- United States

- /

- Software

- /

- NasdaqGS:MNDY

3 High Growth US Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with the S&P 500 and Nasdaq Composite closing higher for the fourth consecutive day, investors are increasingly looking for opportunities in high-growth sectors. In this environment of recovery and optimism, stocks with significant insider ownership can offer a unique advantage, as they often indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 94.1% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here we highlight a subset of our preferred stocks from the screener.

PureCycle Technologies (NasdaqCM:PCT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PureCycle Technologies, Inc. engages in the production of recycled polypropylene (PP) and has a market cap of $1.12 billion.

Operations: PureCycle Technologies generates revenue primarily from the production of recycled polypropylene (PP).

Insider Ownership: 11.1%

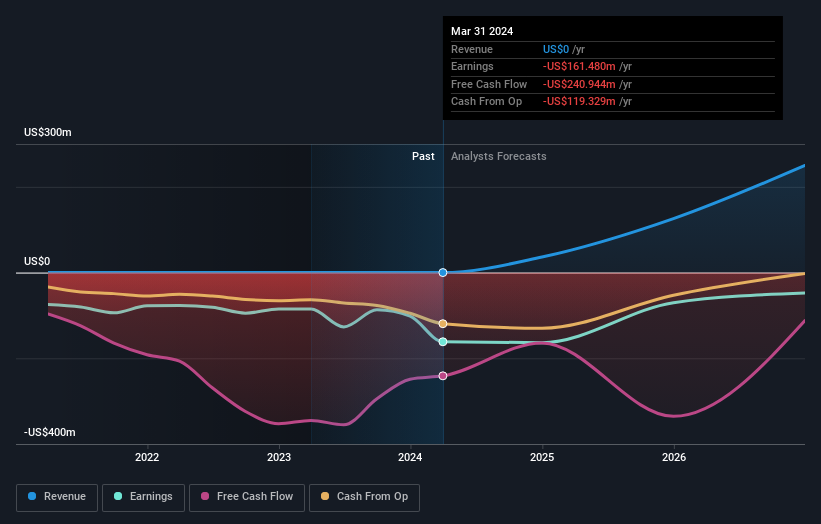

PureCycle Technologies, a growth company with high insider ownership, recently reported a net loss of US$48.21 million for Q2 2024, an improvement from the previous year. Despite the financial losses and volatile share price, the company has promising revenue growth forecasts of 54.3% per year and is expected to become profitable within three years. Recent successful trials with MiniFIBERS highlight its innovative use of recycled materials in textiles, potentially expanding its market applications significantly.

- Unlock comprehensive insights into our analysis of PureCycle Technologies stock in this growth report.

- In light of our recent valuation report, it seems possible that PureCycle Technologies is trading beyond its estimated value.

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and internationally, with a market cap of $4.43 billion.

Operations: The company generates $217.59 million from its Semiconductors segment, providing high-speed connectivity solutions for optical and electrical Ethernet applications globally.

Insider Ownership: 14.1%

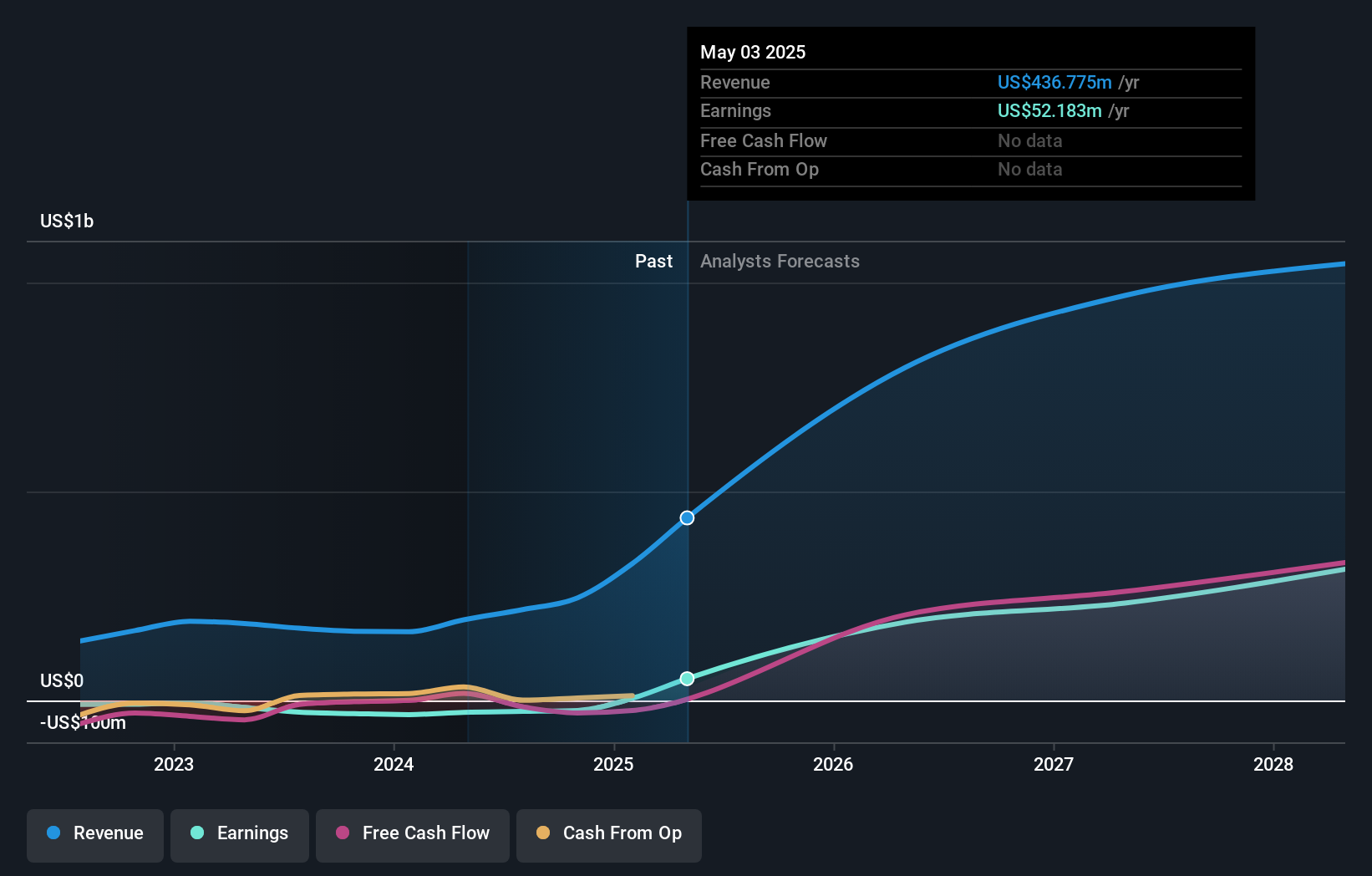

Credo Technology Group Holding, with significant insider ownership, reported Q1 2025 revenue of US$59.71 million, up from US$35.1 million a year ago, and a reduced net loss of US$9.54 million. The company forecasts Q2 2025 revenue between US$65 million and US$68 million. Despite recent share dilution and high volatility, Credo's revenue is expected to grow at 32.5% annually, outpacing the market average of 8.8%, with profitability anticipated within three years.

- Get an in-depth perspective on Credo Technology Group Holding's performance by reading our analyst estimates report here.

- Our valuation report here indicates Credo Technology Group Holding may be overvalued.

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: monday.com Ltd., with a market cap of $12.48 billion, develops software applications across the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Operations: Revenue from Internet Software & Services amounted to $844.78 million.

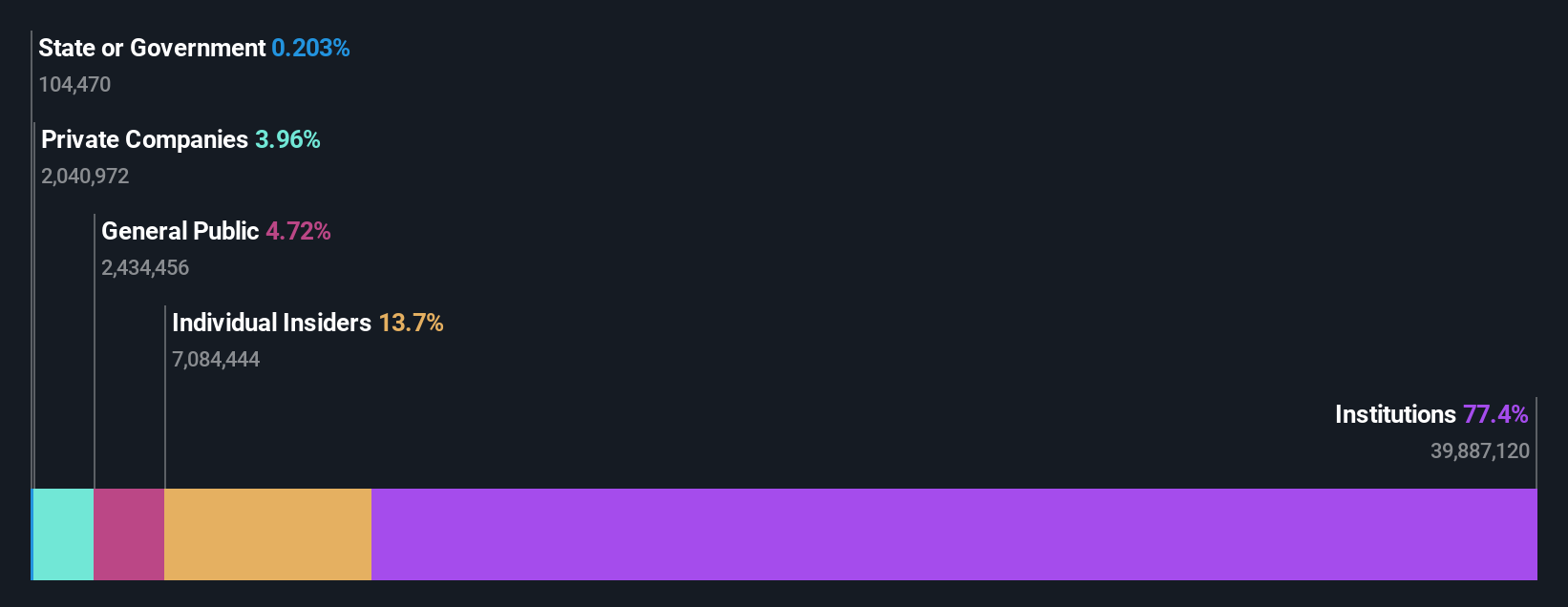

Insider Ownership: 15.7%

monday.com, a growth company with high insider ownership, has shown impressive financial performance, becoming profitable this year. Its earnings are forecast to grow 28.16% annually, significantly outpacing the US market's average. Recent Q2 2024 results revealed revenue of US$236.11 million and net income of US$14.32 million compared to a loss last year. The company also introduced a Portfolio management solution aimed at enterprise customers, enhancing workflow integration and project management efficiency.

- Navigate through the intricacies of monday.com with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that monday.com's current price could be inflated.

Where To Now?

- Explore the 178 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.