- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (INTC) Valuation in Focus After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Intel (INTC) shares have been on the move lately, drawing attention as investors assess what is next for the semiconductor giant. The company’s recent performance has sparked discussions around valuation and future opportunities in the sector.

See our latest analysis for Intel.

Momentum is clearly building for Intel, with a remarkable 1-month share price return of nearly 55% and a year-to-date share price gain approaching 87%. The 1-year total shareholder return of almost 63% underscores renewed investor optimism, especially as recent market developments suggest improving prospects following a challenging period. Despite a longer-term track record that still shows a five-year total return in negative territory, sentiment has shifted notably in recent months. This points to potential growth ahead.

If you're tracking sector momentum in tech and semiconductors, now’s a great moment to broaden your view and discover See the full list for free..

With shares soaring and valuation metrics flashing mixed signals, investors are now asking if Intel’s impressive rally has left further upside on the table, or if renewed optimism has already been fully reflected in the price.

Most Popular Narrative: 45.7% Overvalued

The most widely followed narrative suggests Intel’s fair value sits much lower than the current share price, making the sharp rally look stretched. This sets the stage for a closer look at the drivers behind the valuation call.

Bullish analysts highlight that strategic partnerships, particularly with leading technology firms, have the potential to accelerate Intel's participation in key growth segments such as AI and data center infrastructure. Recent investments in U.S. manufacturing are viewed as supportive of government policy trends. This could increase demand for domestically produced chips and offer a near-term boost to Intel's valuation.

Curious what underpins this cautious price target? The narrative is stacked on optimistic projections for revenue and profit transformation, with future profit multiples usually reserved for sector leaders. Want to discover the exact quantitative leap analysts expect before deciding if the premium is justified? The full story might surprise you.

Result: Fair Value of $25.95 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent execution challenges and uncertainty about Intel's ability to meet critical manufacturing milestones could still derail the current bullish outlook.

Find out about the key risks to this Intel narrative.

Another View: DCF Model Suggests Upside

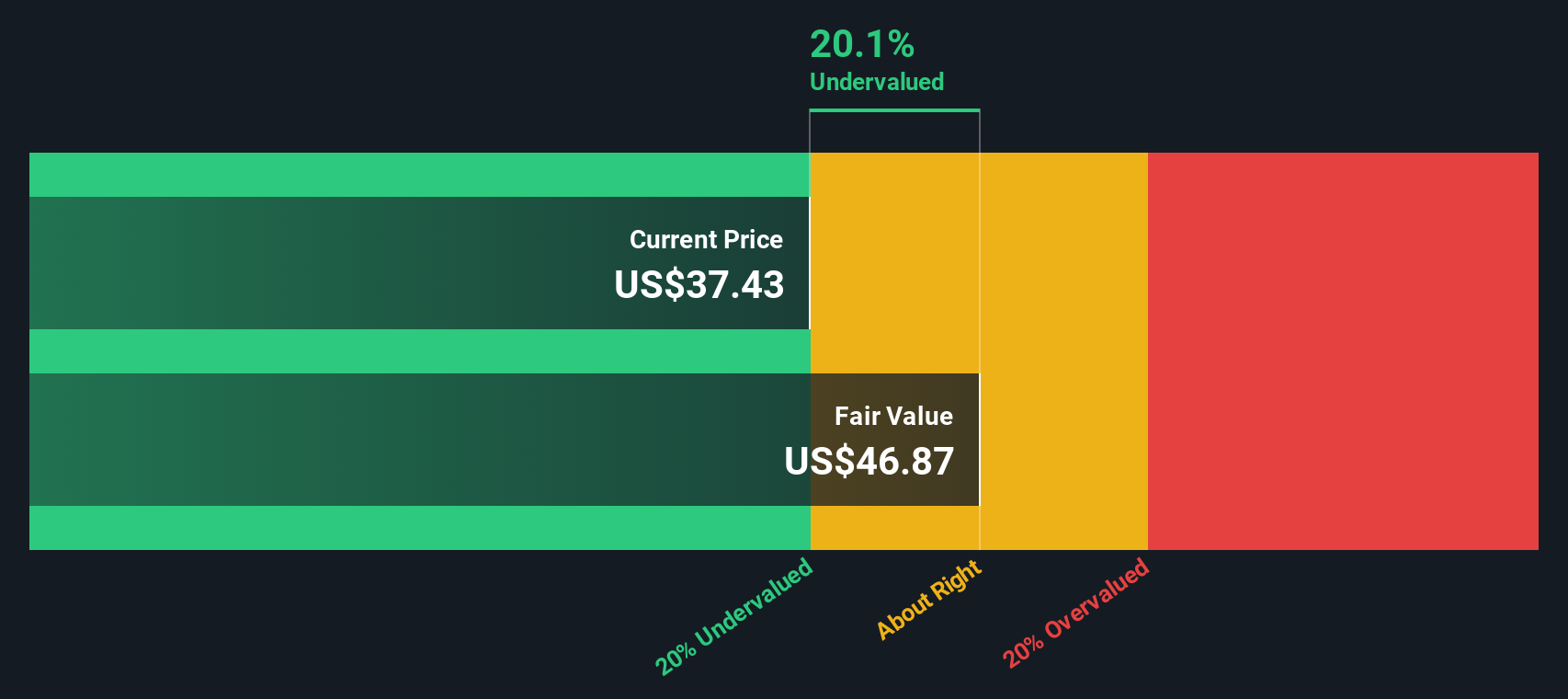

Looking at Intel from another angle, our DCF model points to a fair value of $46.91, which is well above the current trading price of $37.80. Unlike the multiples-based approach, this method suggests the market may be underestimating Intel’s long-term cash flow potential. Does this imply opportunity or just a difference in perspective?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Intel Narrative

If you have your own perspective or want to dig deeper into the numbers, you can shape your own Intel story in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intel.

Looking for more investment ideas?

Don't limit your strategy to just one stock. Get ahead of the curve and uncover fresh investment opportunities uniquely suited to today’s market trends with these focused screeners:

- Tap into high-yield potential by checking out these 18 dividend stocks with yields > 3%, where you’ll find businesses offering attractive returns that can build steady income alongside growth.

- Track the companies pioneering breakthroughs in artificial intelligence with these 25 AI penny stocks, giving you an edge in the fastest-changing sector of the tech market.

- Position yourself early for the next financial frontier by reviewing these 79 cryptocurrency and blockchain stocks. These are firms driving advancements in digital assets, blockchain, and the evolving crypto economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026