- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Is It Time to Revisit Intel Shares After AMD Foundry Rumors?

Reviewed by Bailey Pemberton

Deciding what to do with Intel stock right now? You’re far from alone. With the stock closing at $36.83 and a wild streak of moves in recent months, everyone from first-time investors to seasoned pros is watching closely. The past week alone has seen Intel climb 3.7%, and over the last 30 days, shares skyrocketed by 50.4%. Year-to-date, it’s up a staggering 82.1%. Even looking at the past three years, Intel is sitting on a 50.5% gain. However, zoom out to five years, and the picture isn’t all rosy at -22.3%.

So what’s behind this wave of optimism and volatility? Recent news has certainly kept things lively. There was a flurry of rumors about AMD possibly becoming an Intel Foundry customer, sparking debate about what this could mean for the business model and competitive landscape. It turns out some reports overshot the facts, but even early-stage discussions have caught Wall Street’s attention. Meanwhile, efforts by U.S. policymakers to bring more chip manufacturing stateside, as well as Intel’s own international partnership talks, are pushing the narrative that this is a company in the midst of a meaningful strategic pivot with the potential to capture more of America’s chip demand if the winds blow favorably.

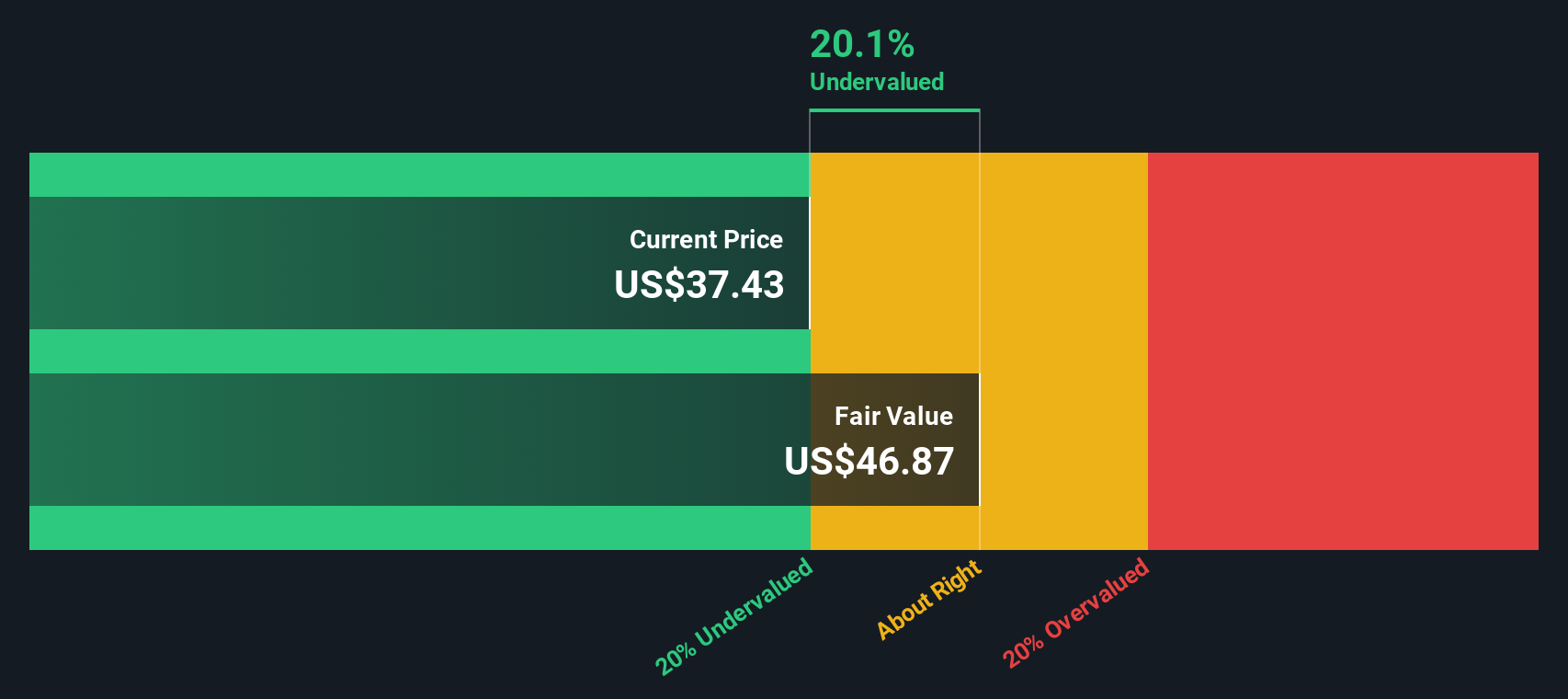

With all this in mind, is Intel’s latest surge justified by its fundamentals or is this just speculative heat? Our valuation score is sitting at 5 out of 6, meaning Intel is undervalued according to five out of six standard valuation checks. Next, let’s break down exactly how these valuation approaches work, and stick around, because there’s an even more insightful way to make sense of all this coming up at the end.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s expected future cash flows and then discounts those numbers back to today’s value, producing an estimate for what the business is truly worth right now. This method is often seen as the gold standard for intrinsic valuation, cutting through short-term noise to focus on underlying earning power.

For Intel, the DCF model starts from the company’s most recent free cash flow, which stands at negative $13.35 billion. Despite that tough starting point, analysts are predicting a significant turnaround over the next decade. By 2029, Intel’s free cash flow is estimated to reach $14.93 billion, with annual projections ramping up in the years following. These are calculated by a blend of analyst estimates and extrapolations. Simply Wall St’s model uses a two-stage Free Cash Flow to Equity approach to map out these future numbers in detail.

After crunching the numbers, the DCF analysis values Intel at $47.49 per share. That is a 22.4% premium to the current market price of $36.83, signaling that the stock is meaningfully undervalued based on our long-term cash flow forecast.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel is undervalued by 22.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

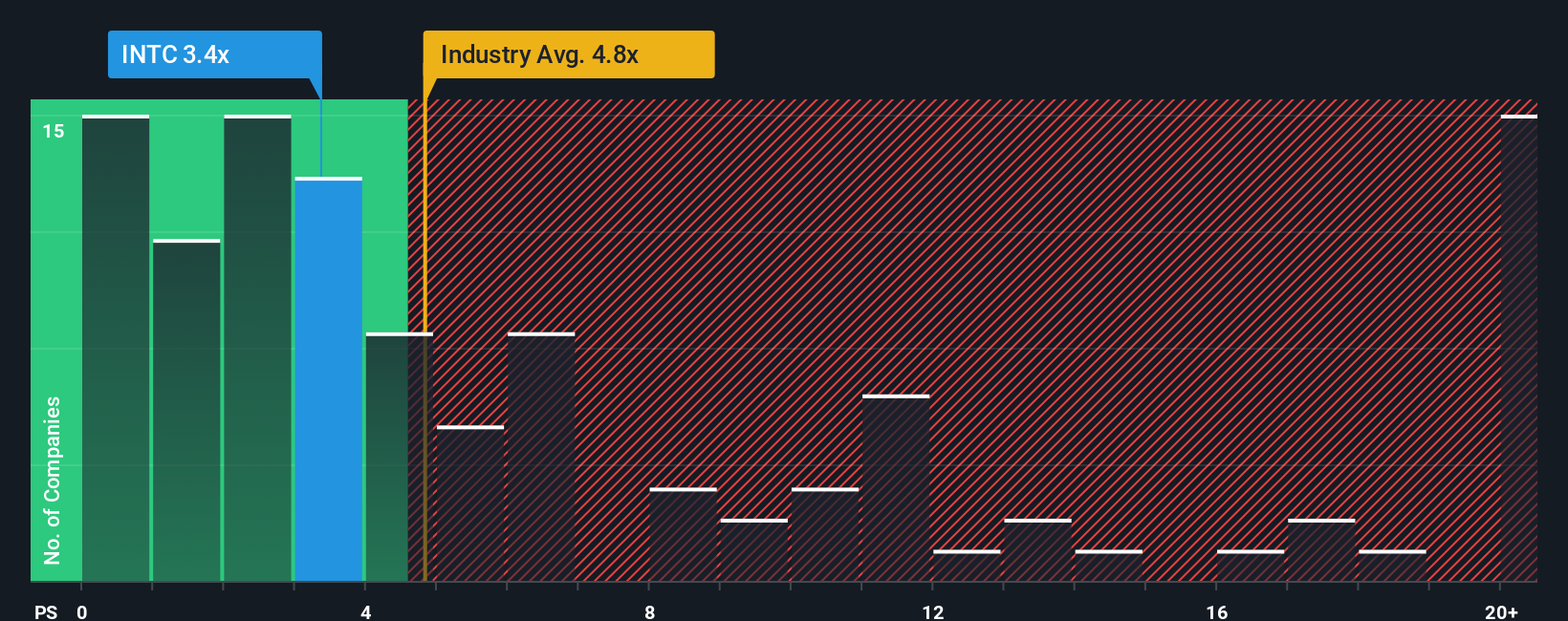

Approach 2: Intel Price vs Sales

For companies like Intel that are transitioning back to profitability or operating on thin margins, the Price-to-Sales (PS) ratio is often the preferred valuation metric. This metric allows investors to compare the company’s value to its total sales, providing insight into how much the market is willing to pay for each dollar of revenue, independent of swings in short-term earnings.

Growth prospects and risks play a major role in what constitutes a fair PS ratio. Companies poised for rapid expansion or enjoying durable competitive advantages typically command higher multiples, while those facing uncertainty or below-average industry growth often trade at a discount to their peers.

Intel’s current PS ratio is 3.24x, which is below the semiconductor industry average of 4.89x and significantly below the peer group average of 16.18x. However, industry averages can overlook the unique combination of factors influencing a single company’s valuation, such as Intel’s evolving business model and profit outlook.

This is where Simply Wall St’s “Fair Ratio” becomes relevant. By incorporating Intel’s earnings growth forecasts, profit margins, market capitalization and company-specific risks, this proprietary metric calculates a fair PS ratio of 5.24x for Intel. Instead of relying solely on peer or industry comparisons, this approach ensures the unique factors that matter for Intel are prioritized in the valuation discussion.

With Intel’s actual PS ratio of 3.24x falling well below its Fair Ratio, the numbers suggest the stock is currently undervalued by this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

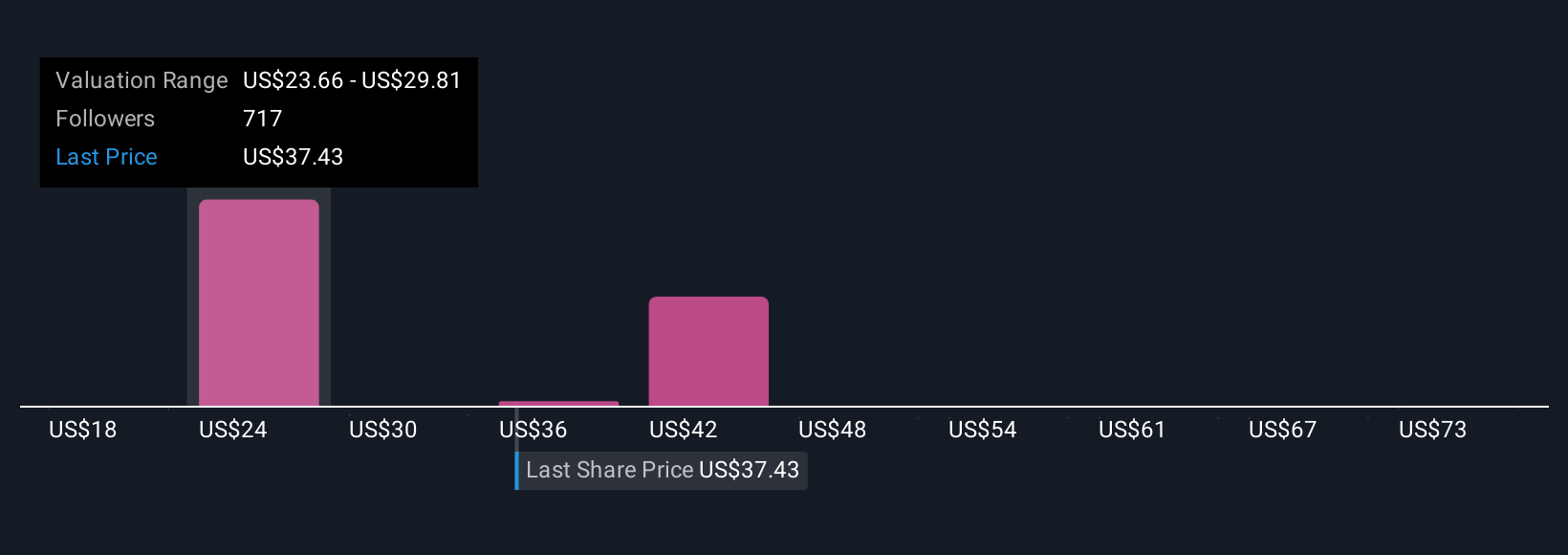

Upgrade Your Decision Making: Choose your Intel Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives, a powerful tool that brings your investment perspective to life by linking Intel’s story to a financial forecast and then connecting it to a fair value.

A Narrative is your personal way to interpret a company's future: you make the call on assumptions like future revenue, earnings, and margins, and then see how those inputs, guided by your view of the business, translate into a fair value for the stock.

Used by millions of investors on Simply Wall St’s Community page, Narratives make valuation easy and accessible; all you need is your outlook and a few simple sliders, and the transparent financial model does the math for you.

With each Narrative, you can instantly compare your Fair Value to Intel’s current share price, helping you decide whether it is time to buy, hold, or sell. Plus, since Narratives update when new news or earnings are released, your view always stays relevant.

For example, some investors see aggressive AI investments and margin recovery driving Intel’s fair value as high as $27.24, while others project only modest improvements, putting fair value closer to $16.15. This highlights how Narratives let you act on your unique convictions and market view.

Do you think there's more to the story for Intel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion