- United States

- /

- Semiconductors

- /

- NasdaqGS:CRUS

Earnings Beats And Upgraded Estimates Might Change The Case For Investing In Cirrus Logic (CRUS)

Reviewed by Sasha Jovanovic

- Recently, Cirrus Logic was highlighted as Zacks Bull of the Day after delivering four consecutive earnings beats and seeing analysts raise their earnings estimates, reflecting confidence in its operations and profitability.

- This recognition underscores how consistent outperformance and improving operating margins can influence analyst sentiment, potentially reshaping expectations for a company already undergoing product and end-market diversification.

- Next, we will examine how Cirrus Logic's recent earnings estimate upgrades might influence its existing investment narrative built around diversification and mixed-signal growth.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cirrus Logic Investment Narrative Recap

To own Cirrus Logic, you need to believe its mixed signal and audio expertise can keep it embedded in key consumer devices while diversification slowly takes hold beyond smartphones. The Zacks Bull of the Day recognition and recent estimate upgrades reinforce the near term earnings momentum story, but they do not remove the biggest risk, which remains customer concentration in a handful of large smartphone accounts.

The company’s ongoing US$500,000,000 share repurchase program, with roughly 9.7% of shares already bought back under the May 2025 authorization, is the clearest recent development tied to this stronger earnings backdrop. While buybacks can amplify per share results when profitability is solid, they also raise the stakes if revenue growth later normalizes after recent pull ins or if margin gains prove harder to sustain.

Yet investors should also be aware that Cirrus Logic’s dependence on a small number of smartphone customers could...

Read the full narrative on Cirrus Logic (it's free!)

Cirrus Logic's narrative projects $1.9 billion revenue and $295.7 million earnings by 2028.

Uncover how Cirrus Logic's forecasts yield a $140.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

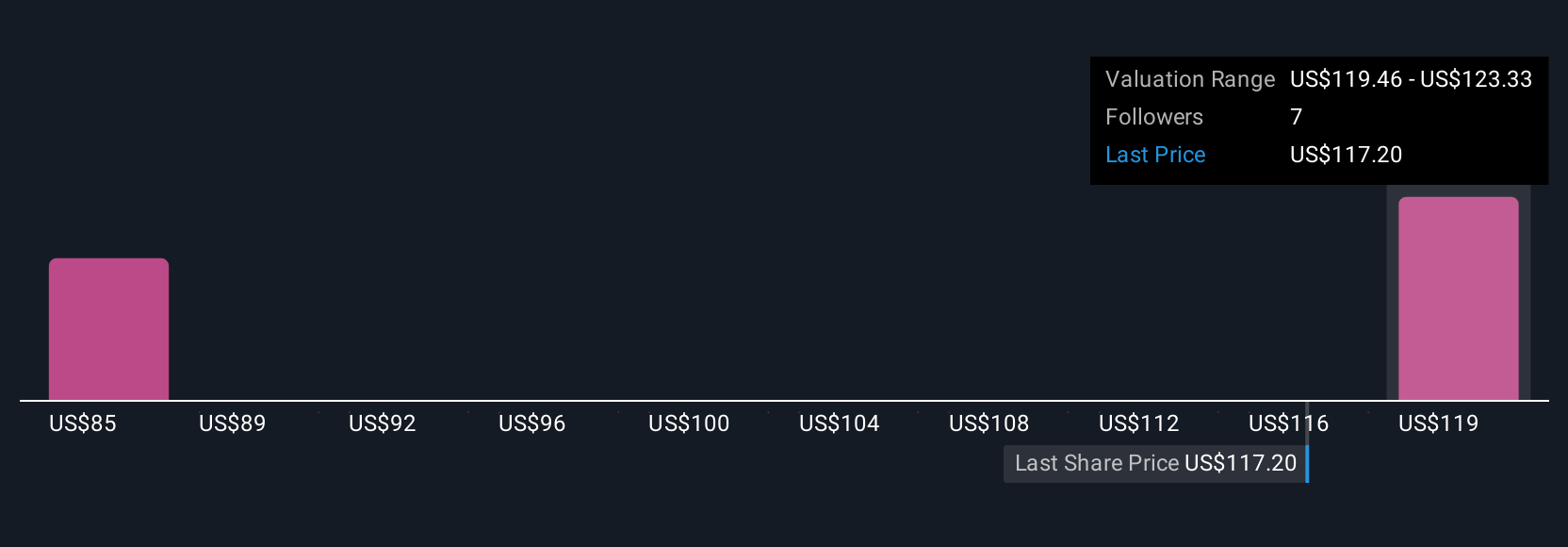

Three members of the Simply Wall St Community currently see fair value between US$84.85 and US$140, highlighting how far apart individual views can be. When you set that against the risk of revenue volatility if a major smartphone customer cuts orders, it underlines why many market participants prefer to weigh several different viewpoints before forming a view on Cirrus Logic’s prospects.

Explore 3 other fair value estimates on Cirrus Logic - why the stock might be worth as much as 15% more than the current price!

Build Your Own Cirrus Logic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cirrus Logic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cirrus Logic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cirrus Logic's overall financial health at a glance.

No Opportunity In Cirrus Logic?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRUS

Cirrus Logic

A fabless semiconductor company, develops mixed-signal processing solutions and audio products in China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026