- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NASDAQ:INTC) shareholders have endured a 54% loss from investing in the stock five years ago

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the Intel Corporation (NASDAQ:INTC) share price dropped 60% over five years. We certainly feel for shareholders who bought near the top. We also note that the stock has performed poorly over the last year, with the share price down 33%. Furthermore, it's down 31% in about a quarter. That's not much fun for holders.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Intel

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Intel moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 7.1% per year is viewed as evidence that Intel is shrinking. That could explain the weak share price.

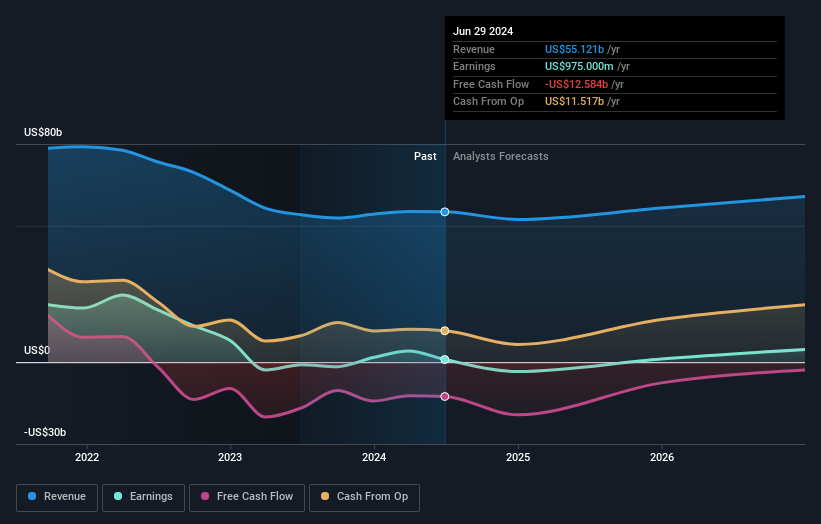

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Intel in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Intel's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Intel shareholders, and that cash payout explains why its total shareholder loss of 54%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 40% in the last year, Intel shareholders lost 31%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Intel is showing 3 warning signs in our investment analysis , you should know about...

Intel is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives