- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Himax Technologies (NasdaqGS:HIMX): Evaluating Valuation as WiseEye AI Tech Lands in Acer Swift Edge 14 Notebooks

Reviewed by Kshitija Bhandaru

Himax Technologies (NasdaqGS:HIMX) just announced that its WiseEye ultralow power AI sensing tech has been built into Acer’s new Swift Edge 14 AI notebooks, which are now rolling off production lines. This move underscores the growing real-world adoption of Himax’s sensing solution in the expanding AI PC market.

See our latest analysis for Himax Technologies.

Against this backdrop of new design wins, Himax Technologies has continued to attract attention from tech investors, with the stock’s latest share price at $9.17 and a steady 1-year total shareholder return of 0.62%. These recent gains hint at renewed optimism about the company's growth prospects as its AI solutions see broader commercial adoption.

If you want to discover more AI and semiconductor innovators making headlines, check out the latest opportunities in our tech and AI stocks screener: See the full list for free.

With shares hovering close to analyst targets and a track record of steady gains, the debate now turns to valuation. Is there still room for upside, or has the market already accounted for Himax’s future growth potential?

Most Popular Narrative: Fairly Valued

With Himax Technologies closing just below the consensus fair value, the current price suggests the market views its outlook as balanced. Investors are monitoring whether ambitious revenue and margin growth targets will be achieved.

Himax's leading position and rapid expansion in automotive display ICs, including TDDI, traditional DDIC, Tcon, and a growing pipeline of OLED projects, place it at the center of automotive digital cockpit upgrades and EV/autonomous vehicle adoption. These trends are expected to drive higher average selling prices and gross margins in the coming years, with accelerated revenue growth from 2027 as mass production increases.

Want to know the bold foundation of this outlook? Forecasts indicate rising profit margins and a revenue growth pace that could outpace previous cycles. Get the details on what might drive a major re-rating and discover the full set of forward-looking assumptions behind this consensus.

Result: Fair Value of $9.31 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and demand volatility could stall Himax’s growth story. This reminds investors that market optimism is balanced by real-world risks.

Find out about the key risks to this Himax Technologies narrative.

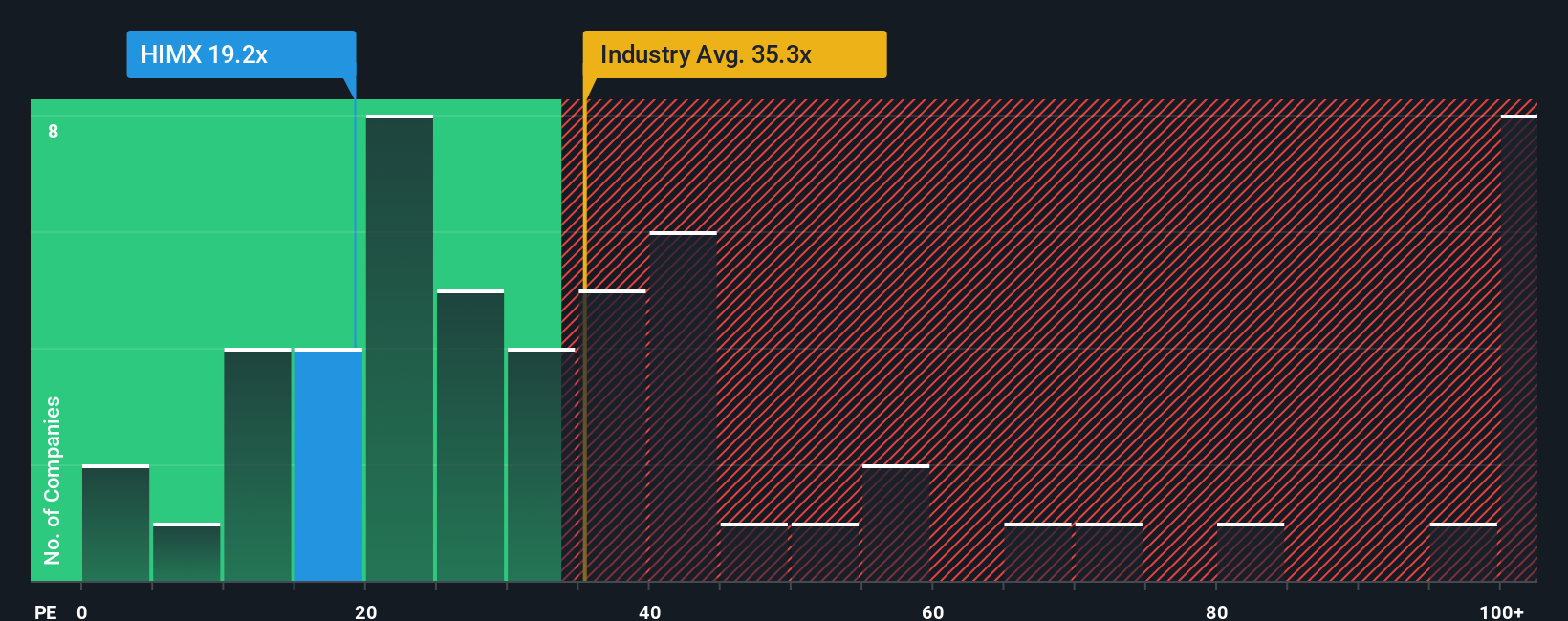

Another View: Testing Fair Value with Earnings Multiples

Looking through a different lens, the current share price means Himax Technologies trades at 21.6 times earnings, far below both the US semiconductor industry average of 37 times and its peer average of 42.5 times. The market’s “fair ratio” stands at 31.4 times, which highlights a noticeable value gap. Is the market underestimating Himax’s potential, or does this discount reflect hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Himax Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Himax Technologies Narrative

If you see things differently or want to dig into the details yourself, you can craft your own perspective on Himax Technologies in just a few minutes, and Do it your way.

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities to just one stock. The best investors always keep an eye on fresh trends and emerging sectors ready for growth.

- Unlock the potential for breakout returns by targeting market inefficiencies through these 894 undervalued stocks based on cash flows.

- Capture income alongside growth by checking out rewarding companies in these 19 dividend stocks with yields > 3%, all offering yields above 3%.

- Capitalize on next-wave digital innovation by following pioneers reshaping global finance with these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives