- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

AI Chip Demand Surge Might Change the Case for Investing in FormFactor (FORM)

Reviewed by Sasha Jovanovic

- On October 7, shares of semiconductor testing company FormFactor rose following an industry boost from AMD and OpenAI’s announcement to power OpenAI’s AI infrastructure with AMD’s Instinct GPUs, highlighting growing demand for advanced chips used in artificial intelligence.

- This development has drawn renewed attention to companies like FormFactor, which are integral in the chip testing segment vital for enabling next-generation AI hardware advancements.

- We'll explore how strengthened AI chip partnerships in the sector could influence FormFactor's investment narrative and earnings outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FormFactor Investment Narrative Recap

Investors in FormFactor are generally buying into the belief that accelerating demand for high-performance AI hardware will drive increased test complexity, leading to higher revenue and potential margin improvement for the company. While the AI-fueled rally in chip sector sentiment is supportive, the most important short-term catalyst, broad AI-driven test expansion, could be tempered by FormFactor’s customer concentration and persistent gross margin pressure, which remain the biggest risks for near-term earnings stability. The impact of the AMD-OpenAI news on these core challenges is encouraging for sentiment, but not yet material for fundamentals.

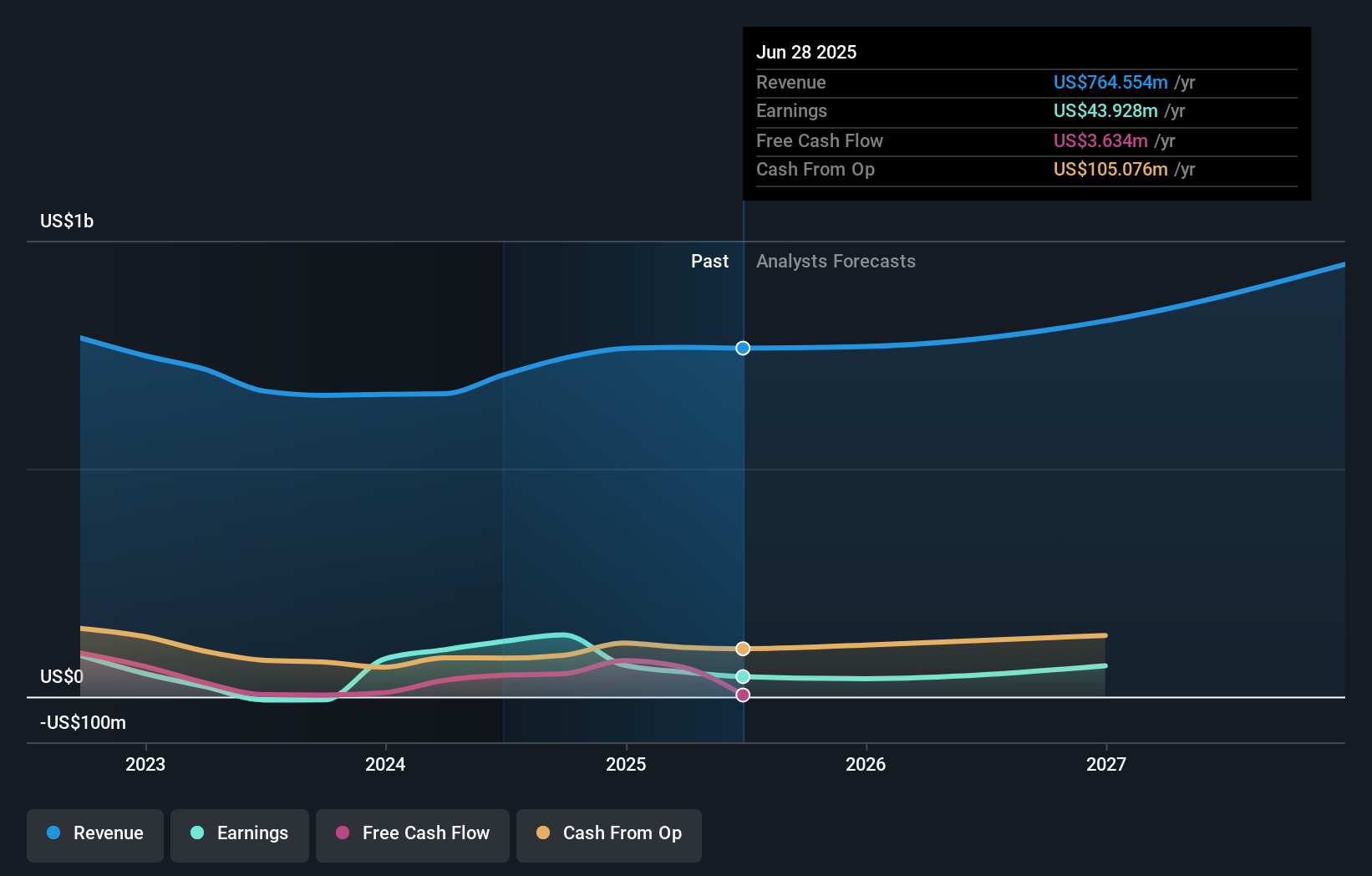

Looking at the latest financials, FormFactor’s Q2 results showed year-on-year declines in both sales and net income, with profit margins compressed to 5.7% from 17.2%. This context highlights the delicate balance between investing for future AI-driven growth and managing the near-term pressures on operating performance, especially as the company expands manufacturing capacity and ramps up new sites in Texas.

Yet, despite growing interest in AI infrastructure, it’s critical to remember that the risk of margin compression due to higher operating costs and product mix shifts is something investors should not overlook, especially as...

Read the full narrative on FormFactor (it's free!)

FormFactor's narrative projects $984.3 million revenue and $97.0 million earnings by 2028. This requires 8.8% yearly revenue growth and a $53.1 million earnings increase from $43.9 million today.

Uncover how FormFactor's forecasts yield a $33.12 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Six private investors from the Simply Wall St Community pegged FormFactor’s fair value estimates between US$10.88 and US$44.63. With such a wide distribution of views, it’s clear that you can find vastly different opinions, especially when weighed against the pressure from lower recent profit margins and sector volatility.

Explore 6 other fair value estimates on FormFactor - why the stock might be worth as much as 17% more than the current price!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives