- United States

- /

- Semiconductors

- /

- NasdaqGS:LSCC

Lattice Semiconductor (LSCC): Reassessing Valuation After sensAI 8.0 Expands Its Edge AI Ambitions

Reviewed by Simply Wall St

Lattice Semiconductor (LSCC) just rolled out sensAI 8.0, a fresh upgrade to its edge AI stack that promises broader model support, better performance, and more flexible deployment options for industrial, automotive, and consumer applications.

See our latest analysis for Lattice Semiconductor.

Even with the sensAI 8.0 launch and a new $250 million share repurchase program, Lattice’s 30 day share price return of 11.07% sits alongside a more modest 23.34% one year total shareholder return. This suggests momentum is stabilizing after a sharp year to date rebound.

If sensAI has you rethinking where edge intelligence could go next, it might be worth scanning other high growth tech and AI names through high growth tech and AI stocks for fresh ideas.

With shares still trading below the average analyst price target, but with growth headwinds and a rich multiple hanging over the story, is Lattice a smart entry point today, or is the market already baking in its AI upside?

Most Popular Narrative Narrative: 8.8% Undervalued

With Lattice Semiconductor last closing at $71.86 against a narrative fair value near $78.77, expectations lean toward more upside if growth delivers.

Product mix shift toward higher value new products (Nexus, Avant, AI optimized FPGAs) is raising overall gross margins, with management indicating new products will be the main revenue driver through 2026; the transition supports sustainable margin and earnings improvement.

Curious how a premium earnings multiple, rapid profit expansion, and accelerating revenue all fit into one price tag? See which bold projections power this fair value story.

Result: Fair Value of $78.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in low and mid range FPGAs and potential China related regulatory friction could quickly challenge today’s upbeat, AI driven valuation story.

Find out about the key risks to this Lattice Semiconductor narrative.

Another Way to Look at Value

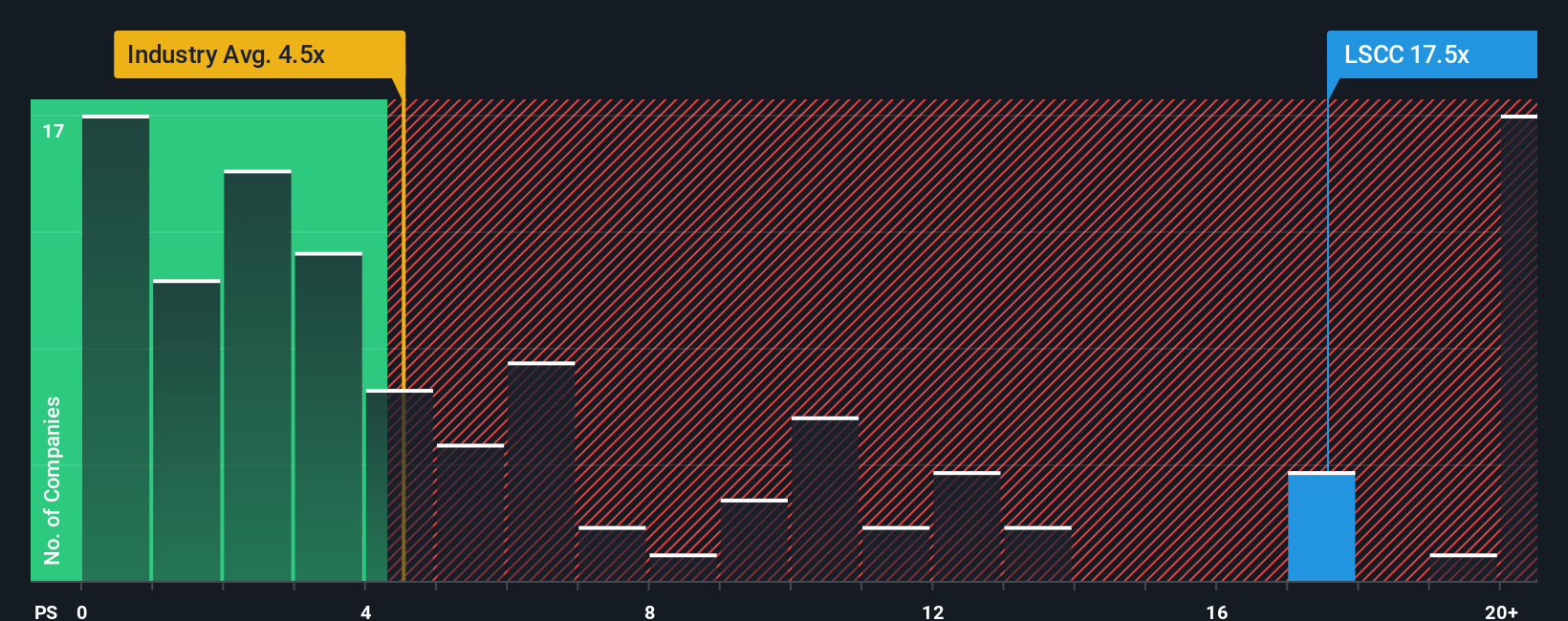

On simple sales multiples, Lattice looks stretched, trading at 19.9 times sales versus 5.3 times for the US Semiconductor group and a fair ratio of 8.9 times. That premium leaves little room for execution hiccups, so what happens if growth or AI sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lattice Semiconductor Narrative

If this view does not fully match your own, or you would rather dive into the numbers yourself, you can build a narrative in minutes: Do it your way.

A great starting point for your Lattice Semiconductor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity when you can line up your next moves using targeted stock ideas built from rigorous data and clear fundamentals.

- Identify potential opportunities early by scanning these 3635 penny stocks with strong financials, which focus on smaller companies with specific financial characteristics.

- Explore the AI theme by tracking these 24 AI penny stocks that are involved in artificial intelligence and have identifiable revenue-generating use cases.

- Find possible value opportunities by reviewing these 913 undervalued stocks based on cash flows, which highlights stocks that may appear mispriced based on estimates of future cash flows and business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSCC

Lattice Semiconductor

Develops and sells semiconductor, silicon-based and silicon-enabling, evaluation boards, and development hardware products in Asia, Europe, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion