- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (NasdaqGS:LRCX) Reports Promising Q3 Results With Year-Over-Year Gains

Reviewed by Simply Wall St

Lam Research (NasdaqGS:LRCX) recently announced promising third-quarter financial results, with significant year-over-year increases in sales and net income. This, combined with optimistic earnings guidance and proactive share buybacks, may have fueled the company’s share price rise by 26% over the last month, significantly outpacing the market's 4% increase over the same period. Lam Research's robust performance and strategic initiatives likely added momentum to its share price, distinguishing it from the broader market trend where earnings are expected to grow by 14% annually.

Buy, Hold or Sell Lam Research? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The promising third-quarter financial results recently announced by Lam Research, coupled with its earnings guidance and share buybacks, could align well with the company's narrative of expanding market opportunities through advanced etch and deposition tools. These developments might bolster Lam's revenue and earnings forecasts by capitalizing on increased deposition and etch intensity and emerging technology inflections. The continuation of proactive initiatives such as customer support enhancements and investment in innovative technologies may substantiate the moderately optimistic earnings growth expectations outlined by analysts.

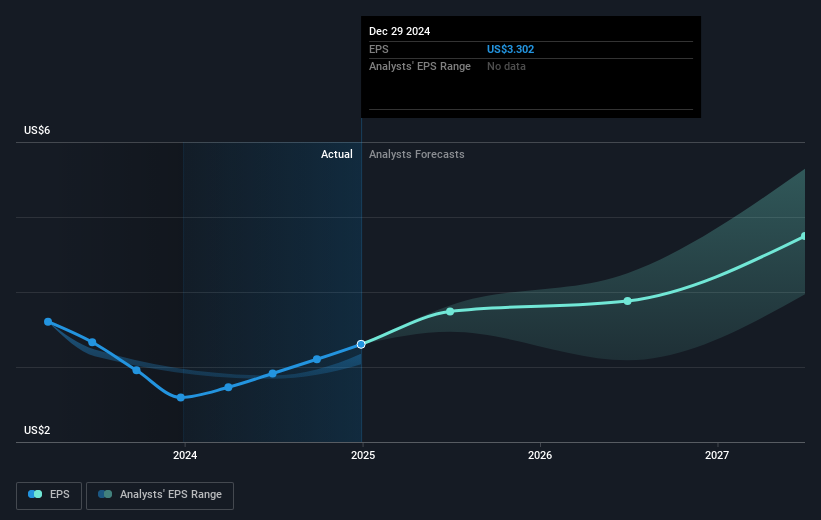

Over the last five years, Lam Research's total shareholder return, including share price appreciation and dividends, reached 245.45%, highlighting significant long-term value creation for investors. This extended period of growth puts the recent monthly price surge of 26%, significantly outpacing the market, into perspective. However, when compared to the performance of the US semiconductor industry over just the past year, Lam Research has underperformed, with the industry returning 18.5% while Lam posted less. The recent positive momentum in share price should be viewed against the analysts' price target of US$89.77, which represents an 18.5% potential upside from the current price of US$73.16. As such, the forecasted revenue and earnings growth are essential in achieving this target, with analysts predicting revenue to grow to $21.7 billion and earnings to $6.2 billion by 2028, assuming a PE ratio adjustment to 22.7x.

Explore Lam Research's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives