- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Collaborates With NetApp To Simplify AI Adoption In Enterprises

Reviewed by Simply Wall St

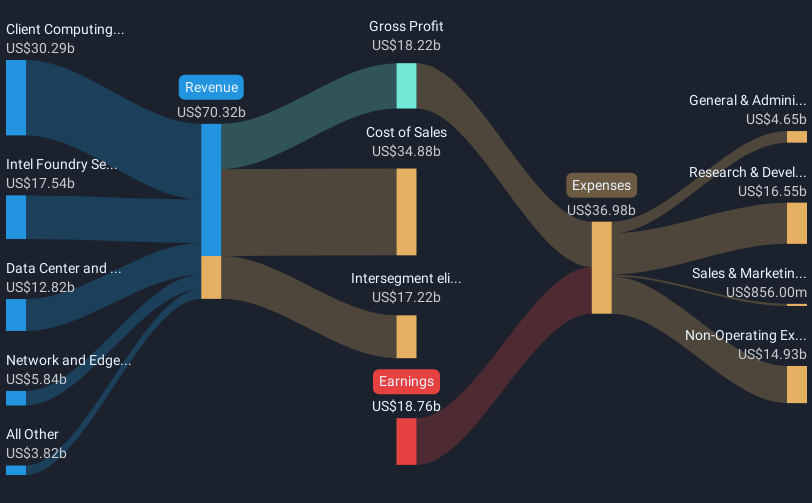

Intel (NasdaqGS:INTC) saw a 5% price increase over the last quarter, reflecting a combination of corporate events and market dynamics. The recent collaboration with NetApp to launch the AIPod Mini showcases Intel's growth in AI capabilities, which could enhance its appeal amid growing demand for such technologies. During this period, geopolitical uncertainties like trade policies weighed generally on markets, but Intel's diversified announcements, including strategic partnerships and tech advancements, could have bolstered its market position. Overall, while contributing factors like these may have added weight to broader market moves, they align with the steady 2% market rise seen recently.

We've identified 1 possible red flag for Intel that you should be aware of.

The recent collaboration between Intel and NetApp to launch the AIPod Mini aligns with Intel's initiative to expand its AI capabilities, which could address certain organizational inefficiencies and drive future revenue growth. However, the long-term success of this partnership in transforming Intel's operations remains uncertain. During the last year, Intel's total shareholder return, accounting for share price changes and dividends, declined by 34.13%. This performance highlights the challenges Intel faces in meeting investor expectations, especially when juxtaposed against its underperformance relative to the broader US market, which achieved an 8.2% return.

This strategic move in AI may influence revenue and earnings forecasts by potentially mitigating revenue growth constraints from older manufacturing nodes. The collaboration could support Intel's strategy to enhance its foundry business, a critical area noted for future growth within the analysis narrative. Despite a recent share price increase, Intel's current share price of US$20.09 remains only slightly below the bearish price target of US$18.61, suggesting the market may already reflect skepticism regarding short-term earnings improvements. The fair value spread also underscores varied analyst opinions on Intel's future performance, influenced by its ability to execute on AI and foundry initiatives effectively.

Explore historical data to track Intel's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion