- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Could Multi-Vendor Connectivity Progress Reshape the Competitive Edge for Microchip Technology (MCHP)?

- Earlier this month, AVIVA Links announced a milestone automotive demonstration in which its ASA-ML chips worked seamlessly with Microchip Technology’s chipset, showcasing multi-vendor interoperability for high-speed vehicle connectivity.

- This demonstration highlights the rapid progress and maturity of the ASA-ML standard, supporting next-generation automotive applications by enabling scalable, secure, and flexible multi-Gigabit connections from multiple semiconductor suppliers.

- We’ll examine how this breakthrough in interoperable vehicle connectivity may help shape Microchip Technology’s evolving investment case.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Microchip Technology Investment Narrative Recap

Owning Microchip Technology means believing in sustained demand for embedded control solutions across critical sectors, with a particular emphasis on automotive and industrial automation as drivers of long-term growth. The recent multi-vendor automotive interoperability showcase with AVIVA Links may reinforce Microchip's automotive technology credibility, but it is unlikely to materially shift the most important short-term catalyst, inventory normalization and improved factory utilization, or the biggest immediate risk, which remains the persistence of elevated inventories and associated charges.

Among Microchip’s recent announcements, the AVIVA Links demonstration most closely aligns with long-term growth catalysts by supporting the adoption of scalable, high-speed connectivity for advanced automotive applications such as ADAS and in-vehicle infotainment. While the technical validation enhances Microchip’s role in the evolving automotive standard, the near-term investment outlook still depends heavily on the pace at which the company can work through excess inventory and restore profit margins.

By contrast, investors should be aware that even as automotive opportunities develop, supply chain normalization challenges remain unresolved and...

Read the full narrative on Microchip Technology (it's free!)

Microchip Technology's outlook estimates $6.6 billion in revenue and $1.4 billion in earnings by 2028. This is based on analysts forecasting 15.9% annual revenue growth and a $1.58 billion increase in earnings from the current $-178.4 million.

Uncover how Microchip Technology's forecasts yield a $76.00 fair value, a 26% upside to its current price.

Exploring Other Perspectives

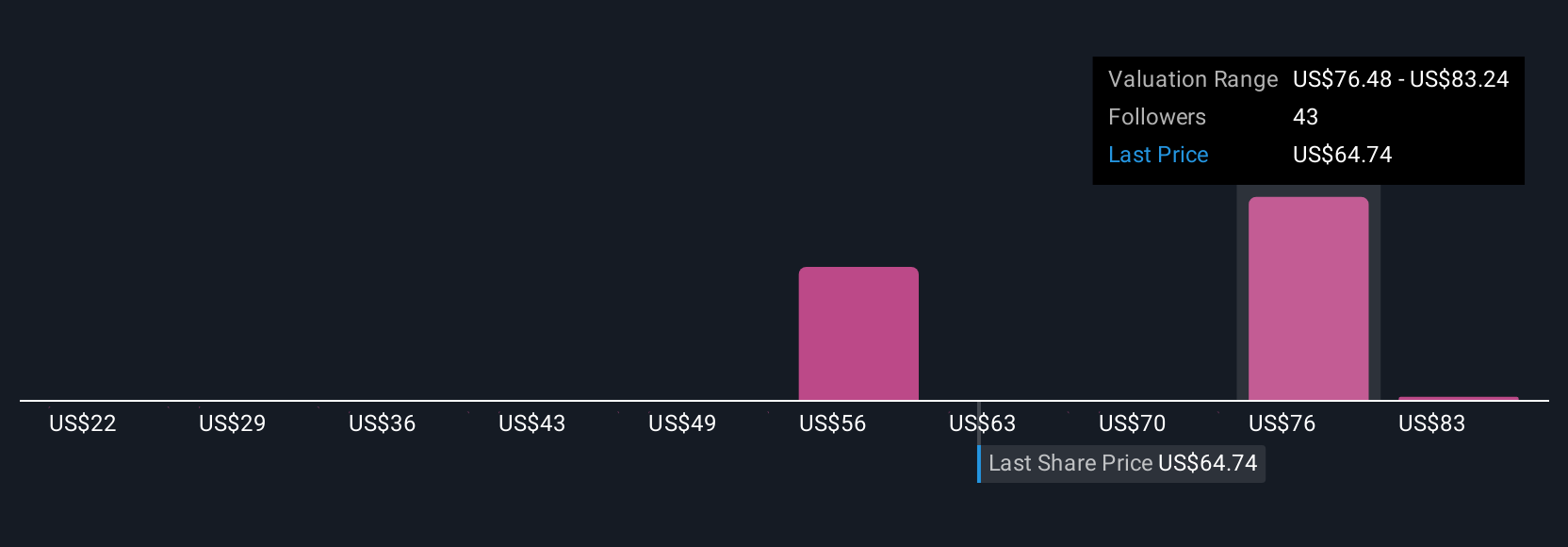

Seven fair value estimates from the Simply Wall St Community range from US$22.39 to US$90 per share, reflecting broad differences in individual outlooks. As end markets recover, catalysts like increased automotive content per vehicle could significantly impact future business performance, making it especially useful to explore several alternative viewpoints here.

Explore 7 other fair value estimates on Microchip Technology - why the stock might be worth less than half the current price!

Build Your Own Microchip Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microchip Technology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Microchip Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microchip Technology's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health - Valuation

TAV Havalimanlari Holding will soar with €2.5 billion investments fueling future growth

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

NVDA+AEVA Agreement is a game changer for the AEVA stock even though it is just a partnership and does not have a roll out until 2028 (which means receivables as early as 2027, I would imagine) This agreement effectively moves the goal posts of profitability for AEVA much closer since this is in addition to the recent Forterra agreement, as well as the (just announced) European carmaker agreement (which is believed to be Mercedes-Benz). Underneath all of this, AEVA has a pre-existing agreement with Daimler truck. So business seems to be booming, especially with really big name brands…which tends to bring in even more brand names (and thus more agreements/contracts/announcements, etc). This dynamic often creates more coverage from analysts (often with upside stock initial coverage) that I believe will be occurring over the next 3 to 6 months (as professional traders/analysts often research for 2 to 3 months before initiating coverage of a new issue). Anyway, this all just one opinion , so please do your own due diligence. Disclaimer: I/We DO trade in this stock from time to time and I/we may (or may not have) a position currently, so again, please do your own due diligence.