- United States

- /

- Semiconductors

- /

- NasdaqGM:BZAI

Blaize Holdings (BZAI) Lands Yotta Deal to Power $56M AI Camera Upgrade Across India and Middle East

Reviewed by Sasha Jovanovic

- Blaize Holdings, Inc. recently announced that Yotta Data Services is the end customer for its US$56 million edge AI initiative, which aims to upgrade over 250,000 cameras in India with real-time video analytics, with deployments planned through 2026.

- This partnership positions Blaize at the forefront of AI-powered video surveillance and analytics, supporting Yotta’s expansion plans across India and the Middle East for scalable public safety solutions.

- We’ll explore how powering a large-scale, AI-driven video surveillance rollout with Yotta could strengthen Blaize’s investment narrative in the global analytics market.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Blaize Holdings' Investment Narrative?

For anyone considering Blaize Holdings, the big picture rests on the adoption of edge AI and video analytics across fast-growing markets. The latest announcement tying Blaize to Yotta’s US$56 million surveillance rollout in India may strengthen short-term catalysts for revenue and deal momentum. With this contract, Blaize gains clear visibility into a multi-year project, providing new substance to its expansion story and potentially adding credibility to its aggressive revenue targets. However, material risks remain, such as ongoing deep losses, negative equity, and highly volatile share prices, even as revenue growth accelerates on paper. Prior market analysis didn’t factor in Yotta’s scale and impact, so current risk assessments could shift if further contract wins follow or if execution on such large projects falters. For now, market optimism appears to hinge on delivering sizable real-world deployments, not just partnerships or product launches.

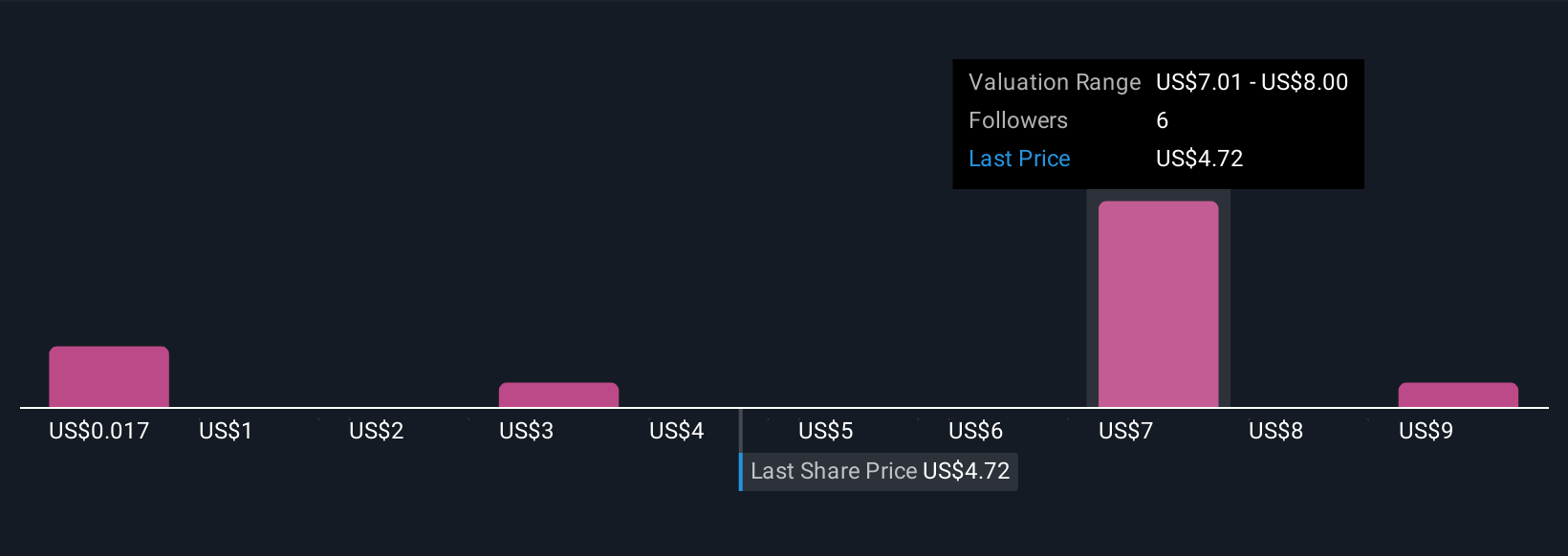

But despite all that, the company’s sustained losses are a critical issue investors need to keep in mind. In light of our recent valuation report, it seems possible that Blaize Holdings is trading beyond its estimated value.Exploring Other Perspectives

Explore 6 other fair value estimates on Blaize Holdings - why the stock might be worth less than half the current price!

Build Your Own Blaize Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blaize Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Blaize Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blaize Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blaize Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BZAI

Blaize Holdings

Provides artificial intelligence (AI)-enabled edge computing solutions.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives