- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is Lam Research’s Rally Sustainable After Shares Surge Over 100% in 2025?

Reviewed by Bailey Pemberton

If you’re wondering whether now is the right moment to jump into Lam Research stock, you’re in good company. After all, few names in the semiconductor equipment space have delivered the kind of run Lam has shown recently. In just the past week, shares climbed 13.8%, and over the past month, Lam’s stock catapulted by 44.9%. Year-to-date returns are jaw-dropping at 105.9%, and the past three years have handed long-term holders a hefty 339.7% gain. With numbers like that, it’s natural to ask yourself: is Lam Research still a buy, or has all the growth already been priced in?

Much of the stock’s latest surge can be traced to renewed optimism about the broader semiconductor market. Investors are increasingly confident that supply chain pressures are easing, and there’s been talk of ramped-up investments in chip manufacturing capacity worldwide. That optimism is being baked into share prices across the industry. Lam Research, with its leading tech and strong customer ties, has been a clear beneficiary. However, rising enthusiasm also tends to shake up expectations around valuations and risk.

On that note, let’s take a look at Lam Research’s valuation score. Based on six common valuation checks, Lam comes in with a score of 2 out of 6, underscoring that the company is currently undervalued on two key metrics. But how should we interpret that? Is a simple scorecard enough? Let’s think bigger as we break down these methods and then explore if there’s a smarter way to value Lam Research that many investors overlook.

Lam Research scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lam Research Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value. This approach allows investors to see the underlying worth of a business based on the money it is expected to generate, instead of simply relying on market prices.

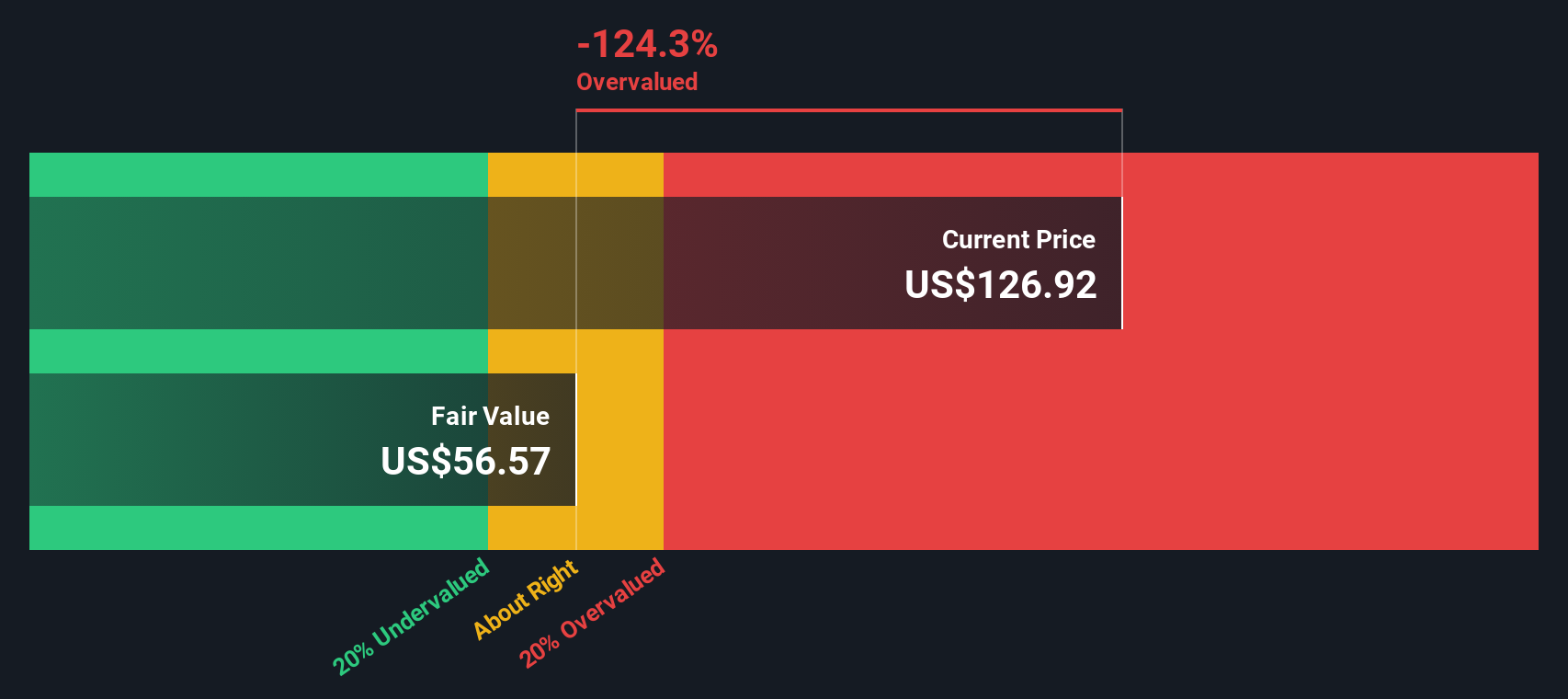

Lam Research’s most recent Free Cash Flow stands at $5.57 billion. Analysts provide detailed cash flow estimates for the next five years, reaching $7.01 billion by 2030. After these initial projections, further numbers are extrapolated by Simply Wall St and extend a full decade into the future. These forecasts suggest Lam’s cash generation will remain strong through 2035, though the annual growth rate appears to moderate in later years.

According to this 2 Stage Free Cash Flow to Equity model, the resulting estimated intrinsic (fair) value for Lam Research is $58.37 per share. This is a sharp contrast to its current market price, with the DCF calculation implying the stock is 155.5% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lam Research may be overvalued by 155.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lam Research Price vs Earnings

For companies like Lam Research that generate consistent profits, the Price-to-Earnings (PE) ratio is a tried-and-true way for investors to gauge value. The PE ratio is especially relevant for profitable firms, because it connects what investors are paying today to what the company actually earns. This is a fundamental driver of long-term returns.

However, not all PE ratios are created equal. Growth prospects, industry trends, and risk all affect what a “normal” or “fair” PE might be. Companies with stronger earnings growth or steadier profits typically command higher multiples, while increased risk or sluggish growth tends to weigh them down.

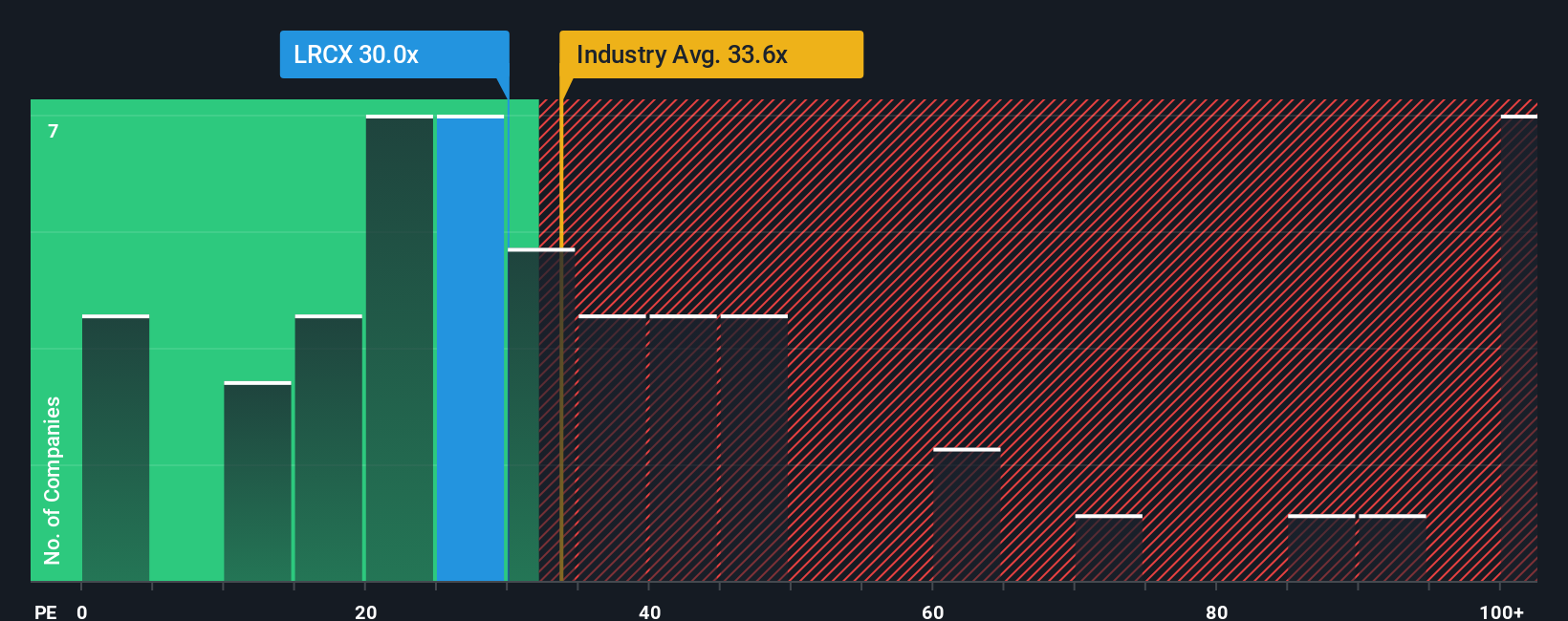

Right now, Lam Research trades at a PE ratio of 35.1x. That puts it slightly below the semiconductor industry average of 37.8x and beneath the peer average of 41.1x. At first glance, this suggests Lam could be modestly undervalued relative to its sector.

To sharpen this perspective, let’s look at Simply Wall St’s “Fair Ratio.” Unlike simple comparisons, the Fair Ratio incorporates everything from Lam’s earnings growth and margins to its size, risks, and where it sits in the larger sector. In Lam’s case, the Fair Ratio stands at 32.0x, meaning the company’s actual PE multiple is just a hair above what would be expected when accounting for all those variables. This offers a more nuanced, tailored benchmark than industry or peer averages alone.

Since Lam’s real PE is only around three points higher than its Fair Ratio, a gap of about 0.1 when rounded, the evidence suggests the stock is trading just about where it should be, given both its quality and market environment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lam Research Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear story you can set about a company’s future, your own perspective on its industry trends, business drivers, and where you think its revenue, earnings, and margins will go. Rather than relying solely on static models or surface-level multiples, Narratives let you connect the company’s evolving business story to a dynamic financial forecast. This process produces a fair value you can compare directly to today’s share price.

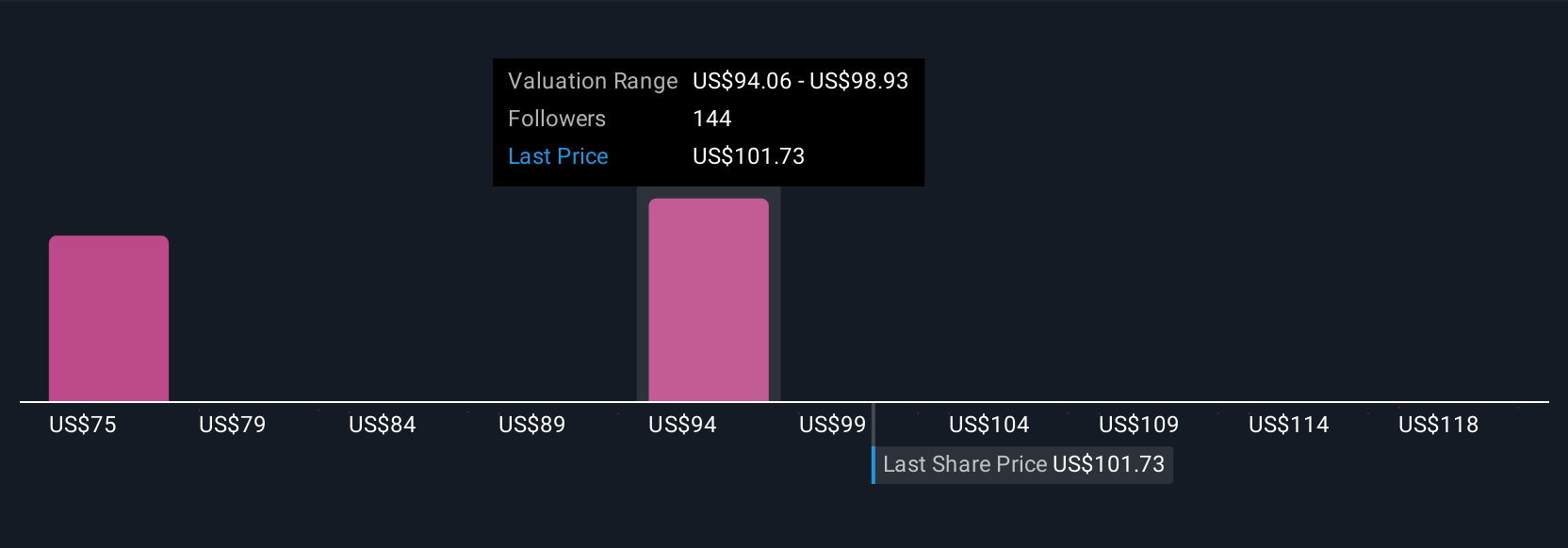

On Simply Wall St’s platform, Narratives are an accessible feature used by millions on the Community page. They help you decide when to buy or sell by updating fair value estimates automatically as new news or earnings information arrives, making your investment process smarter and responsive to real events. For example, some investors might set a bullish Narrative for Lam Research, pricing in aggressive revenue growth, margin expansion, and a fair value of $135.0 per share. Others may take a more cautious view, factoring in risks like tough competition and geopolitics, and land closer to a $80.0 per share fair value. Narratives let you capture your viewpoint, adjust your confidence as facts change, and always keep your decisions anchored to a valuation you believe in.

Do you think there's more to the story for Lam Research? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives