- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is Lam Research Stock Priced Fairly After Its 120.5% Surge in 2024?

Reviewed by Bailey Pemberton

- If you are wondering whether Lam Research is still a smart buy after its huge run up, you are not alone. This stock has become a favorite talking point for investors trying to separate momentum from real value.

- Over the last week the share price has gained 3.0%. It is roughly flat over the past month at -0.9%, but the bigger story is its staggering 120.5% year to date and 106.6% 1 year returns that have radically changed how the market is pricing its future.

- Those moves have come alongside a steady drumbeat of enthusiasm around the semiconductor cycle, with Lam Research often cited as a key enabler of advanced chip manufacturing and a beneficiary of rising capital expenditure from foundries and memory makers. Policy support for domestic chip production and ongoing investment in cutting edge process technology have kept Lam firmly in the spotlight as a strategic supplier.

- Despite the surge, our framework currently gives Lam Research a 2 out of 6 valuation score. This suggests that while it screens as undervalued on some checks, others point to stretched pricing. In the sections that follow we will unpack what different valuation lenses say about Lam today and then finish with a more holistic way to think about its true worth.

Lam Research scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lam Research Discounted Cash Flow (DCF) Analysis

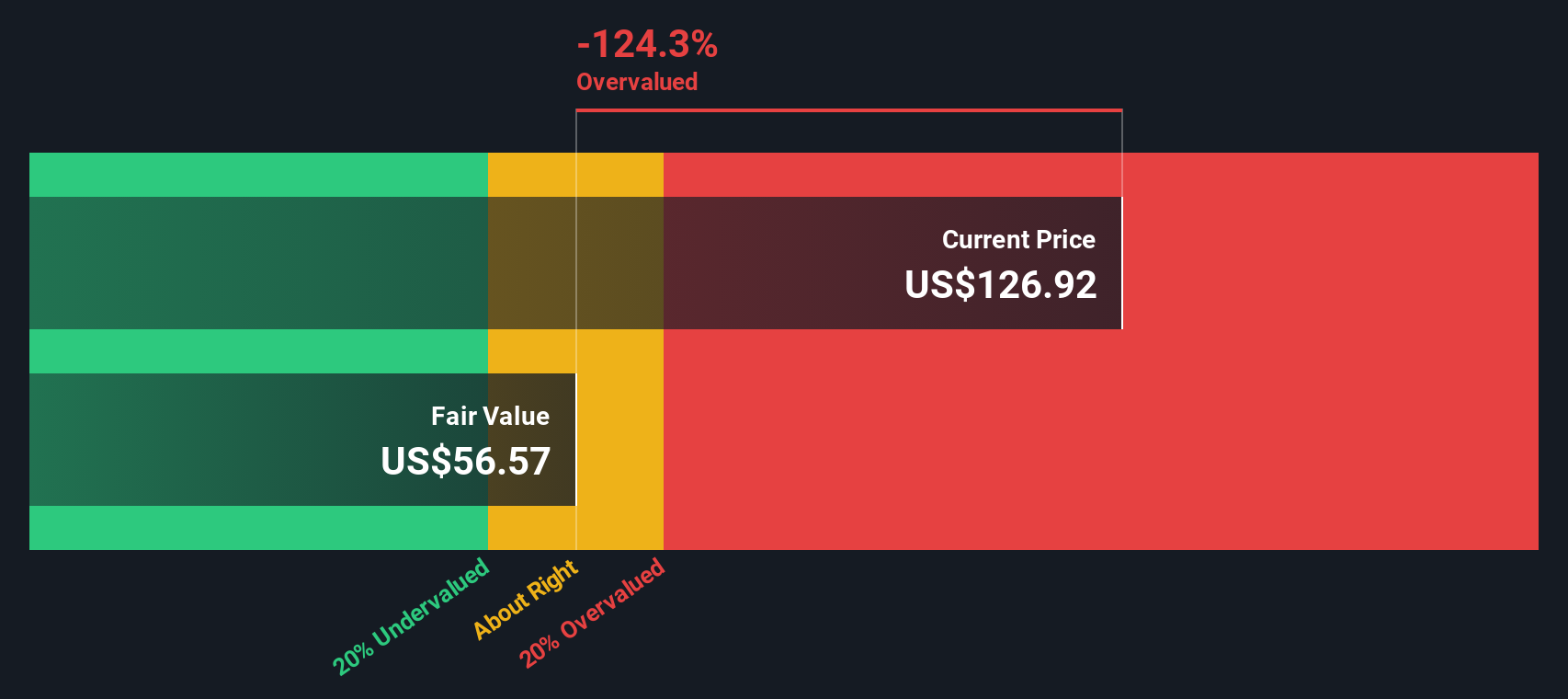

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms. For Lam Research, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $5.7 billion and uses analyst forecasts for the next few years before extrapolating longer term trends.

Analysts and subsequent extrapolations see Lam’s free cash flow rising to around $7.8 billion by 2030, with annual projections gradually stepping higher as the semiconductor cycle and capital spending recover. Each of these future cash flows is discounted back to present value, and then combined with a terminal value to arrive at an estimated intrinsic value per share.

On this basis, the model suggests a fair value of about $66.93 per share, indicating that the stock is roughly 138.7% overvalued relative to the current market price. In other words, the share price reflects much more optimistic cash flow growth than this DCF framework supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lam Research may be overvalued by 138.7%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lam Research Price vs Earnings

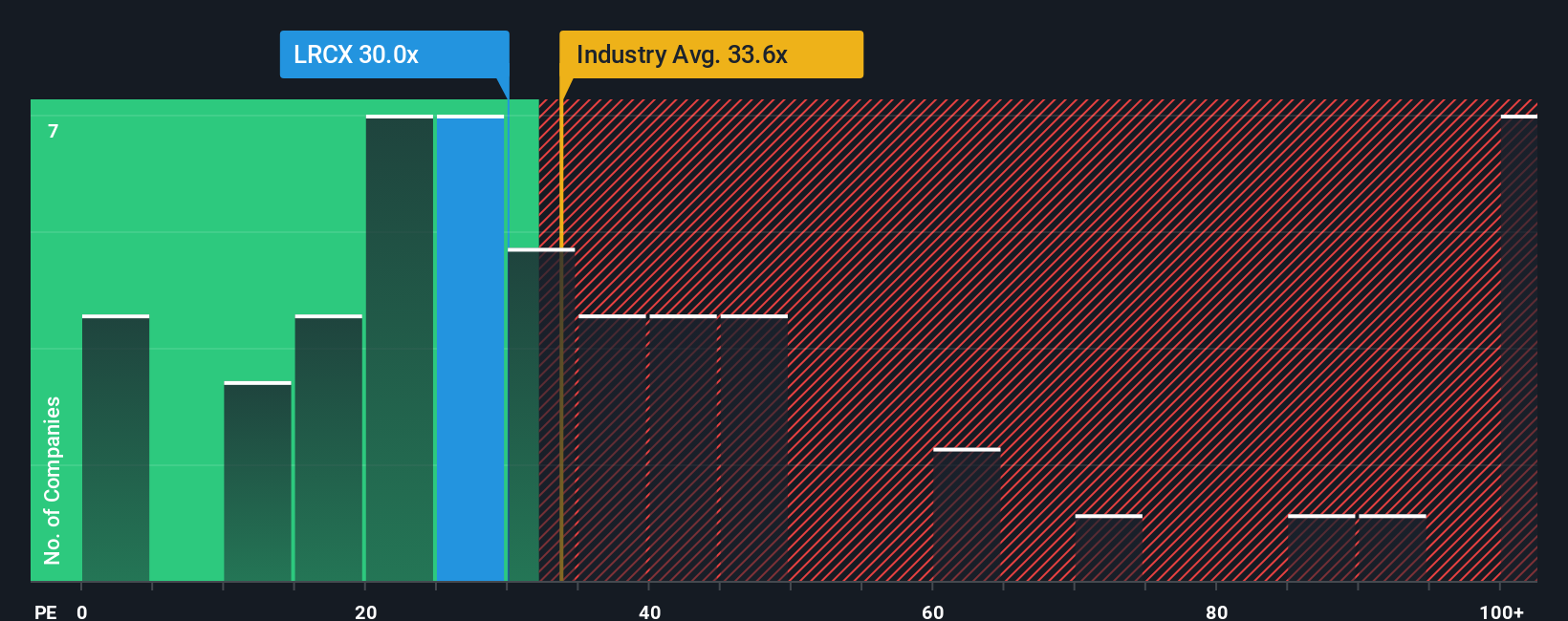

For a profitable, established business like Lam Research, the price to earnings (PE) ratio is a useful way to gauge how much investors are paying for each dollar of current profits. In general, faster growing and lower risk companies justify higher PE ratios, while slower growth or higher uncertainty should come with a discount.

Lam currently trades on a PE of about 34.5x, which is below the peer average of roughly 39.5x and also under the broader Semiconductor industry average of around 37.6x. That might initially suggest the shares are attractively valued relative to similar names.

Simply Wall St’s Fair Ratio goes a step further by estimating what Lam’s PE should be, given its specific earnings growth profile, profitability, industry positioning, market cap and risk factors. For Lam, this Fair Ratio is about 31.0x, implying that, after adjusting for these fundamentals, the current 34.5x multiple is richer than what would typically be justified.

On this basis, Lam looks modestly expensive versus its own fundamentals, even if it appears cheaper than some peers.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

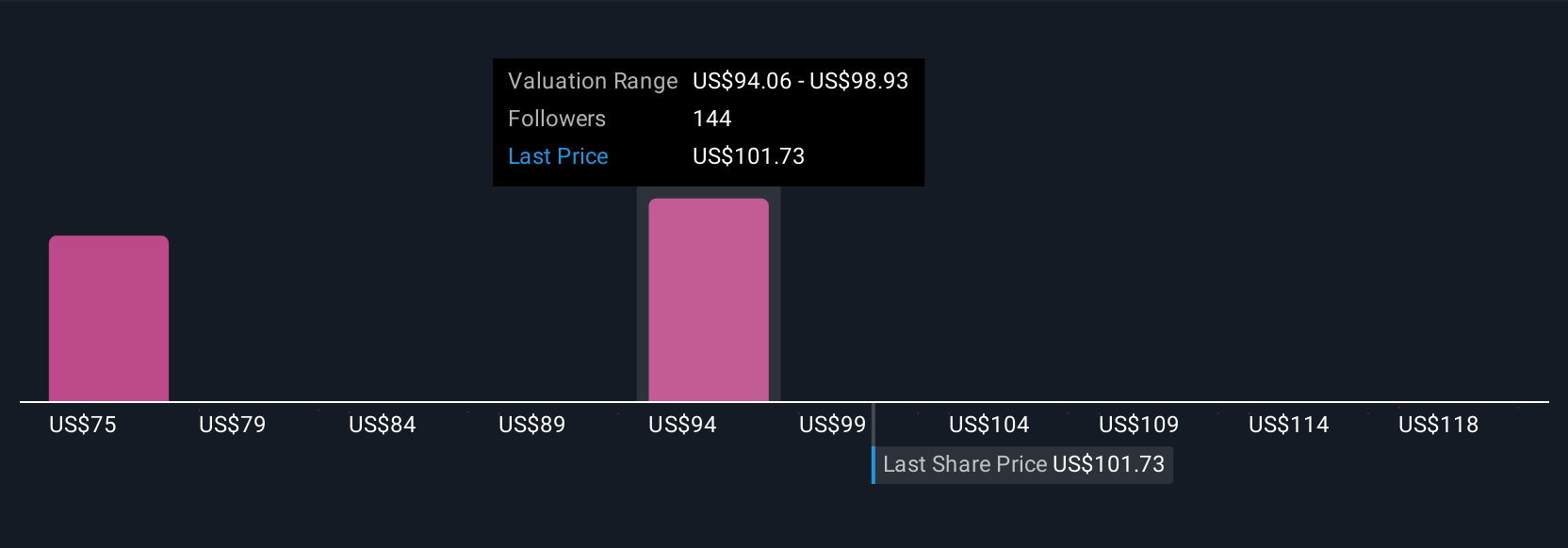

Upgrade Your Decision Making: Choose your Lam Research Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple but powerful way to connect your view of Lam Research’s story with concrete numbers like future revenue, earnings, margins and a resulting fair value estimate. A Narrative is your personal storyline for the company, where you spell out why AI data centers, government incentives, new tools like VECTOR TEOS 3D or risks such as China exposure matter, and the platform turns that view into a financial forecast and a fair value that you can compare to today’s share price to help you decide how you want to approach Lam. On Simply Wall St’s Community page, used by millions of investors, Narratives are easy to create and update, and they automatically refresh when new information, such as earnings or major news, comes in. For example, one Lam Narrative might assume strong AI driven demand, 10.8% annual revenue growth, resilient 28% margins and a fair value around $158 per share, while a more cautious Narrative leans toward slower growth, margin pressure and a fair value closer to $80, showing how different perspectives translate into different investment views.

Do you think there's more to the story for Lam Research? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026