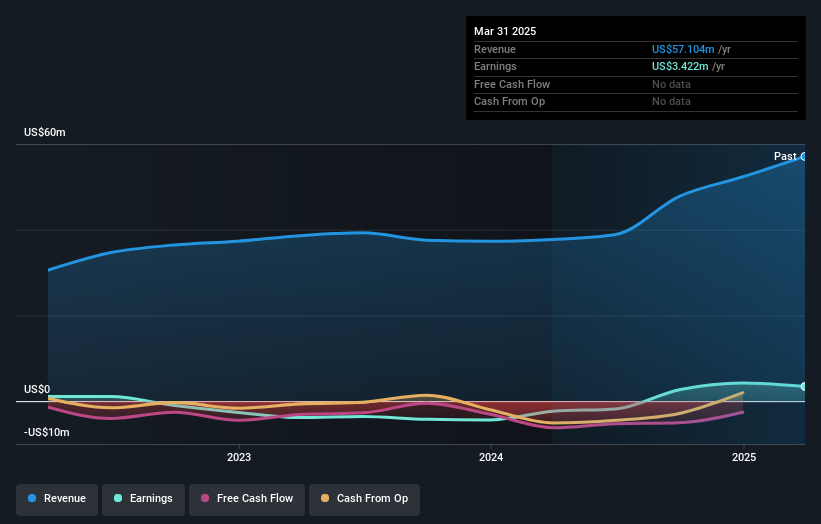

Solesence, a nimble player in the beauty science sector, has shown notable financial strides recently. The company reported a revenue surge to US$20.36 million in Q2 2025 from US$13.05 million the previous year, with net income climbing to US$2.67 million from US$0.86 million. Despite having a high net debt to equity ratio at 68.7%, its interest payments are comfortably covered by EBIT at 9.8 times coverage, indicating solid financial management amidst volatility concerns over its share price movements in recent months and strategic leadership changes aimed at driving future growth.

Hingham Institution for Savings (HIFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hingham Institution for Savings offers a range of financial services to individuals and small businesses in the United States, with a market capitalization of $609.46 million.

Operations: Hingham Institution for Savings generates revenue primarily from its financial services, amounting to $75.07 million. The company's net profit margin reflects its profitability dynamics.

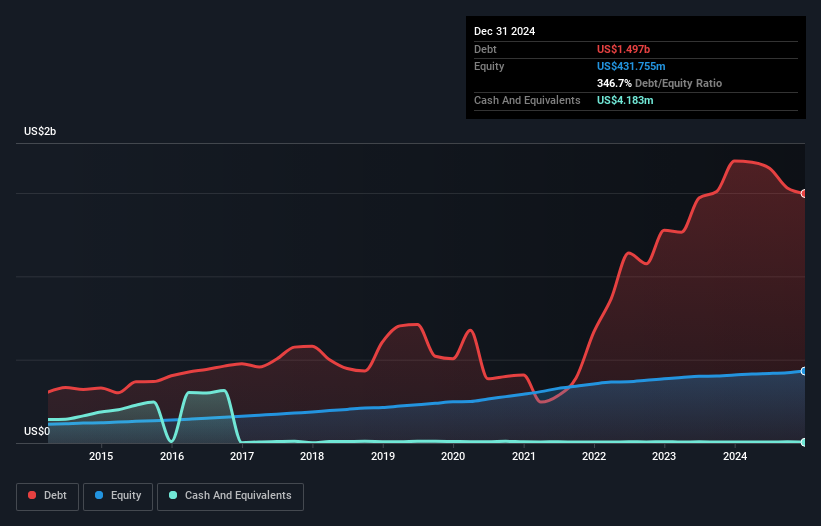

Hingham Institution for Savings, with total assets of US$4.5 billion and equity of US$445.8 million, is a notable player in the financial sector. The bank's total deposits are US$2.5 billion against loans of US$3.9 billion, indicating robust lending activity despite a net interest margin of 1%. While it has an appropriate bad loan ratio at 0.8%, its allowance for bad loans is low at 87%, suggesting room for improvement in risk management practices. Earnings have surged by 64% over the past year, outpacing the industry average significantly, yet earnings have decreased by 18% annually over five years.

Everspin Technologies (MRAM)

Simply Wall St Value Rating: ★★★★★★

Overview: Everspin Technologies, Inc. specializes in the production and distribution of magnetoresistive random access memory (MRAM) technologies across various international markets, with a market capitalization of $257.70 million.

Operations: Everspin generates revenue primarily from its semiconductor segment, which accounts for $51.68 million.

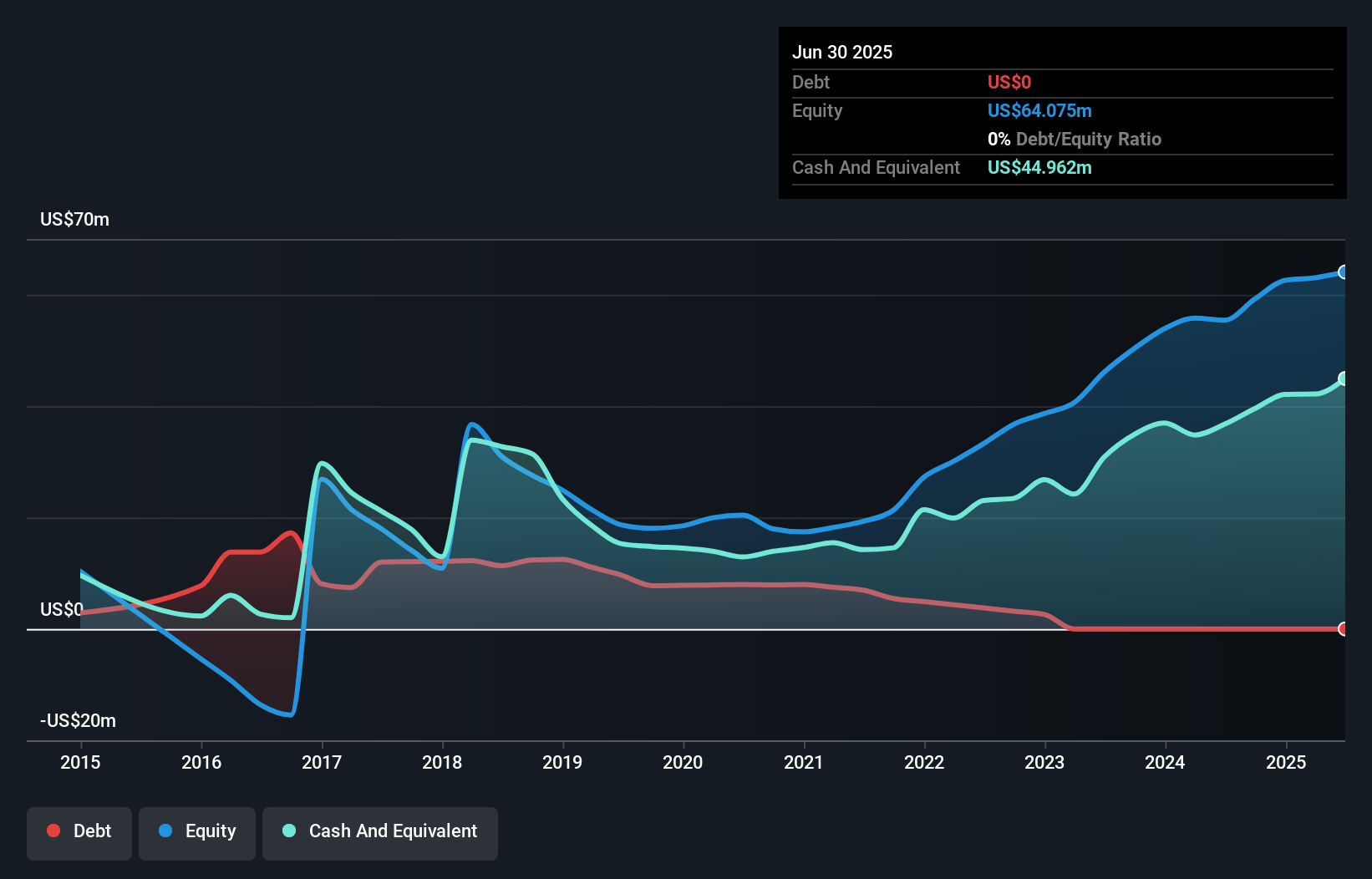

Everspin Technologies is making strides in the semiconductor industry with its innovative MRAM technologies, targeting sectors like AI and IoT. Despite a challenging year with a -3.1% earnings growth, it remains debt-free and boasts high-quality earnings. Recent collaborations, such as with Quintauris for RISC-V platforms, highlight its strategic positioning in automotive and industrial markets. Revenue increased to US$13.2 million in Q2 2025 from US$10.64 million the previous year, while net loss narrowed to US$0.67 million from US$2.5 million, reflecting operational improvements despite competitive pressures and execution risks on new products.

Next Steps

- Dive into all 285 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLSN

Solesence

A science-driven company, develops, manufactures, and sells integrated family of technologies in the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives