- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

New CEO, New Plans: Is The Market Wrong About Intel (NASDAQ:INTC)?

While it might be hard to get excited about Intel ( NASDAQ:INTC ) after its 11% decline over the past month, the fundamentals paint a more positive picture. Despite the company announcing it beat estimates in both revenue and earnings for Q1, investors seemed to overlook these and focus more on the 20% fall in the company's Data Center Group (DCG) revenue.

However, as we know, over the long term stock prices are usually driven by a company’s financial performance, and in Intel's case, they look quite encouraging.

With a new CEO, Pat Gelsinger, at the helm from earlier this year, positive changes are already afoot for Intel. The company now seems very focused on reinventing itself and getting back its swagger from the old days by re-investing heavily, as we'll cover below. Ben Thompson from Stratechery extensively covered Intel's keynote: Intel Unleashed , late last month and while there's a lot left to execute in the company's plans, the new vision that Mr Gelsinger presented looks to be just what the company needs to do well in the future.

Add to that the moves that Intel has already made this year and there's more reason to believe it could achieve its bold plans and be the: "unquestioned leader in all its categories by 2024-2025" .

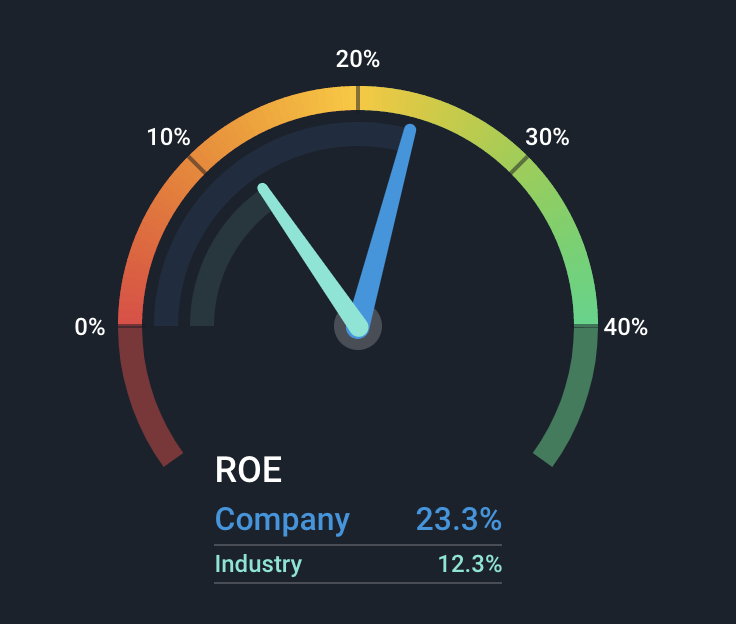

So in this piece, we want to pay attention to Intel's Return on Equity (ROE), its earnings growth and how Intel has been reinvesting its profits. These are important factors to consider by investors because it tells us how effectively shareholders capital is being allocated.

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Intel is:

23% = US$19b ÷ US$80b (Based on the trailing twelve months to March 2021).

The 'return' is the income the business earned over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.23.

Source: NASDAQGS:INTC - Return on Equity vs Industry - April 28th 2021

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

And while Intel has historically used some of its excess earnings for buybacks (buybacks which are now largely finished), it appears the focus is shifting to reinvestment, and since ROE is high, that's likely a wise move.

Intel's Earnings Growth And 23% ROE

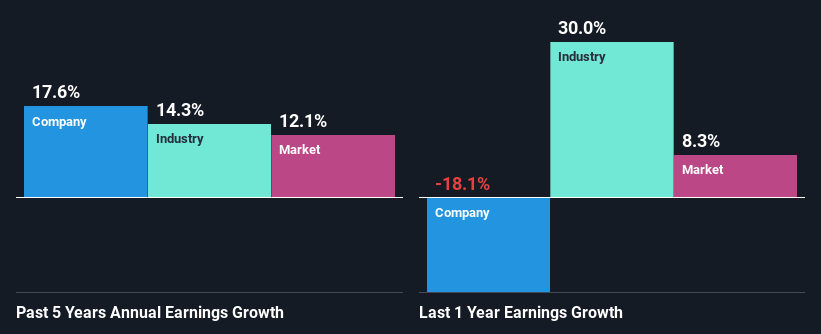

First things first, we like that Intel has an impressive ROE. Secondly, even when compared to the industry average of 12%, the company's ROE is quite strong (although AMD generated 42% ROE and NVIDIA delivered 25%). This likely paved the way for Intel's modest 18% net income growth over the past five years.

Next, on comparing with the industry net income growth, Intel's growth is quite high since the industry average growth was 14% in the same period, which is great to see. However, again we should note that rivals AMD and NVIDIA delivered 82% and 21% annual earnings growth over the last 5 years, respectively, since they've performed so well recently.

Source: NasdaqGS:INTC Past Earnings Growth April 28th 2021

Keep in mind, when trying to value a stock, earnings growth is an important metric to consider. It’s vital for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Since doing so will help them establish if the stock's future looks promising or ominous. Which raises the question: Is INTC fairly valued? This infographic on the company's estimated intrinsic value has everything you need to know.

In terms of simple P/E metrics, it also looks quite appealing. The company isn't viewed as favourably as AMD or NVIDIA, so it trades at a much lower multiple of earnings. Intel trades at 12.8x earnings whereas AMD trades at 40x and NVIDIA trades at 87x, which means there's much less anticipation for Intel to grow. Now that could present an opportunity because if these new initiatives deliver on what they intend, the potential growth might not be accounted for yet.

Is Intel Efficiently Re-investing Its Profits?

Intel has a three-year median payout ratio of 27%, which implies that it retains the remaining 73% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

As for reinvestment, the company's Research and Development expense has remained flat for years now, at roughly $3.2bn per quarter, so it's encouraging to see that it's starting to increase ( $3.6bn in Q1 2021 ). This is probably due to the fact that Intel has added two thousand engineers in 2021 already, and reportedly plans on adding many more through the rest of the year to re-energise its innovation capabilities. Plus, the company is allocating $20bn for its first large-scale foundry operation in Arizona to expand its capabilities within Intel Foundry Services. So expect investment in R&D and PPE to significantly increase over the next few years.

The unprecedented demand for semiconductors, and Intel's commitment to help meet this demand by facilitating chip manufacturing within the US, place the company in a good position to reap rewards from these investments.

As for the capital returns to shareholders, Intel has been paying dividends for more than ten years. This shows that the company is committed to sharing profits with its shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 31%. Regardless, Intel's ROE is speculated to decline to 18%, despite there being no major anticipated change in its payout ratio. It's due to slightly lower earnings expected over the short term.

Summary

In total, we are pretty happy with Intel's underlying performance. Particularly, we like that the company is deciding to further increase its reinvestment into its business, and at a high rate of return. Unsurprisingly, the historical reinvestment has led to impressive earnings growth and since its operating in a huge and growing industry, this will likely be a good tailwind over the long term. That being said, the latest analyst forecasts show that the company is expected to see a slowdown in its earnings growth, at least over the short term.

So while the company tries to reinvent itself under the new leadership and get its same grove from the '80s and '90s back, economic performance will likely be more moderate. If Intel can execute on these plans, the future could be very bright for patient investors.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion