- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Announces Retirement Of Dr. Lavizzo-Mourey From Board Of Directors

Reviewed by Simply Wall St

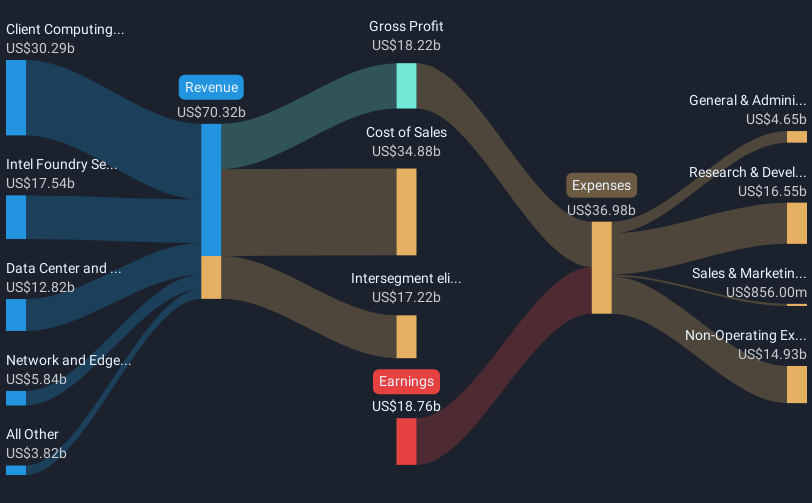

Intel (NasdaqGS:INTC) experienced an 8% increase in share price over the last quarter. This period witnessed several key developments, including the retirement of Dr. Lavizzo-Mourey from the Board of Directors and a key CEO appointment. Despite reporting significant financial losses for 2024, new product launches such as the Xeon 6 processors provided positive momentum. The share price performance came amidst a challenging market environment, with the Nasdaq declining 6% largely due to a tech sell-off. Intel's moves during this time contrasted broader trends, with company-specific changes potentially bolstering investor sentiment.

We've discovered 1 warning sign for Intel that you should be aware of before investing here.

The recent changes at Intel, such as the board reshuffle and CEO appointment, coupled with product launches like the Xeon 6 processors, have injected optimism, possibly boosting investor sentiment. Over the last year, however, the total shareholder return, including share price and dividends, declined 41.52%, contrasting with the 8.56% return of the US Semiconductor industry. These developments highlight Intel's challenges in a competitive landscape marked by new market entrants, especially in the AI PC category, which could affect its revenue and margin growth.

Intel's long-term share performance has been underwhelming compared to the broader market. The share price change relative to its consensus price target of US$22.90 reflects some market skepticism, with Intel trading a slight discount of around 6%. Despite promising prospects, such as AI-driven innovations that may bolster revenue, analysts remain cautious about short-term revenue and earnings forecasts. Current market conditions, compounded by industry pressures, emphasize the importance of Intel delivering on new product timelines to improve financial health and market positioning.

Review our historical performance report to gain insights into Intel's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives