- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Does KLA’s Surge Continue After Record Quarterly Revenue in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with KLA stock? You are not alone. Investors everywhere are taking another look at this company after a string of impressive gains. KLA has surged 2.3% over the last week, nearly 10% in the past month, and an eye-catching 70.7% year-to-date. If you zoom out further, its three-year return stands at over 312%, and over the last five years, it has soared a staggering 457.3%. With numbers like these, you might be wondering if you are late to the party or if there is still room to run.

What is fueling these moves? Part of the answer comes from broad market optimism for tech stocks and ongoing demand for semiconductor equipment, areas where KLA is a key player. As the industry adapts to new supply chain dynamics and increased investment in chip manufacturing, sentiment has continued to support robust valuations for leaders like KLA. That momentum, however, may also bring new risks and higher expectations, making valuation more important than ever for sensible investors.

Here is a reality check: KLA scores just 1 out of 6 on our valuation scale, suggesting it is only undervalued on one major metric. A closer evaluation of how KLA measures up across various approaches is essential, so let us dive into the specifics of each valuation method. And stick with me, by the end, we will look at a smarter way to judge whether KLA is truly worth its price tag.

KLA scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KLA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's dollars. This approach offers a way to gauge intrinsic value based on long-term cash generation potential, rather than just current profits or assets.

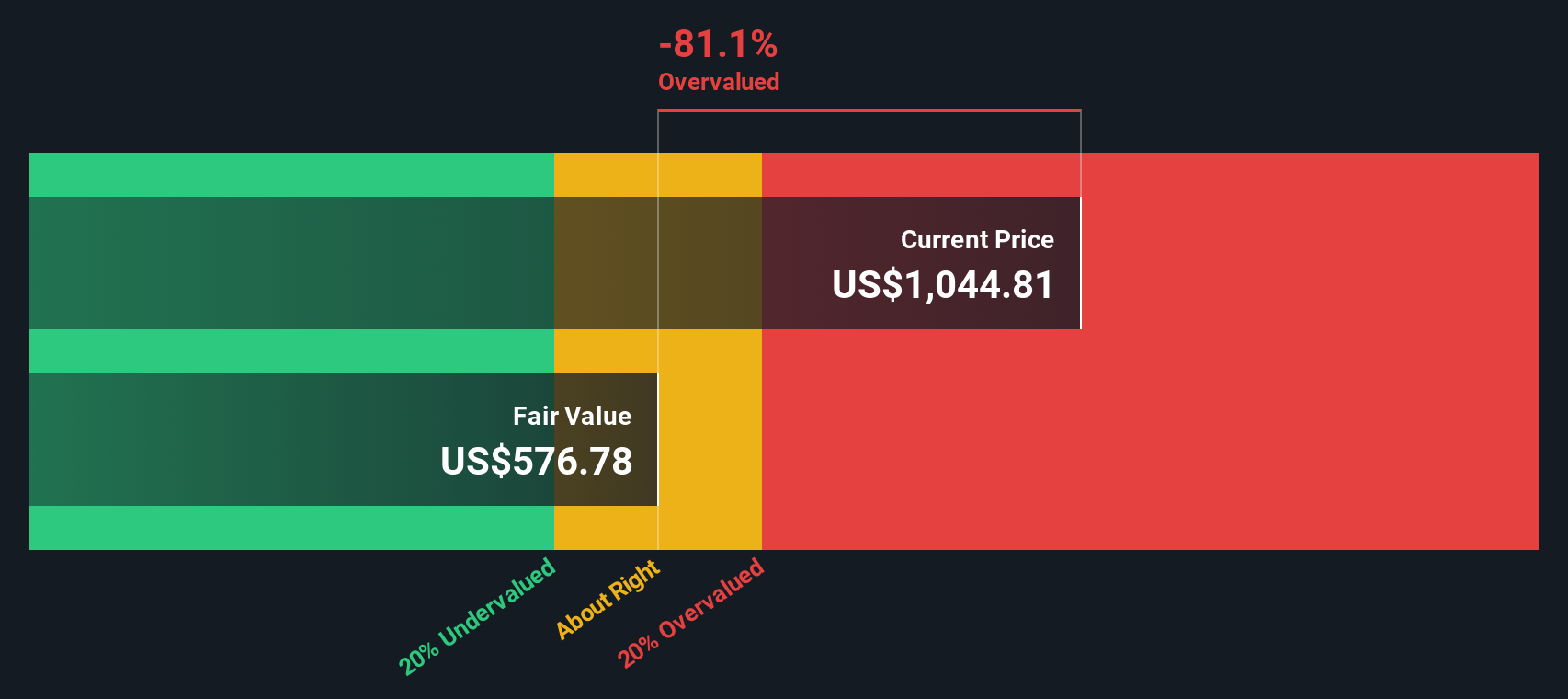

For KLA, the analysis starts with its latest trailing twelve-month Free Cash Flow of $3.72 Billion. Looking ahead, analysts forecast steady increases, with Free Cash Flow reaching approximately $6.30 Billion by 2030. Notably, while detailed estimates from analysts extend five years out, projections beyond that are extrapolated to provide a ten-year view.

Based on these cash flow projections and using a two-stage free cash flow to equity model, KLA's intrinsic value is calculated at $615.60 per share. However, the current price implies the stock is 76.6% above this fair value estimate. In other words, the DCF model suggests that KLA is significantly overvalued on this basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests KLA may be overvalued by 76.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: KLA Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used tools for valuing profitable companies like KLA, as it directly ties a company’s stock price to its earnings power. For businesses that generate consistent profits, the PE multiple helps investors compare the relative price of those earnings across different firms and industries.

It's important to remember that what makes a “normal” or “fair” PE ratio can differ quite a bit depending on expectations for growth and risk. Companies with higher anticipated growth or lower risk tend to command higher PE multiples, while slower growers or more volatile businesses usually trade at lower ratios.

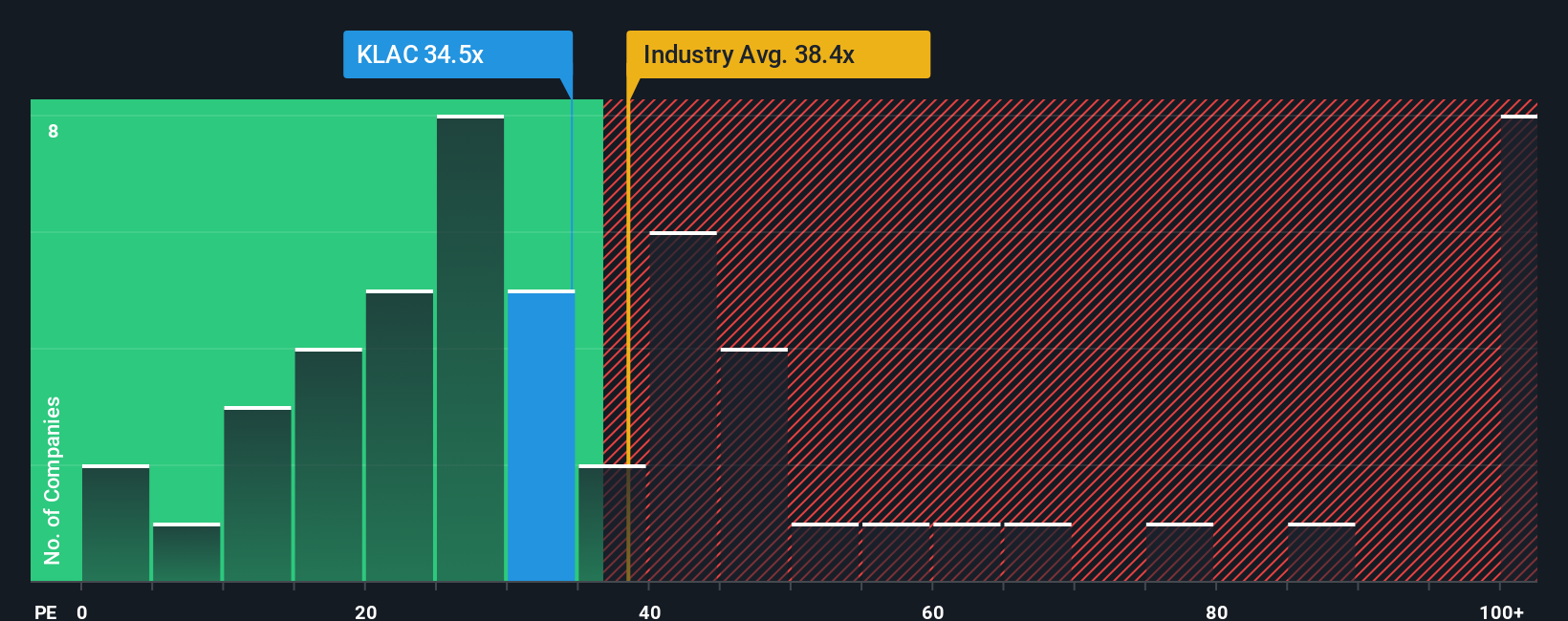

At the moment, KLA is trading at a PE ratio of 35.2x. That puts it almost in line with the semiconductor industry average of 34.9x, but below its closest peers, which sit at an average of 39.2x. Comparing to these benchmarks gives useful context, but it only tells part of the story.

This is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio for KLA is calculated as 31.1x, based on a proprietary model that weighs factors such as KLA’s earnings growth, its profit margins, risks, industry conditions, and market capitalization. This approach digs much deeper than a simple peer match up by taking into account both company-specific and market-wide drivers of value.

With KLA’s current PE ratio standing 4.1 points above its Fair Ratio, the stock appears to be overvalued using this lens. While market enthusiasm for semiconductors in general has lifted KLA, investors are now paying a premium relative to the level justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KLA Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a fresh, intuitive way to connect a company’s story to its likely financial outcome.

A Narrative is more than just a number; it lets you tell the story behind your investing view, combining your assumptions about KLA’s future revenue, earnings, and margins into a forecast of fair value. Rather than treating investing as just a math exercise, Narratives bring context by linking KLA’s unique business drivers, risks, and upside to the numbers you see on screen.

This approach is easy and accessible, available right now within Simply Wall St’s Community page, where millions of investors share and update their perspectives. Narratives allow you to compare your fair value estimate to today’s price, supporting smarter buy and sell decisions at a glance. They are also updated in real time when new news or earnings are released, helping you stay on top of a fast-changing market.

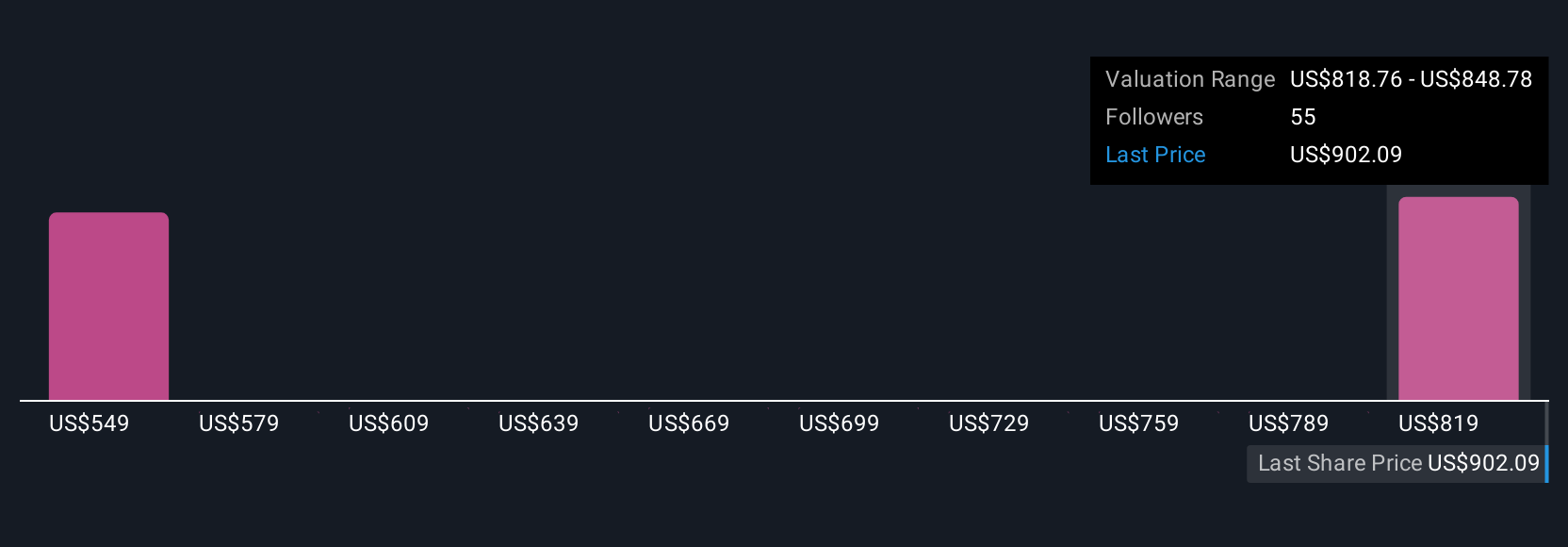

Consider KLA: some investors see long-term AI and advanced packaging trends fueling future price targets as high as $1,075 per share, while others, more cautious about cyclical risks, see fair value closer to $745. With Narratives, you can transparently explain your reasoning and see how your conviction stacks up against the crowd, turning market debates into informed decisions.

Do you think there's more to the story for KLA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives