- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

Does FormFactor’s Recent 17% Rally Signal New Growth or Pricing Ahead of Itself?

Reviewed by Bailey Pemberton

Thinking about what to do with your FormFactor shares or considering jumping in? You are not alone. This stock has been making some interesting moves lately, and investors everywhere are buzzing about whether now is the right time to buy, hold, or sell. After all, the last week saw FormFactor rally by a robust 17.4%, continuing an impressive 45.0% surge over the past month. Those strong short-term gains hint that the market's perception of FormFactor's growth potential or risk profile may be shifting. But if you have been holding over the past year, you know it's not all smooth sailing, with the stock still down 7.9% in the past twelve months and trailing its 3-year and 5-year gains.

What's sparked all the action? Recent market trends, including supply chain shifts and renewed optimism around the semiconductor equipment sector, have certainly helped catch the market's attention. FormFactor seems to be benefiting from industry tailwinds, but the real question on most investors’ minds is whether those gains are supported by the company’s underlying value or if the price has gotten ahead of itself.

By the numbers, FormFactor earns a valuation score of 0 out of 6, meaning it's not considered undervalued by any of our six primary checks. But scores do not tell the whole story. In the next section, we will dig into how those valuations are actually assessed and what each method reveals, before moving on to a smarter way to evaluate what this score really means for your portfolio decisions.

FormFactor scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: FormFactor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates FormFactor’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. This approach gives investors a sense of what the company’s operations are truly worth, beyond daily price swings.

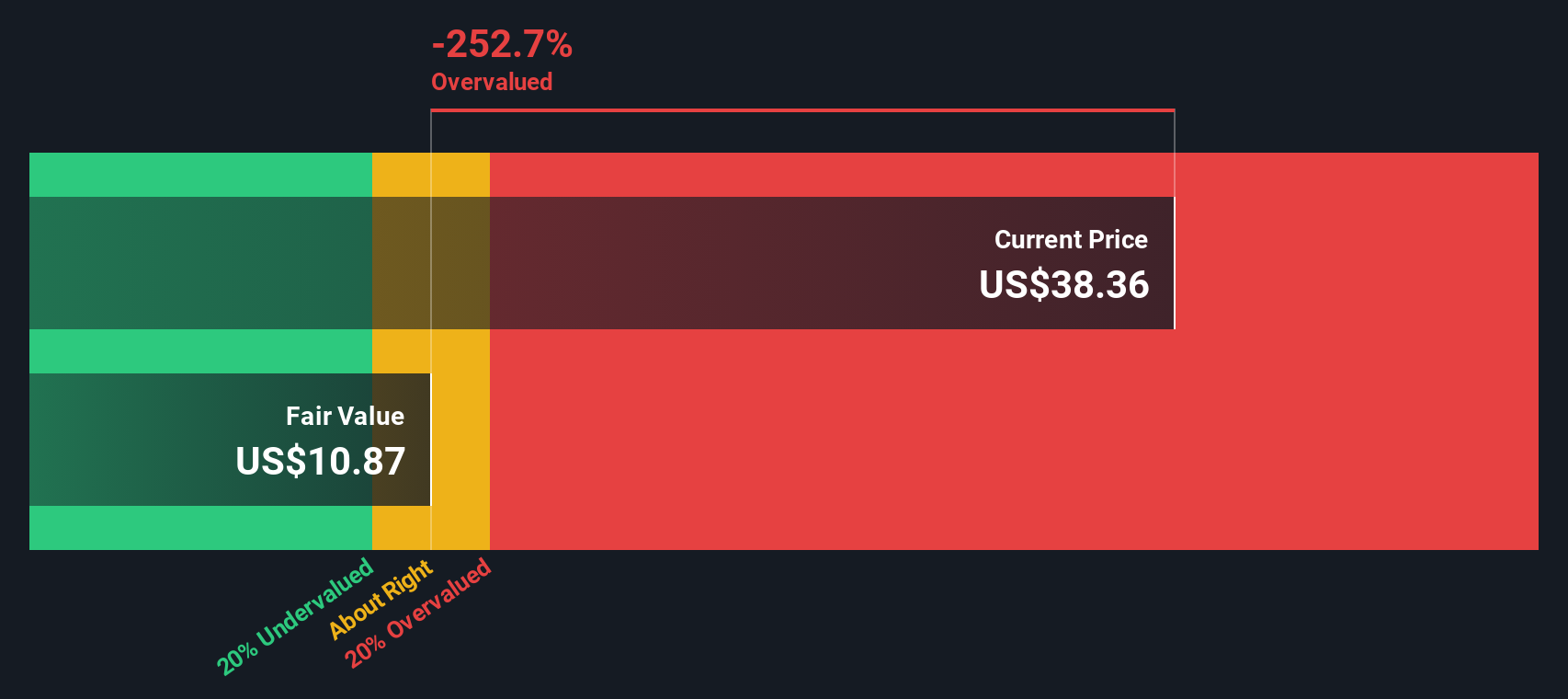

FormFactor’s latest reported Free Cash Flow sits at $28.6 million. Over the next few years, analysts and model projections forecast steady growth, with FCF expected to climb to $84.4 million by 2035. While detailed analyst estimates typically only span up to five years, more distant figures, such as the 2035 projection, are extrapolated based on current trends and growth expectations from Simply Wall St’s analysis. This long-term view helps account for both anticipated growth spurts and the natural caution of discounting uncertain cash flows further out.

After crunching the numbers, the DCF returns an estimated intrinsic value of $10.88 per share. This is markedly below the current market price, resulting in a discount of 291.2 percent. Put simply, the market is pricing FormFactor’s shares at nearly triple what the underlying cash flows would justify. This suggests the stock is significantly overvalued using this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FormFactor may be overvalued by 291.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FormFactor Price vs Earnings

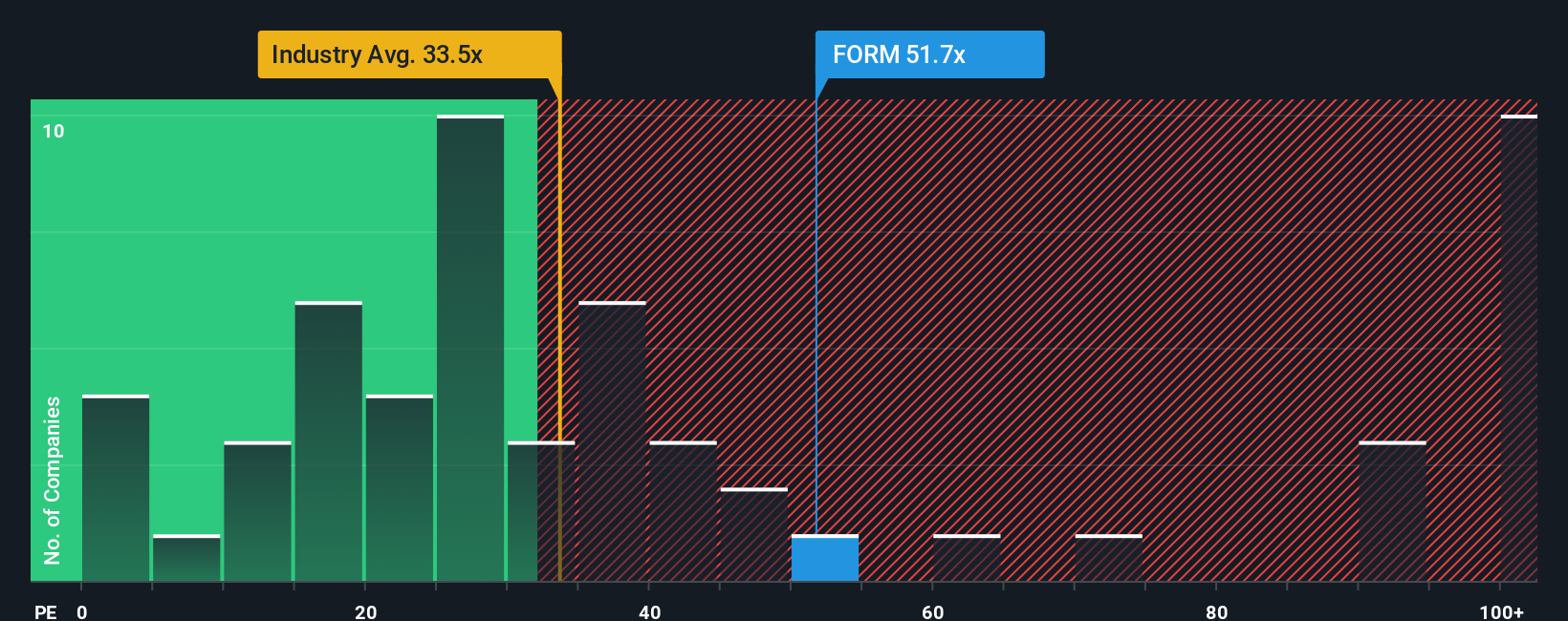

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like FormFactor. Since it measures how much investors are willing to pay for each dollar of a company’s earnings, the PE ratio helps put FormFactor’s market price in the context of its profit-generating power.

Of course, what counts as a “fair” PE isn’t set in stone. Companies with faster growth, higher margins, or less risk typically command a higher PE, while slower-growing or riskier companies trade at lower multiples. In FormFactor’s case, the current PE ratio is 74.7x, putting it well above both the industry average of 37.8x and the peer average of 24.3x.

This is where Simply Wall St’s “Fair Ratio” becomes especially useful. Rather than just comparing FormFactor’s PE to industry or peer norms, the Fair Ratio incorporates the company’s growth outlook, profit margins, industry dynamics, market cap, and risk profile to estimate what the PE “should” be. For FormFactor, the Fair Ratio comes in at 36.8x, which is almost exactly half of its actual 74.7x PE. Since the stock is trading at a much higher multiple than would be justified by its specific characteristics, this analysis suggests the stock is overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FormFactor Narrative

Earlier, we mentioned there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story behind FormFactor's numbers; it lets you describe your expectations for the company's future revenue, profits, and fair value based on your own view of the business. Then, it ties everything together so you can see if the current price matches your outlook.

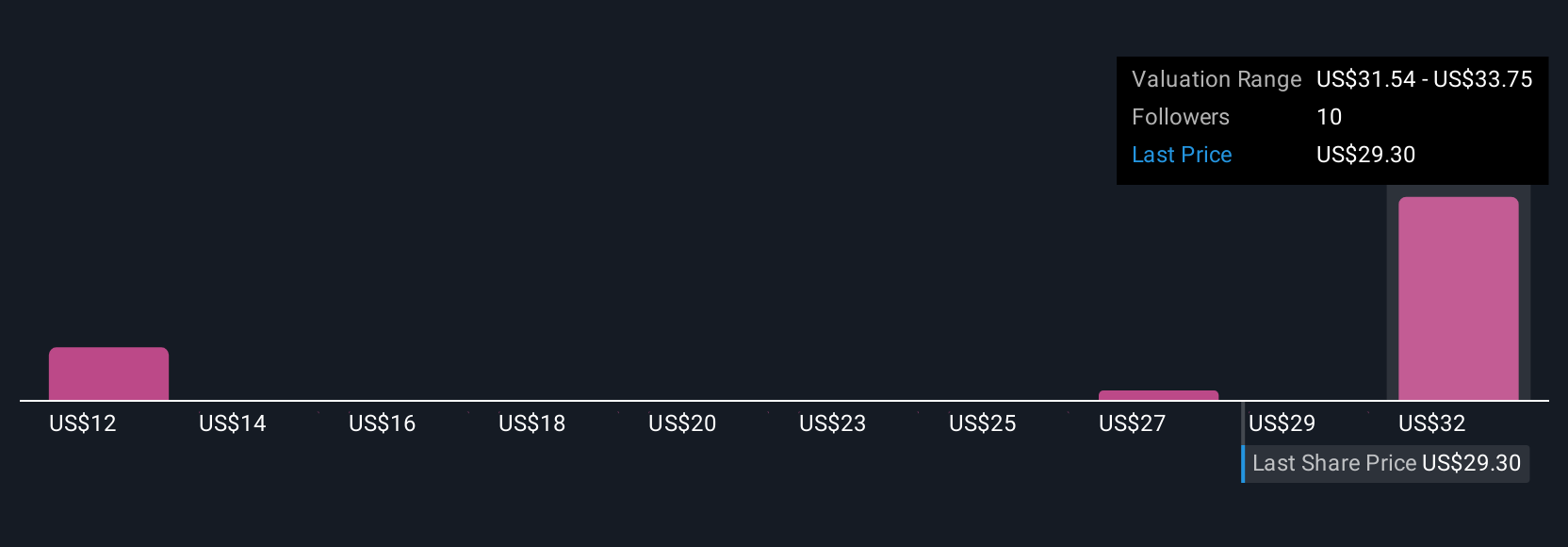

Unlike a static number, a Narrative connects FormFactor’s business drivers, such as AI testing demand or new Texas manufacturing capacity, to your financial forecast and a real-time fair value estimate. This makes it easy to compare your Narrative with the current share price, helping you decide if FormFactor is worth buying, holding, or selling based on your personal assumptions, not just what the market or analysts think.

On Simply Wall St’s Community page, millions of investors are already using Narratives to track their logic, set realistic targets, and spot opportunities. Narratives also update automatically as new results and news come in. For example, some FormFactor investors may predict strong earnings growth and set a fair value as high as $45.00, while others expect tougher competition or weaker margins and estimate a value closer to $23.00. The right Narrative puts you in control, adapting each time fresh information is released.

Do you think there's more to the story for FormFactor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives