- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Is Monolithic Power Systems Stock Justified After 59% Rally and Recent AI Chip Demand Surge?

Reviewed by Bailey Pemberton

If you are weighing your options on Monolithic Power Systems, you are certainly not alone. With a year-to-date gain of 59.1% and a five-year surge above 210%, this stock keeps catching the eyes of both growth seekers and seasoned investors. Just over the past month alone, Monolithic Power Systems rallied another 9.2%, building on a strong momentum that included a solid 2.7% climb in the last week.

What is driving these impressive moves? Much of the hype centers around broader trends in semiconductor innovation and ongoing shifts in market sentiment as investors look for whatever edge they can find in new-cycle technology leaders. Long-term, the stock’s three-year return of 195.1% also showcases resilience, even with only a modest 3.3% gain over the past year, suggesting more mixed feelings about current risk levels.

Yet when it comes to valuation, things get a bit more interesting. Using a six-point scoring system, Monolithic Power Systems racks up a valuation score of just 2, meaning it passes the undervaluation test in only two out of six key metrics. That sets the stage for a deeper exploration of the standard ways analysts value companies like this, along with a look at an even more insightful approach to understanding what the numbers really mean for potential investors.

Monolithic Power Systems scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

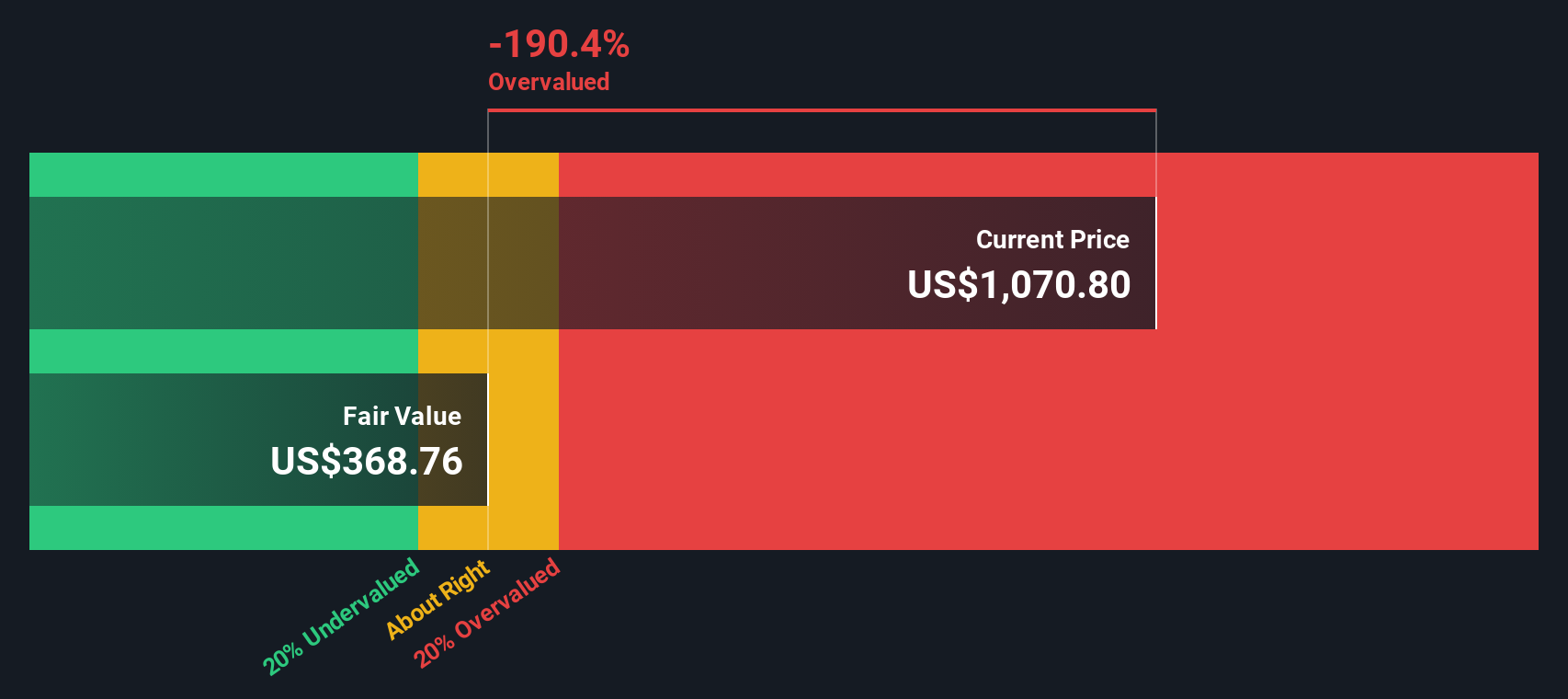

Approach 1: Monolithic Power Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model evaluates a company by forecasting its future cash flows and discounting them back to today’s value. This approach helps investors estimate the intrinsic worth of a stock based on its expected ability to generate cash far into the future.

For Monolithic Power Systems, analysts calculate Free Cash Flow (FCF) over the last twelve months at $763 million. Analyst estimates project this number steadily climbing over the next decade, with forecasts reaching nearly $1.8 billion in 2035. It is important to note that while the initial five years of projections are based on analyst input, further estimates are extrapolated from trends and growth rates.

Based on this data, the DCF model establishes an estimated intrinsic value of $372 per share. However, when comparing this figure to Monolithic Power Systems’ current market price, the DCF calculation suggests the stock is approximately 154.2% overvalued. This implies investors are paying substantially more for future growth than what the cash flow projections justify at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Monolithic Power Systems may be overvalued by 154.2%. Find undervalued stocks or create your own screener to find better value opportunities.

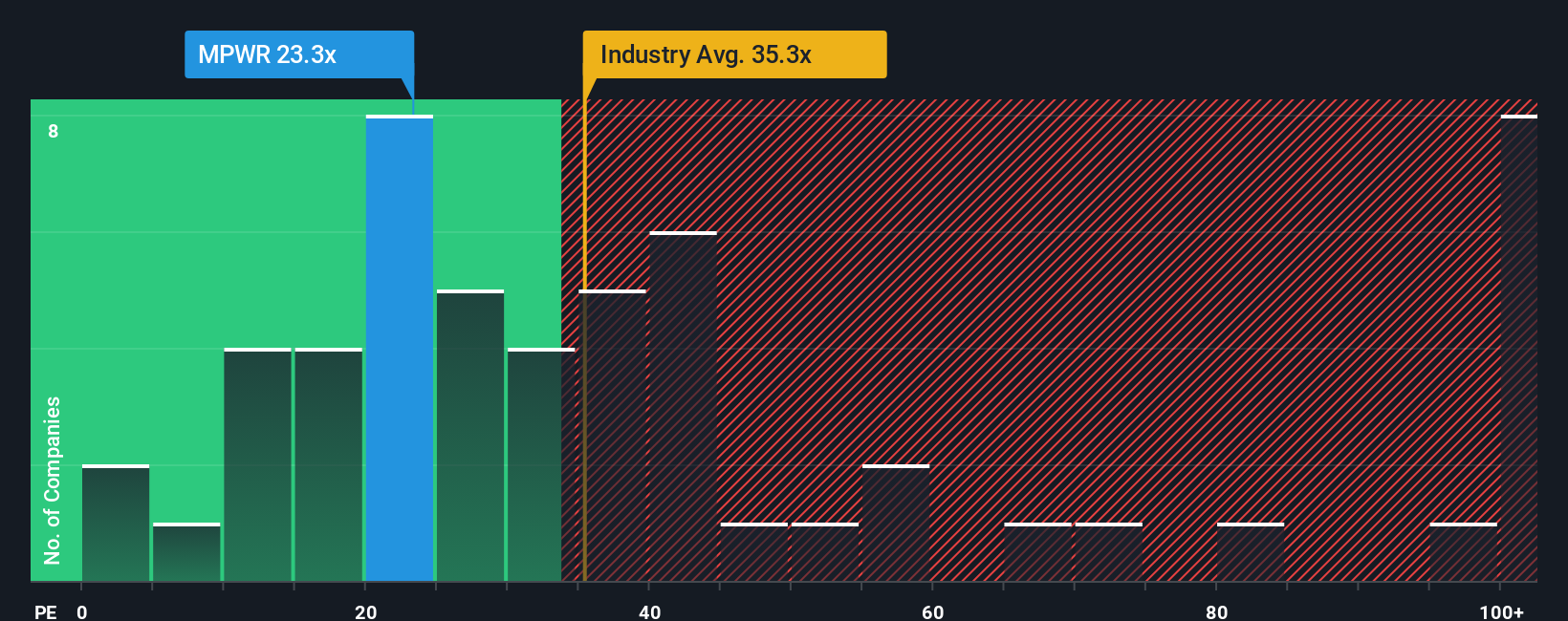

Approach 2: Monolithic Power Systems Price vs Earnings

The Price-to-Earnings (PE) ratio is a staple for assessing the value of profitable companies like Monolithic Power Systems because it directly ties a company’s stock price to its actual earnings power. For businesses generating consistent profits, PE gives investors a clear, comparative sense of how much the market is paying for each dollar of earnings.

However, the PE ratio is more than just a number; it is influenced by growth expectations and the perceived risk of future profits. Fast-growing companies or those seen as lower risk typically trade at higher PE multiples, while slower growers or riskier firms are valued more conservatively. In the semiconductor sector, industry averages provide some context, but they can overlook important company-specific factors.

Monolithic Power Systems is currently trading at a PE ratio of 24.33x. Against the semiconductor industry average of 36.20x, and a peer average of 69.30x, this number looks modest. Yet, Simply Wall St’s proprietary “Fair Ratio,” which calculates a justifiable PE based on growth, risk factors, profit margin, industry segment, and market cap, suggests that 22.58x is fair value for Monolithic Power Systems. This tailored benchmark offers a more precise perspective than generic industry comparisons, highlighting whether the current price is well aligned with the company’s unique profile.

With the actual PE ratio just slightly above the Fair Ratio, Monolithic Power Systems stock is priced about right given its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

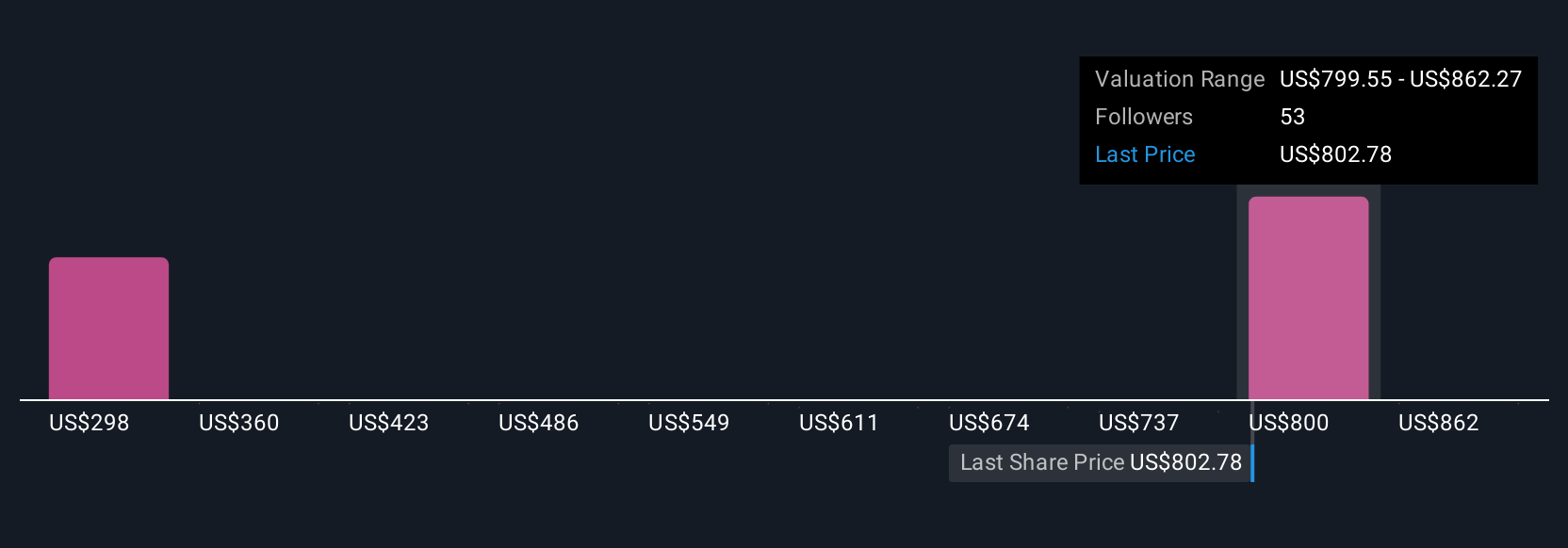

Upgrade Your Decision Making: Choose your Monolithic Power Systems Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful yet approachable tool that let you connect your view of Monolithic Power Systems’ future, whether you’re optimistic about AI-driven growth or cautious about rising costs, to actual financial forecasts and fair value estimates.

Instead of relying solely on static ratios or dense analysis, Narratives empower you to frame your investment thesis as a story. You set the assumptions for future revenue, earnings, and margins, and see how those numbers translate into fair value. This approach bridges the gap between what you believe and what the stock is worth, and enables more personalized, data-driven decisions.

Narratives are available directly on the Simply Wall St platform’s Community page, making it easy for any investor to create, update, and compare perspectives. These are all dynamically refreshed as new news, earnings, or guidance is released.

For example, some investors see Monolithic Power Systems as having fair value closer to the highest analyst target ($940) amid confidence in AI and automotive growth, while others lean toward the bearish end ($750) amid concerns about margin pressure and market saturation. Your own Narrative lets you test these views for yourself and decide whether to buy, hold, or sell based on robust, real-time insights.

Do you think there's more to the story for Monolithic Power Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives