- United States

- /

- Semiconductors

- /

- NasdaqCM:DVLT

Why Datavault AI (DVLT) Is Up 80.9% After Raising Revenue Targets and Expanding Key Partnerships

Reviewed by Sasha Jovanovic

- In recent days, Datavault AI raised its revenue guidance for the second half of 2025 to US$12 million–US$15 million and indicated expectations of surpassing its previous US$40 million–US$50 million target for 2026, citing tokenization demand, licensing, and its IBM partnership as revenue drivers.

- This updated outlook follows a series of new collaborations across sports, esports, and aerospace, highlighting the company's expansion into tangible commercial applications and increasing market relevance.

- We'll now assess how Datavault AI's heightened revenue targets and sector partnerships could reshape its long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Datavault AI Investment Narrative Recap

To be a Datavault AI shareholder, you need to believe in the company’s ability to capitalize on surging demand for tokenization, monetize its intellectual property, and expand through key partnerships, particularly with IBM. The recent revenue guidance increase supports optimism for near-term growth, but the core risk remains around actual revenue realization from large, complex licensing deals, a challenge that has not materially shifted with the new outlook.

Among the latest announcements, the deepening of Datavault AI’s collaboration with IBM, marked by fresh investments of resources and engineering expertise, stands out. This alliance directly relates to the company’s short-term catalysts, offering potential support for both scaling their proprietary data platforms and accelerating enterprise adoption, which underpin their bullish revenue targets.

In contrast, investors should be aware that even with ambitious revenue projections and marquee partners, the risk tied to unrecognized licensing revenue remains...

Read the full narrative on Datavault AI (it's free!)

Datavault AI's narrative projects $94.2 million revenue and $13.3 million earnings by 2028. This requires 176.9% yearly revenue growth and a $81.9 million increase in earnings from -$68.6 million today.

Uncover how Datavault AI's forecasts yield a $3.00 fair value, a 44% upside to its current price.

Exploring Other Perspectives

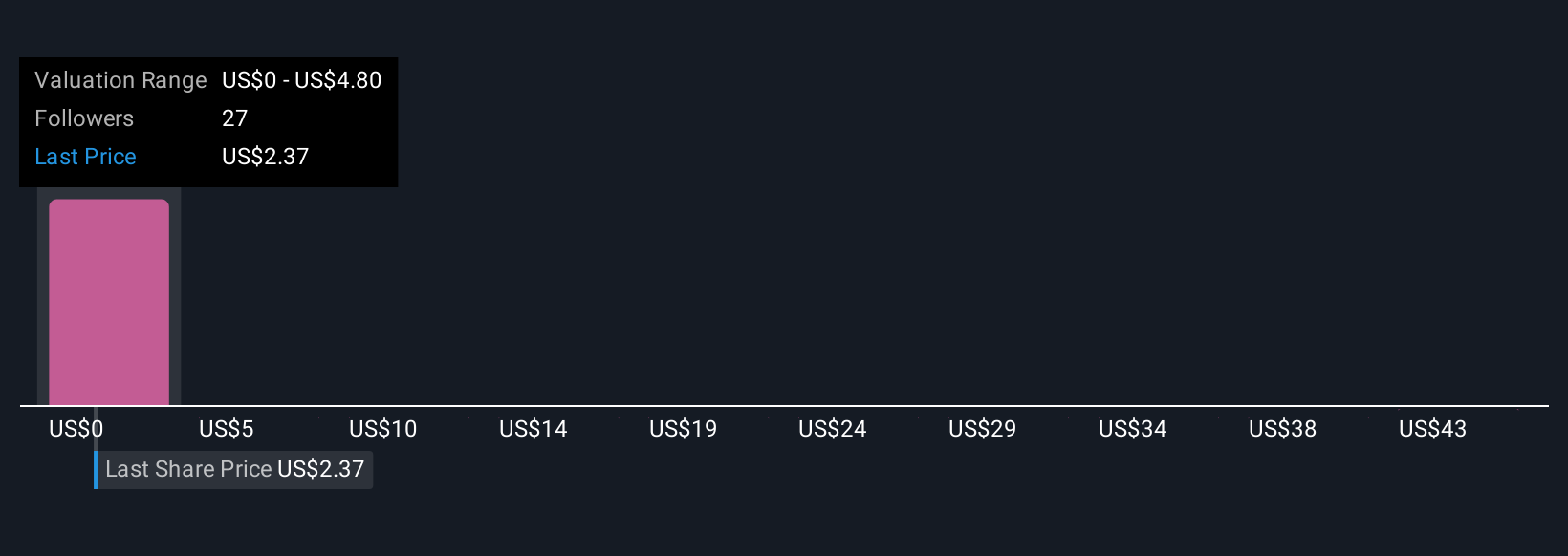

Seven fair value estimates from the Simply Wall St Community span a wide range from US$4,801 to US$48,010 per share. While views differ sharply, the company’s reliance on booking, but not yet recognizing, significant licensing transactions could influence actual results far differently than anticipated, so consider comparing these diverse views to your own scenario analysis.

Explore 7 other fair value estimates on Datavault AI - why the stock might be worth just $4.80!

Build Your Own Datavault AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Datavault AI research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Datavault AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Datavault AI's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DVLT

Datavault AI

A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

Moderate risk with limited growth.

Similar Companies

Market Insights

Community Narratives