- United States

- /

- Semiconductors

- /

- NasdaqGS:COHU

Cohu (COHU) and the AI Breakout Narrative: Is Investor Sentiment Shifting Despite Fund Reductions?

Reviewed by Sasha Jovanovic

- In October 2025, institutional trading strategies and renewed positive sentiment, driven by AI-generated models, signaled a potential technical breakout for Cohu Inc., despite Dimensional Fund Advisors reducing its stake by 296,015 shares as of September 30.

- This surge in trading activity and interest, anchored by predictive AI tools, has shifted market focus from recent institutional divestment to emerging bullish potential for the stock.

- We'll explore how the prospect of an AI-driven technical breakout impacts Cohu's investment narrative and future growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cohu Investment Narrative Recap

To be a shareholder in Cohu, you need to believe that rising demand for advanced semiconductors and expanded applications in automotive, edge computing, and AI will drive long-term revenue growth. The recent AI-driven institutional trading signals introducing near-term bullish momentum may support technical upside, but do not fundamentally change the biggest catalyst, winning next-generation test handler business in high-growth markets, or the largest risk, which remains exposure to cyclical downturns in key end markets. Cohu’s upcoming third quarter 2025 earnings announcement on October 29 is timely, as the market weighs short-term sentiment shifts against longer-term business execution on product qualification and customer expansion. This release is especially relevant given the company’s transition towards more advanced platforms and its efforts to secure a foothold in AI-related semiconductor testing. On the other hand, investors should pay close attention to persistent revenue volatility tied to industry cycles, particularly if...

Read the full narrative on Cohu (it's free!)

Cohu's narrative projects $640.1 million revenue and $90.3 million earnings by 2028. This requires 17.6% yearly revenue growth and a $177.4 million earnings increase from current earnings of -$87.1 million.

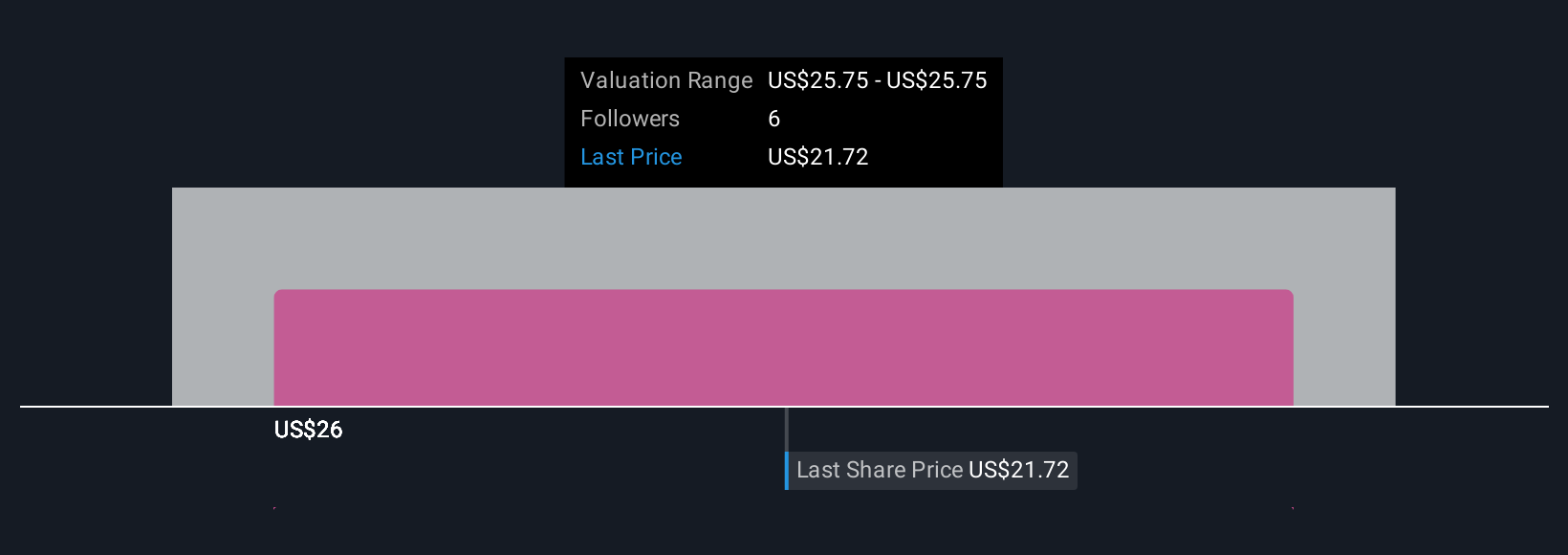

Uncover how Cohu's forecasts yield a $25.75 fair value, a 19% upside to its current price.

Exploring Other Perspectives

All 1 of the Simply Wall St Community's fair value estimates for Cohu clustered at US$25.75. While recent AI-driven market interest may impact sentiment, risks tied to industry cycles remain significant. See how your view compares to these community estimates.

Explore another fair value estimate on Cohu - why the stock might be worth just $25.75!

Build Your Own Cohu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cohu research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cohu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cohu's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COHU

Cohu

Through its subsidiaries, provides semiconductor test equipment and services in the United States, China, Malaysia, the Philippines, Singapore, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives