- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group (CRDO): Evaluating Valuation After New AI Network Innovations and OCP Collaboration

Reviewed by Simply Wall St

Credo Technology Group Holding (CRDO) just made waves at the OCP Global Summit by unveiling new ZeroFlap optical transceivers and upgrades to its PILOT software platform. These moves highlight Credo's focus on solving reliability and speed issues in large-scale AI networks.

See our latest analysis for Credo Technology Group Holding.

Credo’s spotlight at the OCP Summit comes just as momentum is building around the stock, with its 1-year total shareholder return reaching an extraordinary 255% and a three-year total return close to tenfold. Recent product launches and continued AI infrastructure focus are energizing investor sentiment, even as the 1-day share price fluctuated and the past month saw a modest pullback. This serves as a reminder to investors how quickly risk and opportunity can shift in this space.

If you're watching semiconductor innovation shake up AI networks, it's an ideal time to discover See the full list for free.

But with the stock’s massive rally and new products already making headlines, the real question now is whether investors are still overlooking further upside or if the future is already fully priced in.

Most Popular Narrative: 14.4% Undervalued

With Credo's fair value set at $160.27, well above the last close of $137.20, the latest narrative points to strong upside potential driven by sustained demand and execution in high-performance connectivity.

The industry-wide transition towards energy-efficient, high-speed interconnects (such as AECs) in data centers and hyperscale infrastructure aligns directly with Credo's product strengths and market leadership. This positions the company to benefit from secular shifts and improving operating leverage and net margins.

Want to know what’s boosting enthusiasm behind this ambitious price target? The narrative hinges on projections for explosive revenue, fatter profit margins, and a soaring future earnings multiple. Wondering just how bold these assumptions are? See for yourself—there’s more to these numbers than meets the eye.

Result: Fair Value of $160.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing hyperscaler spending or intensified competition could quickly challenge today's optimism about Credo's pace of growth and profitability.

Find out about the key risks to this Credo Technology Group Holding narrative.

Another View: What Do Valuation Ratios Reveal?

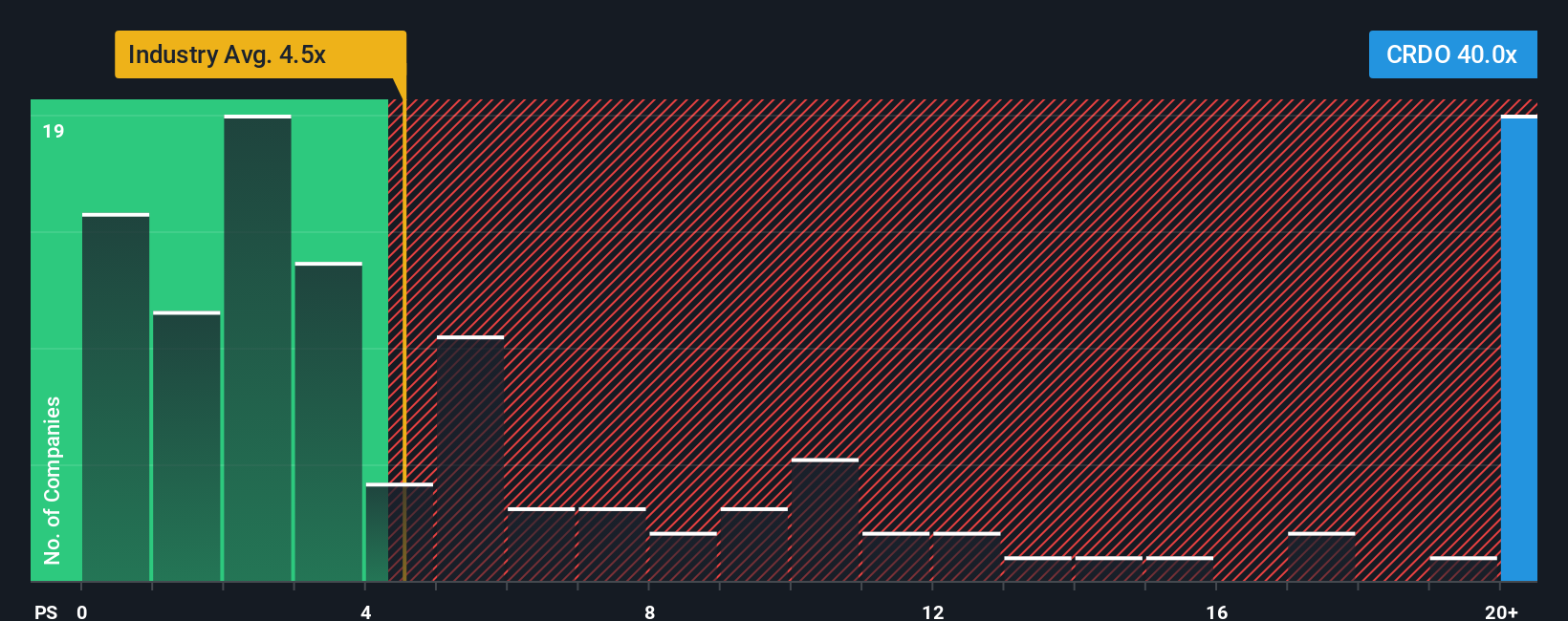

Looking through a different lens, the current price-to-sales ratio sits at 39.5x, far above both the peer average of 13.5x and the US Semiconductor industry average of 5.1x. Even when compared to a fair ratio estimate of 22x, Credo's shares appear to be expensive. Could this premium signal risk if growth expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credo Technology Group Holding Narrative

If you see the story differently or want to run the numbers yourself, you can put together your own perspective in just a few minutes with Do it your way.

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't settle for just following the crowd. Amplify your investing strategy by seizing unique opportunities across fast-changing sectors before others catch on.

- Unlock hidden value by chasing overlooked opportunities with these 878 undervalued stocks based on cash flows, which may offer strong cash flow potential.

- Supercharge your watchlist by targeting the next wave of AI-driven innovation using these 26 AI penny stocks to access standout tech growth stories.

- Capture income and growth by tapping into these 17 dividend stocks with yields > 3%, finding companies with market-beating yields and robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives