- United States

- /

- Semiconductors

- /

- NasdaqCM:KOPN

Kopin Corporation (NASDAQ:KOPN) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

The Kopin Corporation (NASDAQ:KOPN) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 50% in that time.

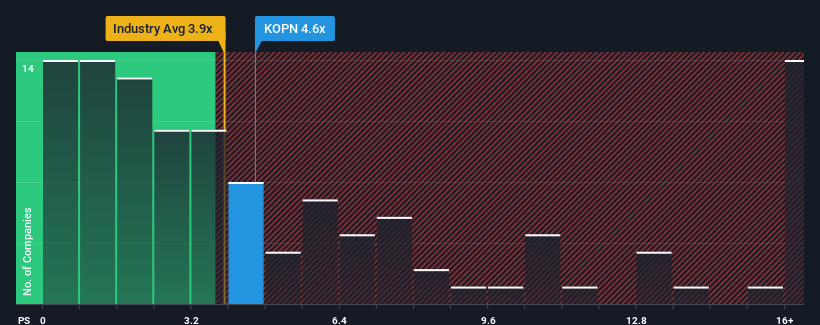

Even after such a large drop in price, you could still be forgiven for thinking Kopin is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.6x, considering almost half the companies in the United States' Semiconductor industry have P/S ratios below 3.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Kopin

How Kopin Has Been Performing

Kopin could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kopin.How Is Kopin's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kopin's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 4.6% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 19% each year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 23% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Kopin's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Kopin's P/S

Despite the recent share price weakness, Kopin's P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Kopin, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Kopin has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kopin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KOPN

Kopin

Develops, manufactures, and sells microdisplays, subassemblies, and related components for defense, enterprise, industrial, and consumer products in the United States, the Asia-Pacific, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives