- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Assessing Enphase Energy After a 90.7% Three Year Slide in Share Price

Reviewed by Bailey Pemberton

- Wondering if Enphase Energy at around $29 a share is a beaten down trap or a genuine value opportunity? In this article, we walk through whether the current price still reflects the company’s long term potential.

- The stock has bounced 5.6% over the last week, but is still roughly flat over 30 days and down sharply, about 59.8% over the past year and 58.8% year to date, after a much steeper 90.7% slide over three years.

- Much of this move has tracked shifting sentiment around solar demand, policy support in key markets, and competition in residential energy solutions. News around changing installation growth expectations and evolving incentives has left investors debating whether Enphase is facing a temporary reset or a more structural slowdown.

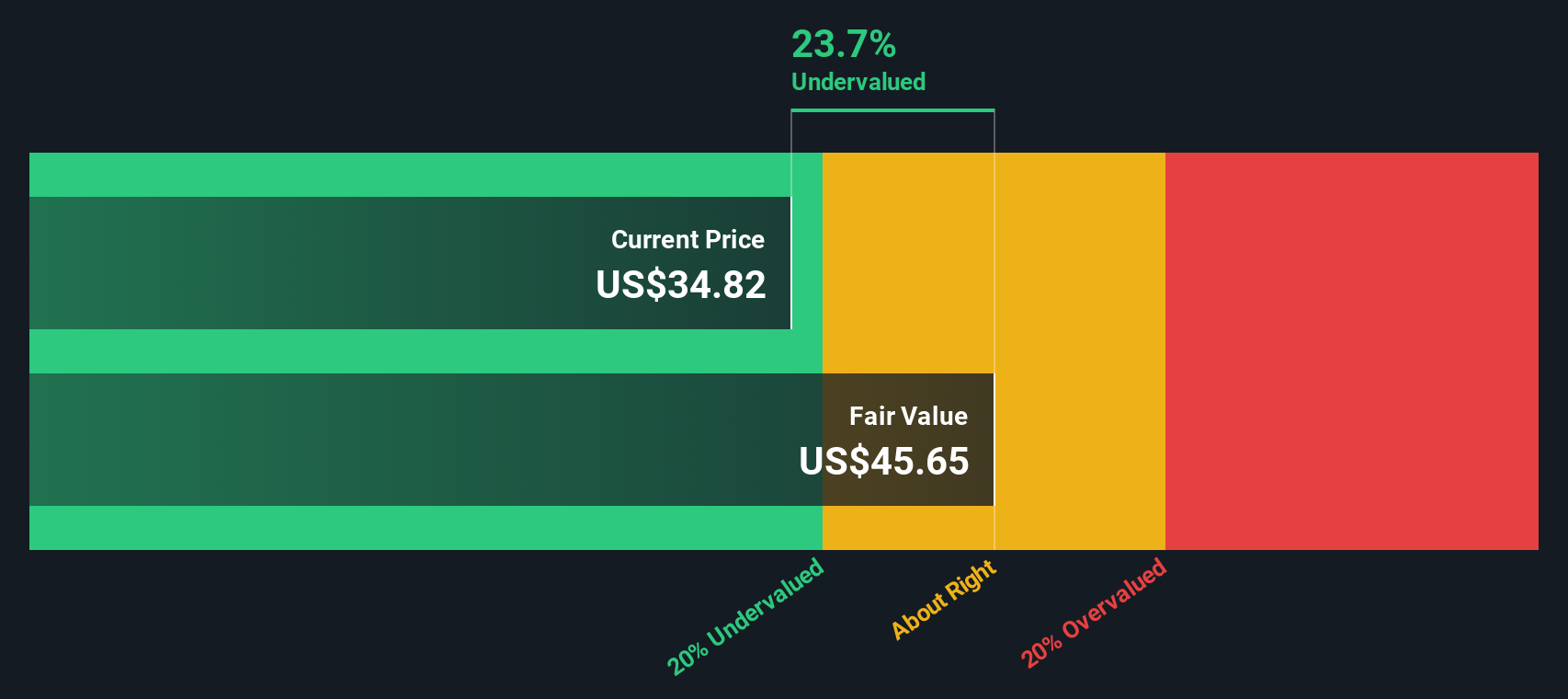

- Despite the volatility, Enphase currently scores a 5/6 valuation score, suggesting it screens as undervalued across most of our checks. In the next sections we will unpack what that means across different valuation methods and hint at an even better way to judge value by the end of the article.

Find out why Enphase Energy's -59.8% return over the last year is lagging behind its peers.

Approach 1: Enphase Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in $ terms. For Enphase Energy, the model starts with last twelve month Free Cash Flow of about $203 million and uses analyst forecasts for the next few years, then extends those trends further out.

Under this 2 Stage Free Cash Flow to Equity approach, Simply Wall St projects Enphase’s Free Cash Flow could rise to roughly $639 million by 2035, with growth moderating over time as the business matures. These yearly cash flows are then discounted back to present value, reflecting the risk and time value of money.

Putting all those discounted cash flows together, the model arrives at an estimated intrinsic value of about $38.60 per share. Compared with the current price around $29, the DCF implies the stock is roughly 23.9% undervalued. This suggests the market may be overly pessimistic about Enphase’s long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enphase Energy is undervalued by 23.9%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Enphase Energy Price vs Earnings

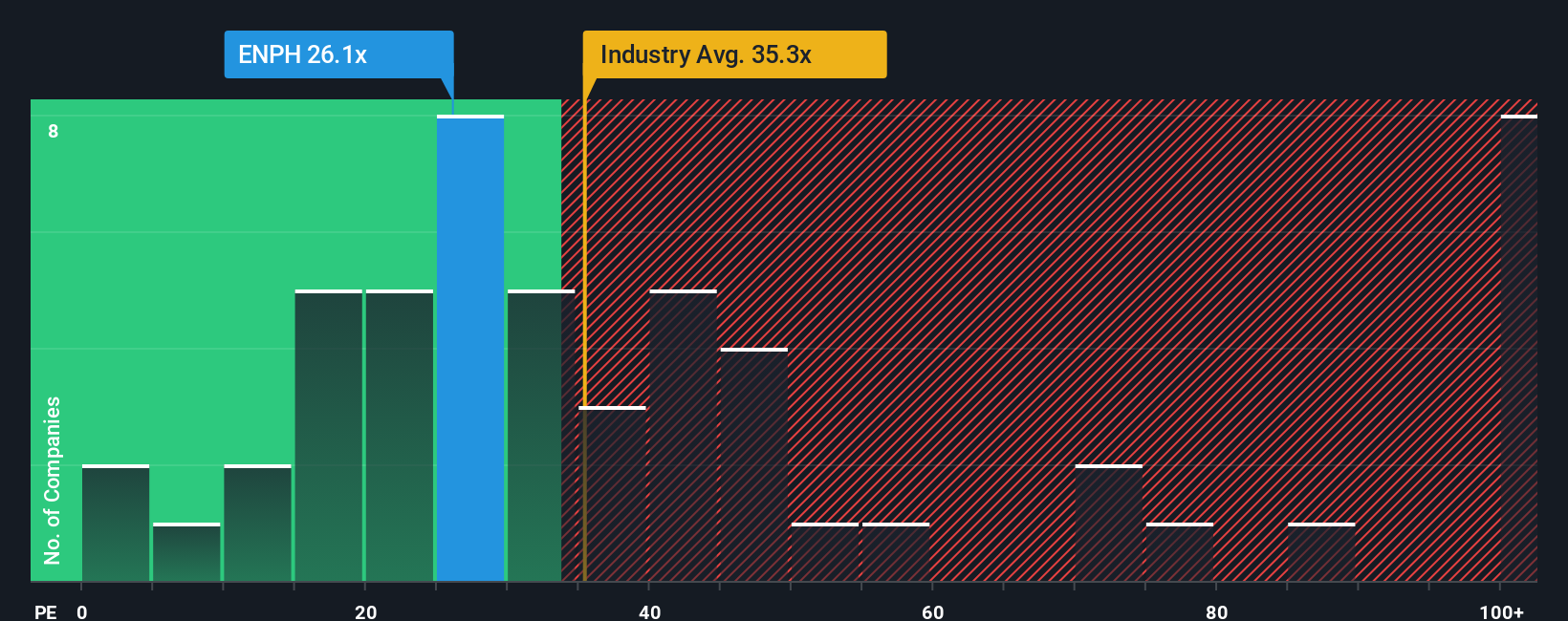

For a profitable company like Enphase, the Price to Earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. A higher PE generally reflects stronger growth expectations or lower perceived risk, while a lower PE can signal either modest growth ahead or heightened uncertainty.

Enphase currently trades on a PE of about 19.7x. That is well below the broader Semiconductor industry average of roughly 37.6x and also far beneath the 71.4x average of its faster growing peers, suggesting the market is applying a noticeable discount. To move beyond simple comparisons, Simply Wall St calculates a Fair Ratio of around 24.1x. This is a proprietary estimate of the PE that would be justified given Enphase’s specific earnings growth outlook, profitability, size, industry context and risk profile. Because this measure is tailored to the company’s fundamentals, it is more informative than looking at broad industry or peer averages alone.

With Enphase trading at 19.7x versus a Fair Ratio of 24.1x, the stock screens as undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Enphase Energy Narrative

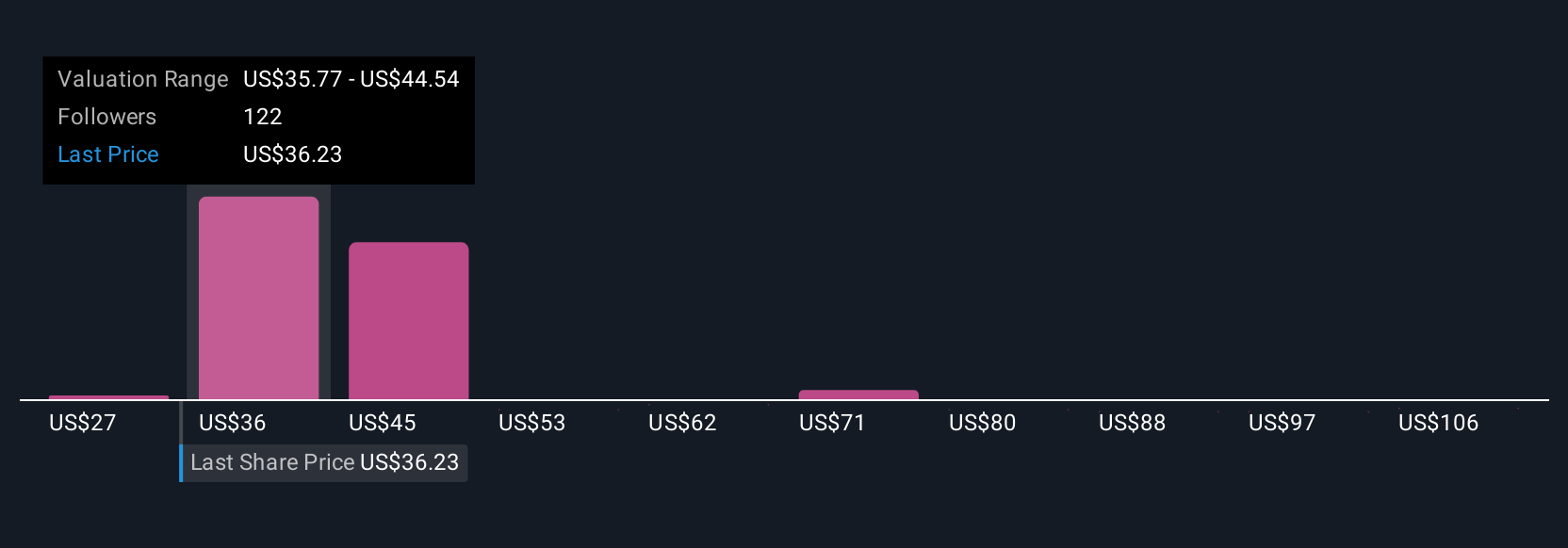

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that connects your view of Enphase Energy’s story with a concrete financial forecast and a fair value you can compare to today’s price. A Narrative on Simply Wall St is your story behind the numbers, where you spell out how you expect Enphase’s revenue, earnings and margins to evolve, link that to catalysts and risks, and then see what share price those assumptions imply. Narratives are available on the Community page of Simply Wall St, used by millions of investors, and they update dynamically as fresh news, earnings and analyst estimates come in, so your fair value estimate stays aligned with the latest information. That means you can quickly see when your Narrative fair value sits well above the current price, or when it falls below, signalling it might be time to trim your position. For example, one Enphase Narrative might assume earnings reach $404.3 million by 2028 and justify a fair value closer to $85, while a more cautious Narrative might lean toward $53 million in earnings and a value near $27, showing how different perspectives can coexist and guide decisions.

Do you think there's more to the story for Enphase Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026