- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

We Think Shareholders Will Probably Be Generous With Monolithic Power Systems, Inc.'s (NASDAQ:MPWR) CEO Compensation

We have been pretty impressed with the performance at Monolithic Power Systems, Inc. (NASDAQ:MPWR) recently and CEO Michael Hsing deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 10 June 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Monolithic Power Systems

Comparing Monolithic Power Systems, Inc.'s CEO Compensation With the industry

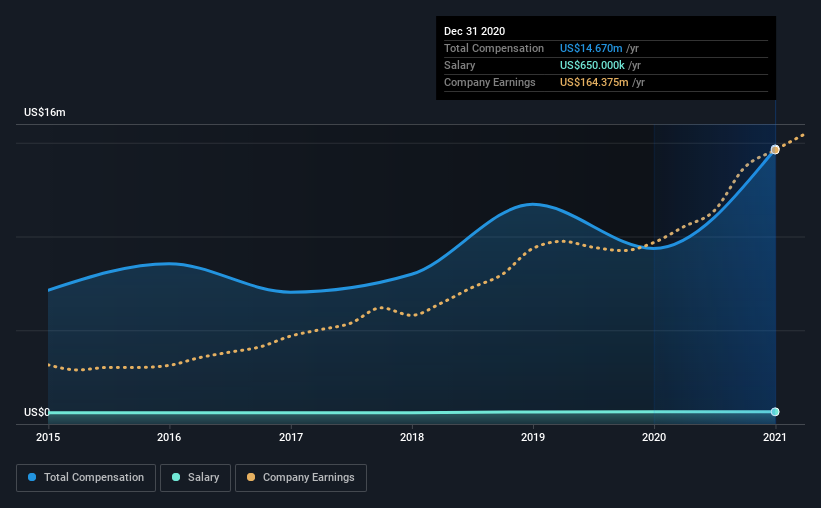

According to our data, Monolithic Power Systems, Inc. has a market capitalization of US$15b, and paid its CEO total annual compensation worth US$15m over the year to December 2020. We note that's an increase of 57% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$650k.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$12m. So it looks like Monolithic Power Systems compensates Michael Hsing in line with the median for the industry. Furthermore, Michael Hsing directly owns US$389m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$650k | US$650k | 4% |

| Other | US$14m | US$8.7m | 96% |

| Total Compensation | US$15m | US$9.4m | 100% |

On an industry level, roughly 14% of total compensation represents salary and 86% is other remuneration. Investors may find it interesting that Monolithic Power Systems paid a marginal salary to Michael Hsing, over the past year, focusing on non-salary compensation instead. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Monolithic Power Systems, Inc.'s Growth

Monolithic Power Systems, Inc.'s earnings per share (EPS) grew 30% per year over the last three years. Its revenue is up 43% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Monolithic Power Systems, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Monolithic Power Systems, Inc. for providing a total return of 157% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Monolithic Power Systems primarily uses non-salary benefits to reward its CEO. Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Monolithic Power Systems that investors should think about before committing capital to this stock.

Switching gears from Monolithic Power Systems, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Monolithic Power Systems, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026