- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

Subdued Growth No Barrier To First Solar, Inc. (NASDAQ:FSLR) With Shares Advancing 56%

First Solar, Inc. (NASDAQ:FSLR) shares have continued their recent momentum with a 56% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

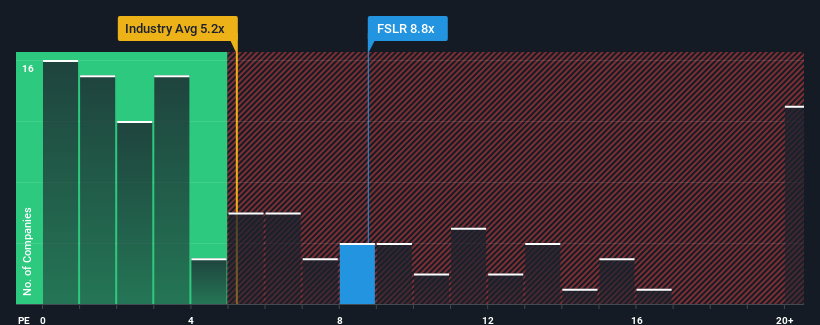

After such a large jump in price, First Solar's price-to-sales (or "P/S") ratio of 8.8x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 5.2x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for First Solar

What Does First Solar's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, First Solar has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think First Solar's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For First Solar?

First Solar's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 27% last year. Revenue has also lifted 20% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 27% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that First Solar's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does First Solar's P/S Mean For Investors?

Shares in First Solar have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for First Solar, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for First Solar (1 doesn't sit too well with us) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives