- United States

- /

- Oil and Gas

- /

- NYSE:SOC

US Growth Companies With High Insider Ownership In December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge driven by a rally in major technology companies, with the Nasdaq Composite breaking past 20,000 points for the first time, investors are keenly observing growth companies that combine potential for expansion with high insider ownership. In this context of record highs and robust tech performance, stocks where insiders hold significant stakes can offer unique insights into company confidence and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| MoneyLion (NYSE:ML) | 18.9% | 89.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and internationally, with a market cap of $11.08 billion.

Operations: The company generates revenue of $245.59 million from its semiconductor segment, focusing on high-speed connectivity solutions for Ethernet applications in various regions.

Insider Ownership: 13.6%

Credo Technology Group Holding shows potential for growth with its revenue forecast to increase by 36.2% annually, outpacing the US market. Recent earnings reported a revenue rise to US$72.03 million, reducing net losses compared to last year. Despite high insider ownership, there has been significant insider selling recently and shareholder dilution over the past year. Credo's expansion into Japan with Net One Systems highlights strategic moves in AI infrastructure markets.

- Click here to discover the nuances of Credo Technology Group Holding with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Credo Technology Group Holding is priced higher than what may be justified by its financials.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $30.90 billion.

Operations: The company's revenue primarily comes from sales of subscription services to its cloud platform and related support services, totaling $2.30 billion.

Insider Ownership: 37.2%

Zscaler is experiencing growth, with earnings projected to increase by 39.26% annually and revenue expected to surpass the US market's growth rate. Despite a recent CFO retirement announcement, Zscaler continues strategic expansions, such as its partnership with Cognizant for AI-enabled security solutions. However, significant insider selling has occurred recently. The company trades at 35% below estimated fair value and aims for profitability within three years while enhancing its cybersecurity offerings through partnerships and product innovations.

- Get an in-depth perspective on Zscaler's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Zscaler's share price might be too pessimistic.

Sable Offshore (NYSE:SOC)

Simply Wall St Growth Rating: ★★★★★☆

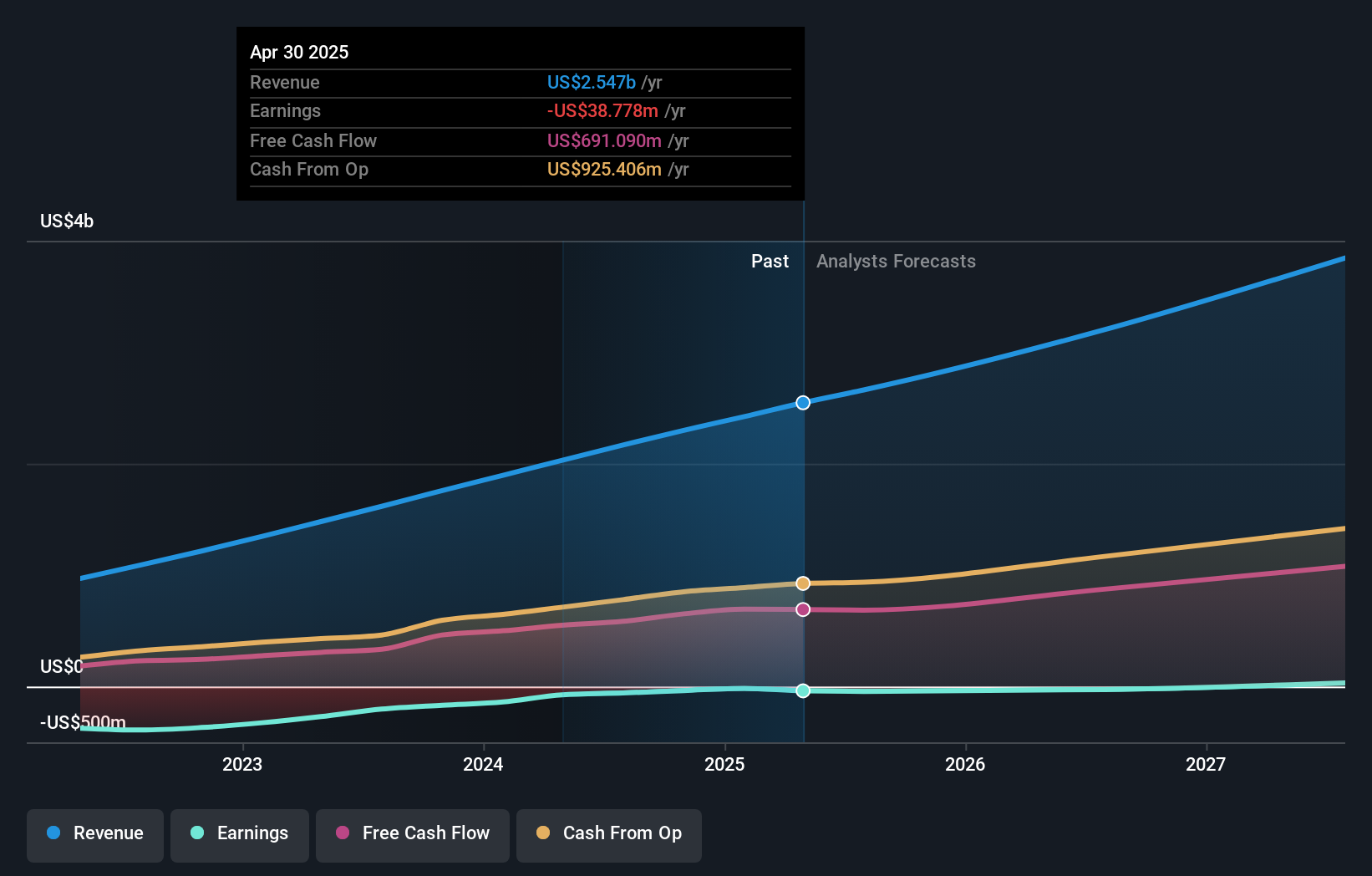

Overview: Sable Offshore Corp. is involved in oil and gas exploration and development activities in the United States, with a market cap of $1.81 billion.

Operations: Sable Offshore Corp.'s revenue streams are derived from its activities in oil and gas exploration and development within the United States.

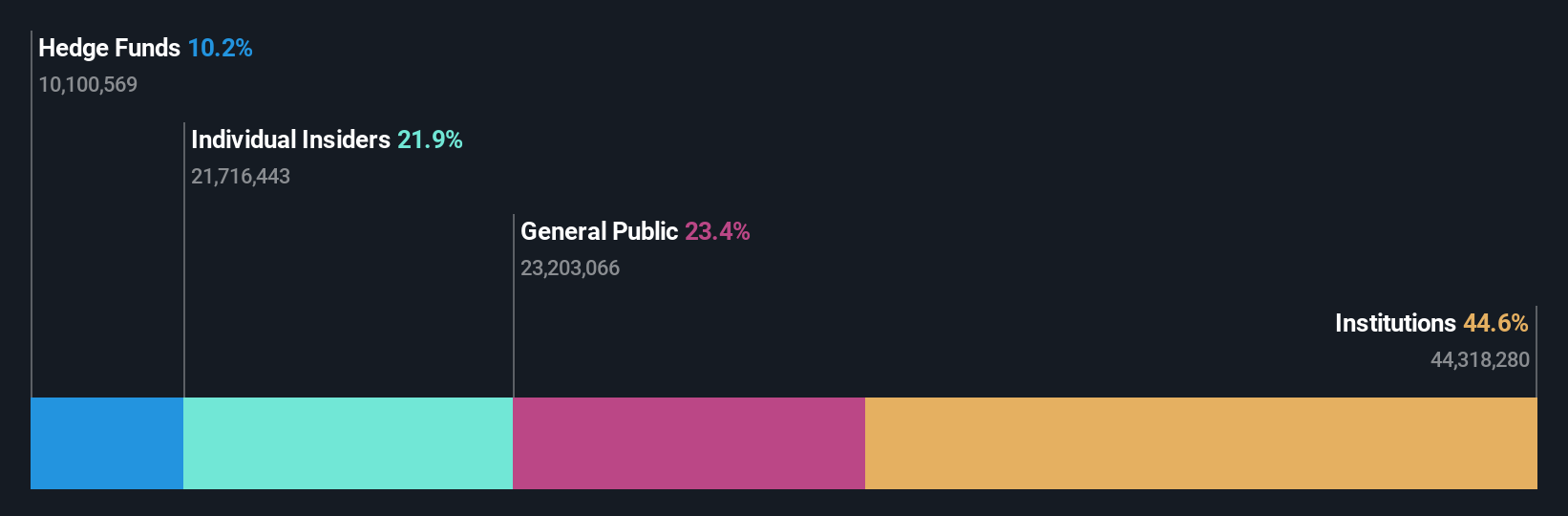

Insider Ownership: 24.3%

Sable Offshore's growth potential is marked by expected annual revenue growth of 100.9%, significantly outpacing the US market average. Despite trading at 88.2% below its estimated fair value, recent financials reveal substantial losses, with a net loss of US$255.57 million in Q3 2024. The company has issued new stock through private placements and shelf registrations, indicating shareholder dilution concerns amidst high volatility in share price and no significant insider trading activity recently noted.

- Click to explore a detailed breakdown of our findings in Sable Offshore's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sable Offshore shares in the market.

Turning Ideas Into Actions

- Click this link to deep-dive into the 201 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Engages in the oil and gas exploration and development activities in the United States.

High growth potential low.