- United States

- /

- Semiconductors

- /

- NasdaqCM:INDI

indie Semiconductor And 2 Other US Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with major indices like the S&P 500 and Dow Jones Industrial Average hitting record highs, investors are increasingly exploring diverse opportunities beyond traditional large-cap stocks. Penny stocks, despite their somewhat antiquated name, remain a viable investment area for those interested in smaller or newer companies that can offer unique growth potential. This article will explore three such penny stocks that exhibit strong financial foundations and could present intriguing possibilities for long-term success amidst current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7805 | $5.74M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $142.61M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2255 | $8.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.27 | $559M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9511 | $80.94M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.98 | $435.65M | ★★★★☆☆ |

| VCI Global (NasdaqCM:VCIG) | $1.79 | $5.64M | ★★★★★☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

indie Semiconductor (NasdaqCM:INDI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: indie Semiconductor, Inc. develops automotive semiconductors and software solutions for applications such as advanced driver assistance systems, autonomous vehicles, in-cabin technology, connected cars, and electrification, with a market cap of approximately $992.91 million.

Operations: The company's revenue is primarily derived from its semiconductors segment, totaling $228.81 million.

Market Cap: $992.91M

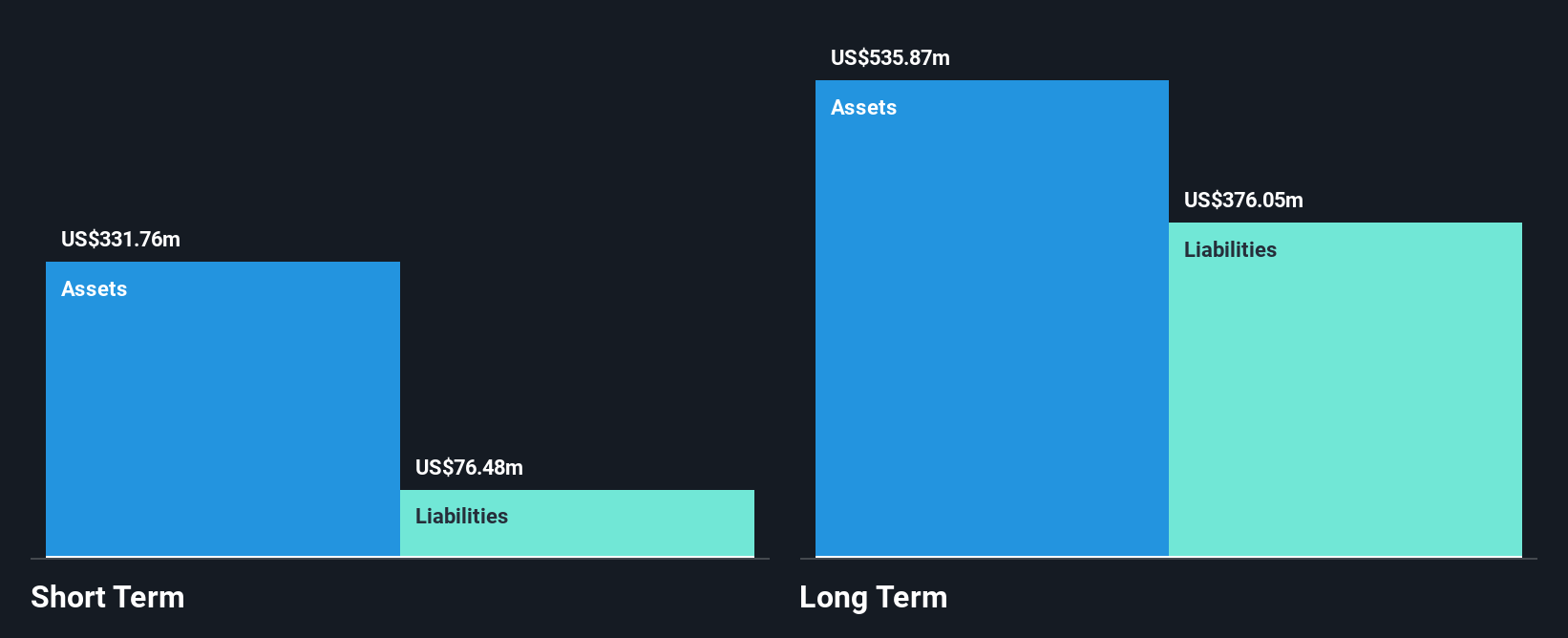

indie Semiconductor, Inc. has been navigating the penny stock landscape with a focus on automotive semiconductors. Despite being unprofitable and experiencing increased losses over five years, the company maintains a satisfactory net debt to equity ratio and sufficient cash runway for over a year. Revenue reached US$158.67 million for the first nine months of 2024, showing slight growth from the previous year. Recent product advancements include an ASIL-D certified safety IC for vehicle powertrains, potentially enhancing its market position in automotive safety solutions and unlocking new opportunities with global OEMs and Tier 1 customers by late 2025.

- Get an in-depth perspective on indie Semiconductor's performance by reading our balance sheet health report here.

- Examine indie Semiconductor's earnings growth report to understand how analysts expect it to perform.

3D Systems (NYSE:DDD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Systems Corporation offers 3D printing and digital manufacturing solutions across multiple regions, including the Americas, Europe, the Middle East, North Africa, the Asia Pacific, and Oceania, with a market cap of approximately $458.16 million.

Operations: The company's revenue is divided into two primary segments: Healthcare, generating $197.93 million, and Industrial, contributing $256.87 million.

Market Cap: $458.16M

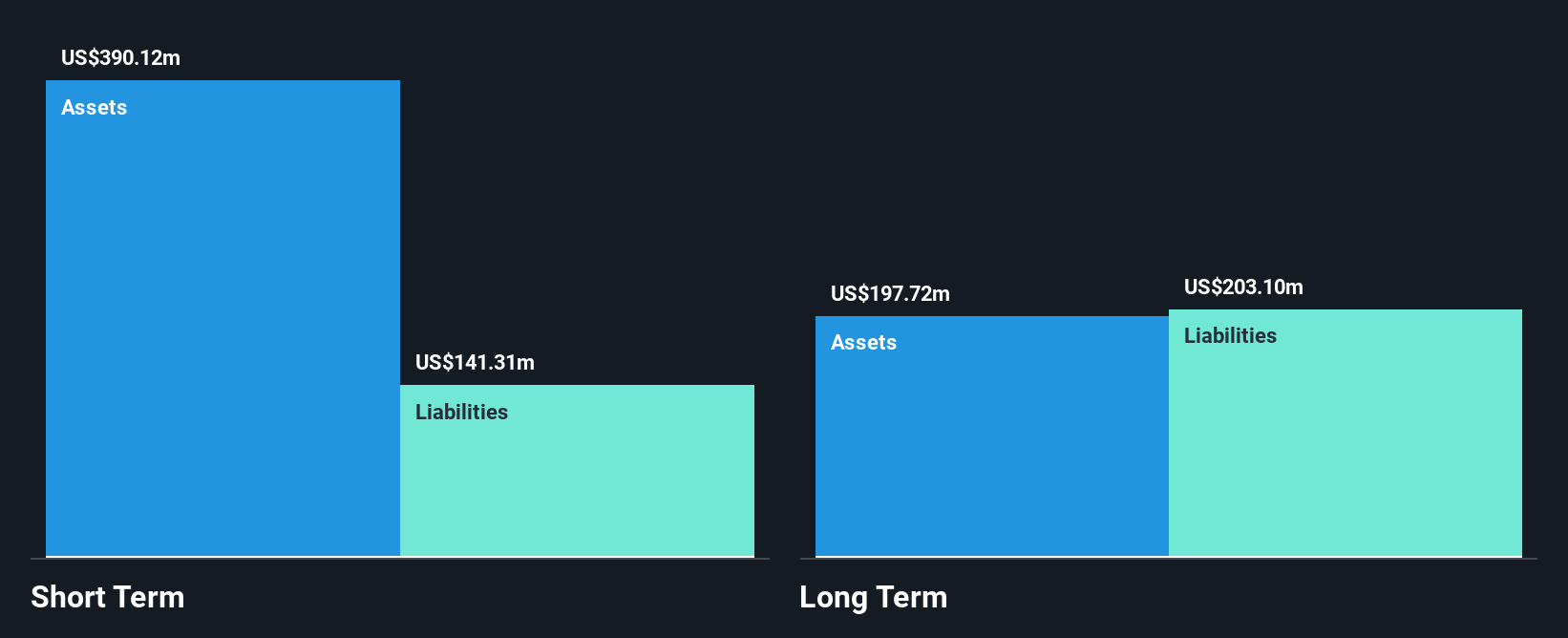

3D Systems Corporation, with a market cap of approximately US$458.16 million, operates in the 3D printing sector. Despite being unprofitable and facing increased losses over the past five years, it maintains a satisfactory net debt to equity ratio and sufficient cash runway for more than a year. Recent developments include partnerships with Sauber Motorsports to enhance production capacity using advanced 3D printing technologies. However, revenue guidance for Q3 2024 indicates a decline due to macroeconomic challenges affecting hardware systems, partially offset by strong materials growth. The company also faces volatility in its share price and management changes amidst restructuring efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of 3D Systems.

- Explore 3D Systems' analyst forecasts in our growth report.

RLX Technology (NYSE:RLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RLX Technology Inc. manufactures and sells e-vapor products in China and internationally, with a market cap of approximately $2.33 billion.

Operations: The company generates revenue primarily from its Personal Products segment, amounting to CN¥2.16 billion.

Market Cap: $2.33B

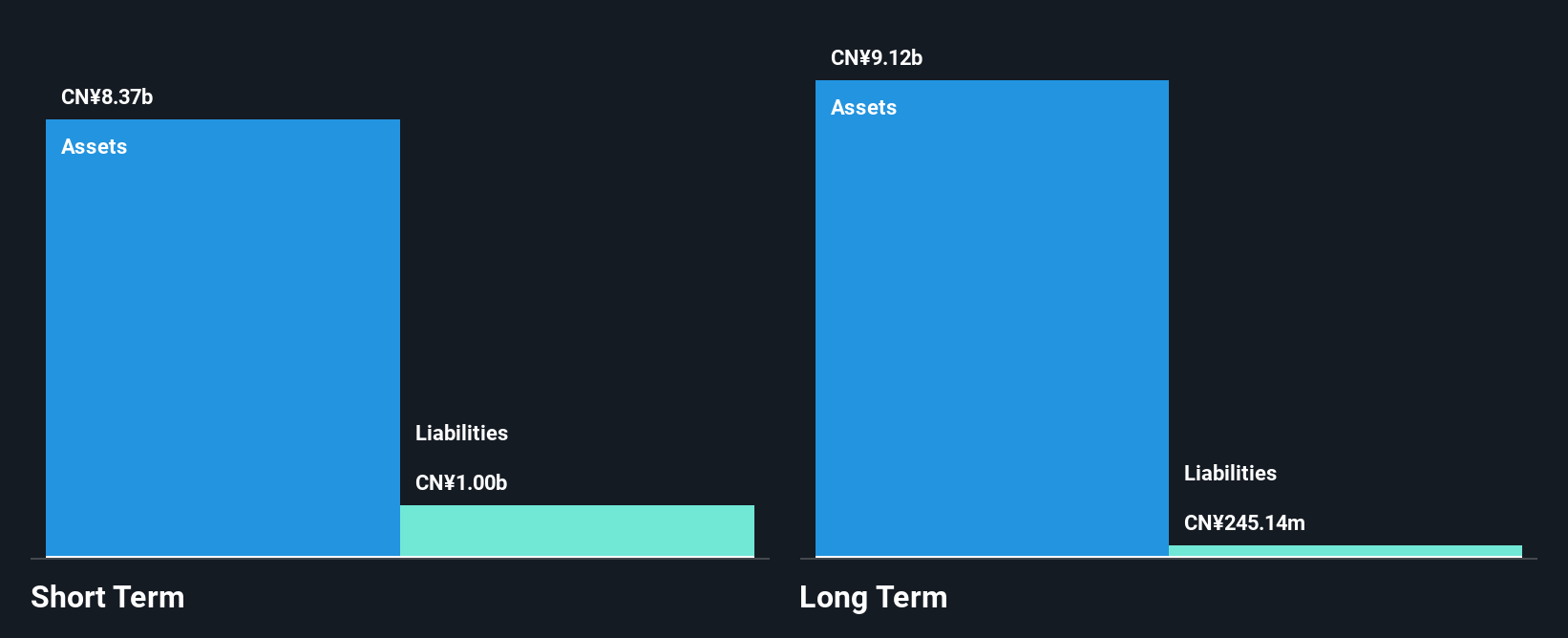

RLX Technology Inc., with a market cap of US$2.33 billion, has shown robust financial performance in the e-vapor sector, reporting CN¥756.29 million in sales for Q3 2024, up from CN¥498.93 million a year ago. The company's earnings growth of 596.5% over the past year surpasses industry averages, supported by high-quality earnings and improved profit margins now at 29.8%. RLX is debt-free with strong asset coverage for liabilities and stable weekly volatility at 8%. The board and management team are experienced, contributing to its strategic stability despite a low return on equity of 4.2%.

- Click to explore a detailed breakdown of our findings in RLX Technology's financial health report.

- Review our growth performance report to gain insights into RLX Technology's future.

Turning Ideas Into Actions

- Unlock more gems! Our US Penny Stocks screener has unearthed 714 more companies for you to explore.Click here to unveil our expertly curated list of 717 US Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if indie Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:INDI

indie Semiconductor

Provides automotive semiconductors and software solutions for advanced driver assistance systems, driver automation, in-cabin, connected car, and electrification applications.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success