- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (NasdaqGS:MCHP) Climbs 18% Despite US$54 Million Net Loss

Reviewed by Simply Wall St

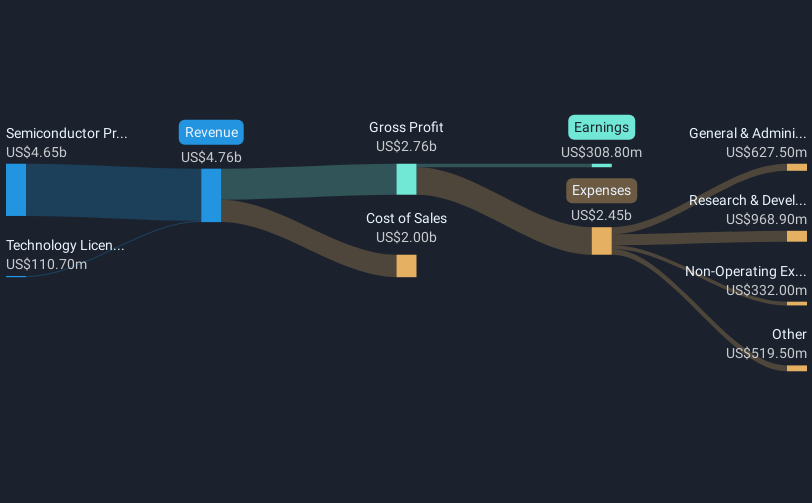

Microchip Technology (NasdaqGS:MCHP) saw an 18% rise in its share price over the past week amidst a range of significant company and market events. Despite weaker financial results announced on February 6, including a net loss of $54 million versus last year's income of $419 million, the company maintained its quarterly dividend of $0.455 per share and confirmed future corporate guidance, possibly stabilizing investor sentiment. The appointment of Victor Peng to the Board of Directors provides strategic leadership that may have been well-received. While market conditions were volatile, with the S&P 500 hitting record highs only to slide later, Microchip's stock appears to have moved counter to broader trends that saw major declines in tech stocks. Additionally, global market indices rose by 1.2% over the past week, revealing a broader positive sentiment in which Microchip could have participated, notwithstanding specific challenges faced by other major tech firms and geopolitical influencers.

Get an in-depth perspective on Microchip Technology's performance by reading our analysis here.

Over the last five years, Microchip Technology (NasdaqGS:MCHP) achieved a total return of 45.38%, including dividends. This period saw several impactful elements shaping the company's trajectory. In 2020, Microchip made strides with product launches, such as SiC power modules and cryptography-enabled MCUs, fortifying its technological offerings. Partnerships, including one with Transphorm in April 2020, helped advance system support capabilities. Financially, while certain earnings announcements showed variance, a debt financing agreement in March 2020 bolstered liquidity.

Despite underperforming the US Semiconductor industry over one year, Microchip's commitment to returning value via dividends and a share buyback program, completing over 31.50 million shares by late 2024, supported investor confidence. The recent appointment of Victor Peng to its Board and ongoing product innovations, like the new Low-Noise Chip-Scale Atomic Clock, suggest a focus on future growth, albeit through a challenging market backdrop.

- Get the full picture of Microchip Technology's valuation metrics and investment prospects—click to explore.

- Uncover the uncertainties that could impact Microchip Technology's future growth—read our risk evaluation here.

- Is Microchip Technology part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives