- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Launches Audi Edge Cloud Initiative Amid Last Week's 12% Price Decline

Reviewed by Simply Wall St

Broadcom (NasdaqGS:AVGO) recently experienced an 12% price decline over the past week, coinciding with significant market fluctuations driven by geopolitical tensions regarding tariffs. The technology sector faced its own pressures, with major indexes like the S&P 500 and Nasdaq Composite also recording declines. Broadcom's announcements, including the launch of Audi's Edge Cloud initiative and updates to its DSP portfolio and VMware vDefend, reflect continued innovation. However, mixed market sentiment and sector-specific pressures, including those affecting the company's operations in the automotive and tech industries, may have overshadowed these product and client advancements.

Every company has risks, and we've spotted 3 weaknesses for Broadcom you should know about.

From March 2020 to March 2025, Broadcom's total shareholder return reached a very large 720.22%, illustrating significant long-term growth. This performance contrasts sharply with recent fluctuations and is a testament to robust strategic initiatives over several years. An important development was Broadcom's heavy investment in AI R&D, including the creation of next-gen accelerators, positioning the company as a leader in the AI space. The expansion of its AI customer base and a shift towards subscription models for recurring revenue further underscored its innovative expansion into high-demand areas.

Additionally, Broadcom's corporate maneuvers, such as its strategic alliances, boosted its market presence. Initiatives like the expanded collaboration with T-Systems to promote cloud services exemplified its proactive approach to partnerships. However, Broadcom faces challenges, such as dependency on certain hyperscale customers and geopolitical risks, which could affect its AI revenue. Despite these risks, Broadcom's focus on technological leadership and innovation contributed to its substantial long-term shareholder return. Moreover, the company outpaced the US Semiconductor industry, which returned only 2.7% over the past year.

Learn about Broadcom's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

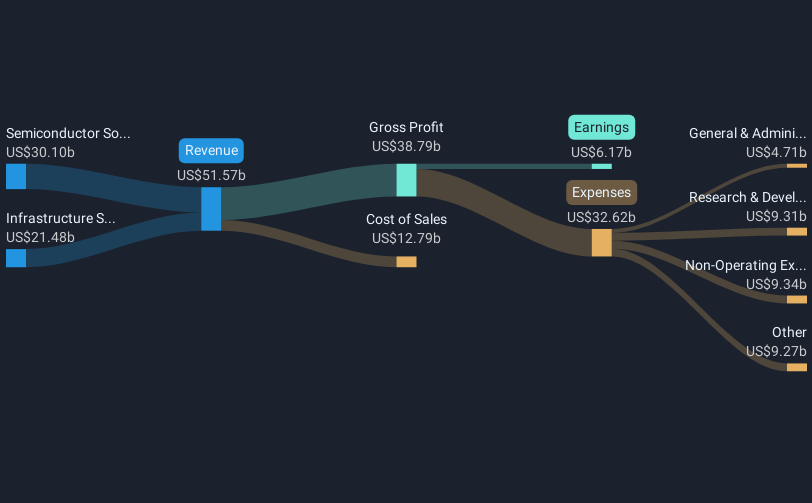

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives