- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Unveils Incident Prediction For Symantec Endpoint Security

Reviewed by Simply Wall St

Broadcom (NasdaqGS:AVGO) recently unveiled its innovative Incident Prediction feature for Symantec Endpoint Security Complete. This announcement coincided with the company's remarkable 28% price increase over the past month. While market trends showed a 4% rise over the last seven days and a 12% increase over the year, Broadcom's performance was notably ahead. Against the backdrop of these general market gains, Broadcom's advance in cybersecurity technology through its AI-driven initiatives might have been an influential factor, bolstering its shares significantly and indicating strong investor confidence.

Every company has risks, and we've spotted 3 weaknesses for Broadcom you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

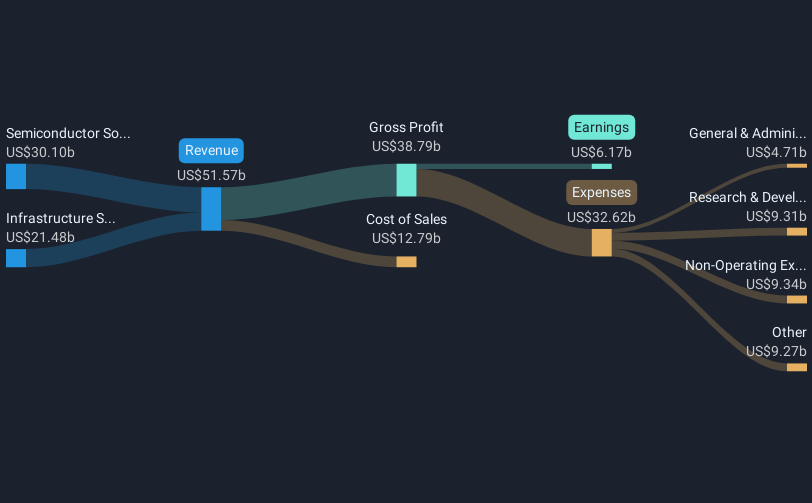

The recent introduction of Broadcom's Incident Prediction feature for Symantec Endpoint Security has the potential to reinforce its narrative of investing in AI R&D and hyperscale partnerships. These advances could enhance Broadcom's position in AI technology, potentially leading to increased customer engagement and revenue growth. This aligns with forecasts that project Broadcom's revenues to reach US$89.6 billion by 2028, driven by expanded AI customer bases and innovative technological offerings. The recent share price increase suggests positive market sentiment towards these developments.

Over a five-year period, Broadcom's total return, including share price and dividends, has been very large, providing context for the company's longer-term investment appeal. Relative to the broader market's returns of 11.6% over the past year and the US Semiconductor industry's 18.5%, Broadcom's recent 28% share price surge over the past month stands out as significant and may be seen as a reflection of investor confidence in its strategic direction.

The company's recent initiatives not only support robust revenue growth projections but also indicate that earnings, currently at US$10.40 billion, could increase as forecasted to US$37.70 billion by 2028. Despite the strong recent share price performance, concerns over geopolitical risks and reliance on hyperscale customers remain. The share price of US$200.09, while appreciably increased, remains below the analyst consensus price target of US$238.54, suggesting room for potential price appreciation should the company meet or exceed growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives