- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Himax Technologies (NasdaqGS:HIMX): Reassessing Valuation After New WiseEye AI, Micro-Display and CPO Progress

Reviewed by Simply Wall St

Himax Technologies (NasdaqGS:HIMX) is back on traders radar after new momentum in its WiseEye AI and FrontLED micro display, as well as progress toward mass producing Co Packaged Optics for AI data centers.

See our latest analysis for Himax Technologies.

The recent WiseEye and CPO milestones seem to have flipped sentiment, with the share price now at $9.48 and a 26.74% year to date share price return contributing to a 47.10% one year total shareholder return. This suggests momentum is building rather than fading.

If Himax is on your radar because of its AI angle, it can be worth comparing it with other high growth tech and AI stocks that are starting to attract attention for similar reasons.

Yet with the stock now trading above consensus price targets despite soft recent revenue trends, investors face a key question: Is Himax a mispriced AI beneficiary, or has the market already baked in its next leg of growth?

Most Popular Narrative: 11% Overvalued

With Himax closing at $9.48 versus a narrative fair value near $8.54, the story leans optimistic and hinges on several long dated growth engines.

The company's deepening engagement and design wins in emerging smart glasses/AR markets, underpinned by unique proprietary technologies in ultra-low power sensing (WiseEye), microdisplay, and nano-optics, create opportunities to capitalize on the rising demand for next-generation wearables, providing a new long-term revenue stream that will positively impact both top-line growth and margins.

Curious how steady growth expectations, rising margins and a reset in future earnings multiples still add up to an above market valuation signal? The underlying blueprint might surprise you.

Result: Fair Value of $8.54 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and weak near term demand could derail automotive and AI momentum, challenging the earnings and valuation path implied by this narrative.

Find out about the key risks to this Himax Technologies narrative.

Another Lens on Value

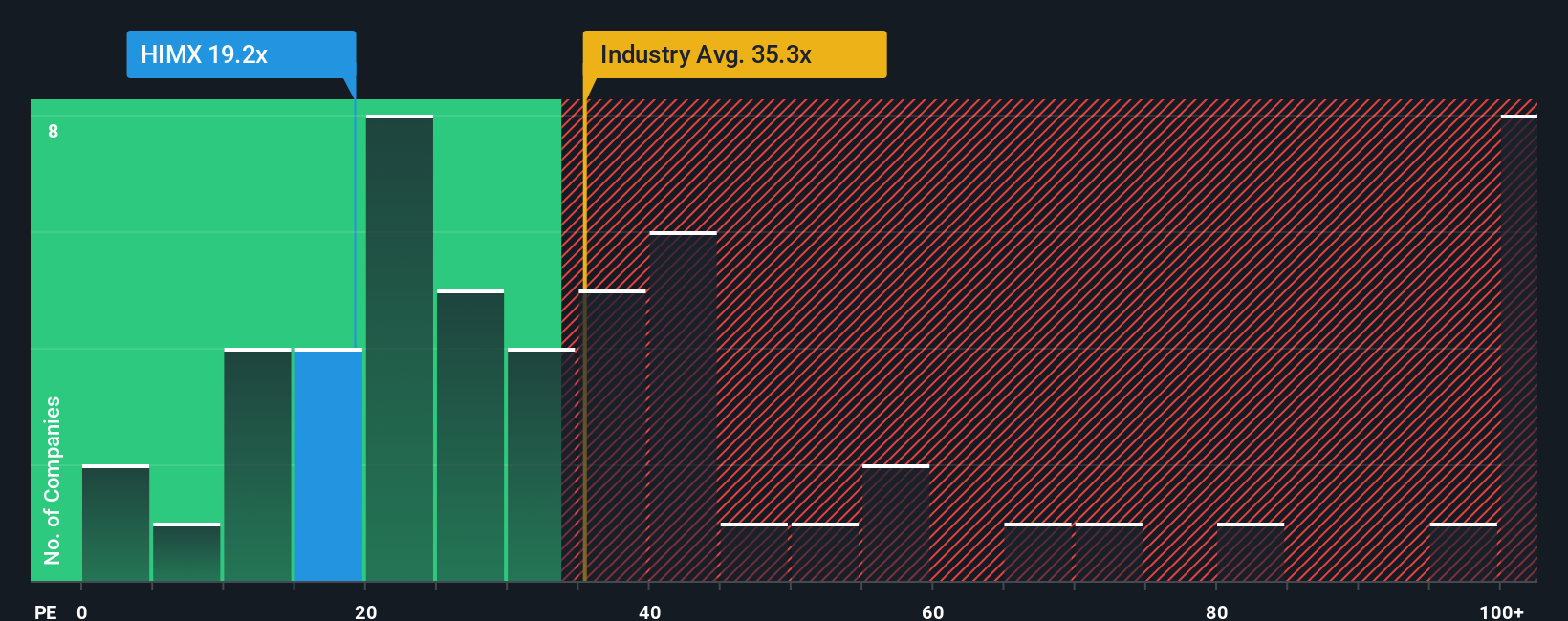

While the narrative fair value suggests Himax is 11% overvalued, its 26.7x price to earnings ratio sits well below both the US semiconductor average of 37.9x and peer levels near 82.9x, compared with a fair ratio of 50.3x. Is sentiment lagging the fundamentals here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Himax Technologies Narrative

If this framing does not quite fit your view, or you prefer hands on research, you can quickly craft a personalized Himax thesis in under three minutes: Do it your way

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Himax might be compelling, but you will kick yourself later if you ignore other opportunities our Screener has already filtered for strength, quality and momentum.

- Target income potential with dependable cash flows by reviewing these 12 dividend stocks with yields > 3% that can support long term compounding and help stabilise your overall portfolio returns.

- Capitalize on structural AI adoption by examining these 25 AI penny stocks that could translate surging demand for intelligent software and infrastructure into sustained earnings growth.

- Seize mispriced opportunities early by scanning these 909 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion