Last Update 08 Feb 26

DVLT: Tokenization Pipeline And Index Inclusion Will Support Future Upside

Analysts have trimmed their price target on Datavault AI, highlighting slightly lower assumed discount rates, a modestly stronger profit margin, and a reduced future P/E multiple as the key drivers of the change.

What's in the News

- Datavault AI Inc. has been added to the S&P Semiconductors Select Industry Index, which can affect how index funds and ETFs that track this benchmark gain exposure to the stock. (Index Constituent Adds)

- Stockholders approved an amendment to the company’s certificate of incorporation that increases authorized capital stock from 320,000,000 shares to 2,020,000,000 shares. Of this amount, 2,000,000 shares are classified as common stock, par value $0.0001 per share. (Changes in Company Bylaws/Rules)

- Datavault AI has exclusively licensed its proprietary smart contracts intellectual property to Wellgistics Health Inc. for use in PharmacyChain and EinsteinRx, aimed at digitizing prescription drug tracking and improving visibility for payers. (Client Announcements)

- The company entered a Tokenization Service Agreement with Triton Geothermal LLC, providing for up to US$8,000,000 in tokenization fees tied to an anticipated digital token offering with a projected gross value of about US$125,000,000, plus a 5% participation in Triton’s ongoing digital token transaction fees. (Client Announcements)

- Datavault AI updated its revenue guidance, now calling for 2025 revenue of US$30m to US$60m, compared with US$2.7m in 2024, and indicating an expectation that 2026 revenue will be above US$200m. (Corporate Guidance)

Valuation Changes

- Fair Value: The fair value score is unchanged at 4.0, indicating no adjustment to the overall valuation anchor used in the model.

- Discount Rate: The discount rate has fallen slightly from 10.79% to 10.64%. All else equal, this tends to lift the present value of projected cash flows.

- Revenue Growth: The assumed revenue growth rate remains very large at about 321.40%, with no change between the prior and updated assumptions.

- Net Profit Margin: Net profit margin has risen slightly from 14.70% to 15.45%, reflecting a modestly higher profitability assumption.

- Future P/E: The assumed future P/E multiple has declined from 27.97x to 26.51x, implying a slightly lower valuation placed on future earnings.

Key Takeaways

- Strategic partnerships, proprietary technology, and acquisitions position Datavault AI for robust, high-margin recurring revenue growth across diverse, regulated data markets.

- Compliance-first infrastructure and alliances with industry leaders enable scalable, secure solutions tailored to capitalize on accelerating digital transformation and shifting market regulations.

- Heavy reliance on unrecognized revenue, aggressive acquisitions, exposure to regulatory risks, and dependence on key partnerships could create earnings volatility and limit sustainable growth.

Catalysts

About Datavault AI- A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

- The announcement of multiple proprietary data exchange platforms (International Elements Exchange, NIL Exchange, Political Exchange) launching on compliant, AI-powered infrastructure positions Datavault AI to capitalize on accelerating digital transformation across sectors, suggesting significant future revenue growth as these exchanges monetize new verticals.

- The company's deepened alliance with IBM, including Platinum Partner status and integration of Watsonx.ai, provides Datavault with scalable AI capabilities and best-in-class cybersecurity, supporting enterprise-grade adoption and efficient scaling, which could drive higher net margins by improving operational leverage and reducing per-unit delivery costs.

- Recent advancements in patented proprietary technology and licensing arrangements (e.g., Nyiax, Dolby, WiSA, DataScore systems) and a strengthening of the IP portfolio set Datavault apart from commoditized competitors, enabling monetization of unique solutions that may boost high-margin recurring revenue streams.

- The immediate booking of $2.5 million in licensing (with additional revenue recognition expected as contracts are fulfilled) and strategic acquisitions (CompuSystems, API Media) unlock access to new customer bases and event-driven data flows, enhancing revenue predictability and offering step-changes in topline growth trajectory.

- Regulatory shifts enabling large-scale data monetization in U.S. financial markets (GENIUS Act) alongside Datavault's compliance-first, automated governance infrastructure position the company to benefit from increasing mandates for data transparency and provenance, likely sustaining durable, high-quality earnings growth.

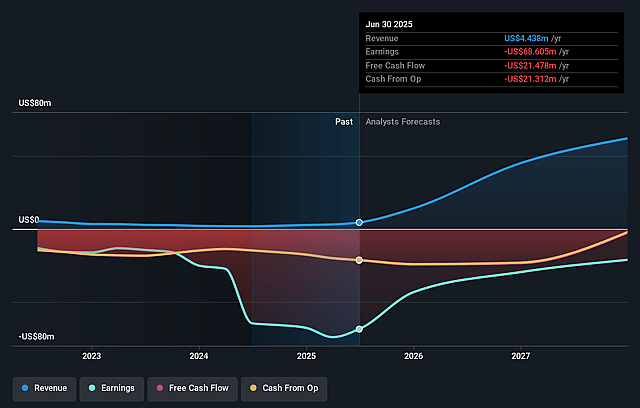

Datavault AI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Datavault AI's revenue will grow by 176.9% annually over the next 3 years.

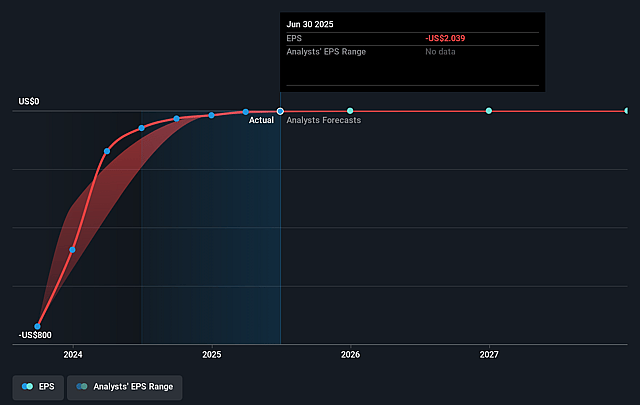

- Analysts are not forecasting that Datavault AI will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Datavault AI's profit margin will increase from -1545.9% to the average US Semiconductor industry of 14.1% in 3 years.

- If Datavault AI's profit margin were to converge on the industry average, you could expect earnings to reach $13.3 million (and earnings per share of $0.11) by about September 2028, up from $-68.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.4x on those 2028 earnings, up from -0.4x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Datavault AI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on booking-but not yet recognizing-large licensing transactions (such as with Nyiax) introduces revenue recognition risks and underscores potential volatility in actual realized revenue, which could impact reported earnings and undermine investor confidence.

- Datavault AI's aggressive acquisition and expansion strategy (e.g., CSI and API Media acquisitions, significant growth targets) could strain integration capabilities and lead to operational inefficiencies; if synergies are not quickly realized or execution falters, this could pressure net margins and delay sustainable profitability.

- The company's positioning in tokenomics, blockchain, and real-world asset exchanges exposes Datavault AI to increased uncertainty and future regulatory scrutiny, with evolving global data privacy and financial compliance frameworks potentially constraining its business model and addressable markets, thereby limiting revenue growth.

- Dependence on key partnerships-such as IBM Platinum and tech integrations with Nyiax and Dolby-and references to unique patent-backed technologies heighten concentration risks; should any partnership falter or intellectual property advantages erode (e.g., due to legal challenges or industry commoditization), competitive moat and revenue streams could be compromised, negatively impacting long-term earnings.

- The narrative highlights rapid scaling ambitions and a focus on capturing new, innovative markets like NIL, political, and elements exchanges, but these early-stage, novel markets can be highly competitive and susceptible to disruption by large, established technology incumbents; failure to establish a dominant foothold amid intensifying competition could suppress future revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Datavault AI based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $94.2 million, earnings will come to $13.3 million, and it would be trading on a PE ratio of 38.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $0.28, the analyst price target of $3.0 is 90.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Datavault AI?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.