- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (LRCX) Valuation in Focus After Semicon West 2025 Tech Advances and Strong Sector Momentum

Reviewed by Kshitija Bhandaru

Lam Research (LRCX) took center stage at Semicon West 2025, debuting its VECTOR TEOS 3D deposition tool and sharpening its focus on advanced semiconductor manufacturing. Investors are closely tracking the company’s latest moves as industry buzz grows.

See our latest analysis for Lam Research.

Lam Research’s share price has rocketed over 80% year-to-date, riding a wave of AI-fueled optimism, industry partnerships, and demand for advanced chip equipment. While momentum is undeniably strong, recent market volatility, including a one-week share price drop, shows how quickly sentiment can shift in the semiconductor space. Over the longer term, Lam’s three-year total shareholder return of more than 330% cements its status as a standout in the sector.

If the excitement around Lam has you scanning for more opportunities, consider exploring See the full list for free. to see what other technology and AI innovators are catching investor attention.

With momentum this strong, the question now shifts to valuation. Is there more upside ahead for Lam Research, or has the market already priced in the company’s future growth story?

Most Popular Narrative: 8.7% Overvalued

According to the most followed narrative, Lam Research’s estimated fair value stands well below the last closing price, signaling that recent gains have pushed the stock into premium territory. This perspective leans heavily on future earnings growth, margin dynamics, and a higher valuation multiple to justify the current share price.

Lam's leadership in new process technologies, like ALD Moly for metal deposition and advanced packaging solutions (SABRE 3D systems), positions the company to capture an increasing share of spend on next-generation chip manufacturing, leading to market share gains, higher average selling prices, and expanding gross margins over the long term.

What’s really driving Lam’s high price tag? The narrative leans on robust expansion in cutting-edge chip tech and margin boosts. But do the underlying profit and sales forecasts stack up? The financial leap behind this valuation will surprise you. Catch the full story inside the most popular narrative.

Result: Fair Value of $120.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks linger, including potential slowdowns from Chinese demand normalization and rising competition from global equipment vendors. These factors could pressure Lam’s margins.

Find out about the key risks to this Lam Research narrative.

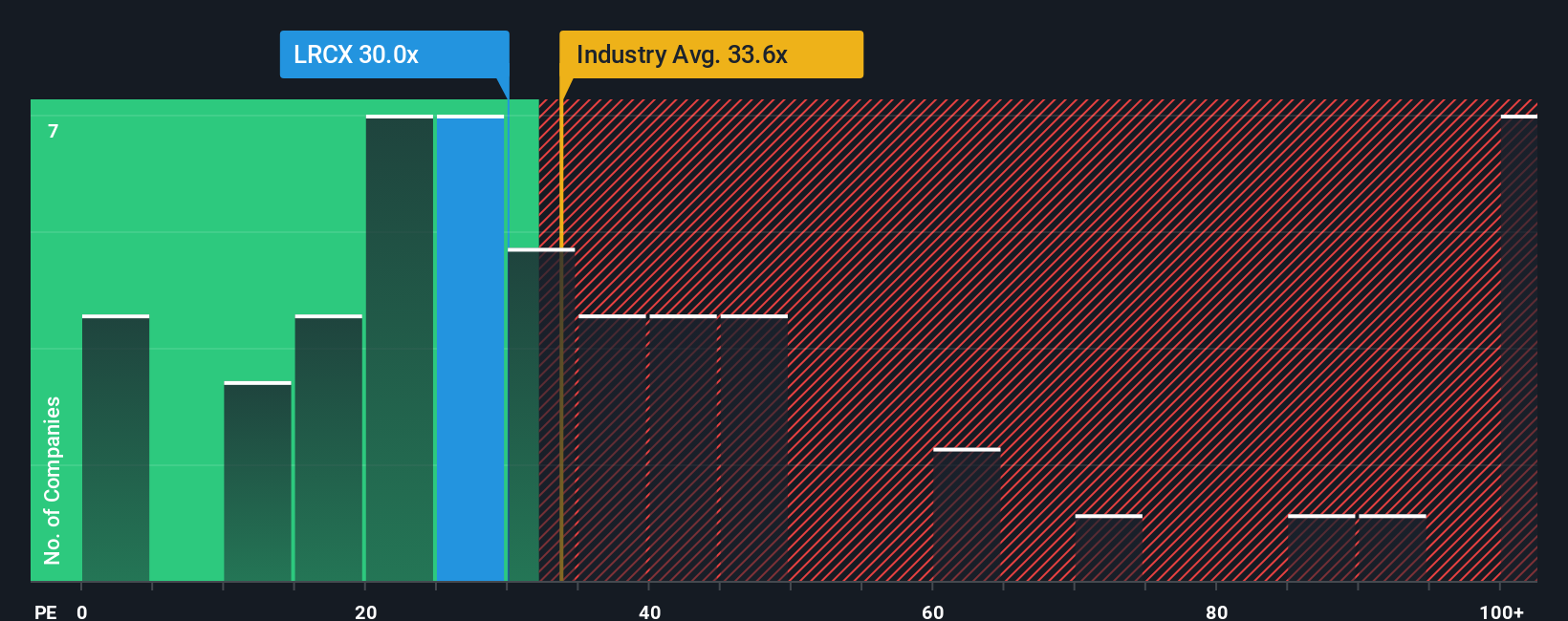

Another View: Multiples Tell a Different Story

While narrative-driven fair value estimates peg Lam Research as overvalued, its price-to-earnings ratio of 30.9 times actually looks reasonable compared to the US semiconductor industry's average of 35.3 times and peers at 36 times. The current multiple is even slightly below the fair ratio of 31.8, which the market could eventually converge on. This suggests that, despite steep recent gains, valuation risk might not be as severe as it seems if earnings keep pace. Is the market being too cautious, or is a rerating ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lam Research Narrative

If you have a different view or want to dig deeper into the numbers, you can create your own Lam Research outlook in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Lam Research.

Looking for more investment ideas?

Smart investors constantly look for new opportunities beyond the usual headlines. Expand your horizons now and seize the potential in fast-growing sectors before the crowd catches on.

- Target consistent income streams by tapping into these 19 dividend stocks with yields > 3% with attractive yields and strong payout histories.

- Unearth early-stage opportunities by screening for these 3586 penny stocks with strong financials making waves in emerging markets.

- Stay ahead of the curve by evaluating these 33 healthcare AI stocks and harnessing innovation at the intersection of technology and health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026