- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Collaborates With Audi For Smart Manufacturing Amid 10% Share Price Dip

Reviewed by Simply Wall St

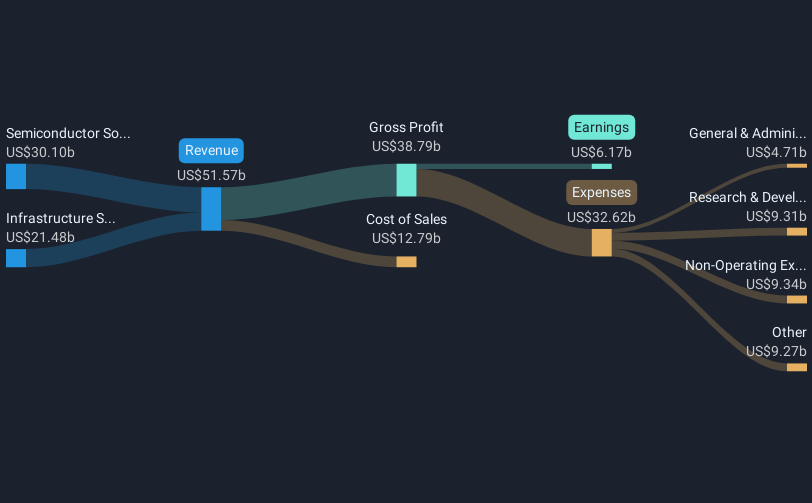

Broadcom (NasdaqGS:AVGO) recently announced its collaboration with Audi on the Edge Cloud 4 Production initiative, aimed at modernizing manufacturing through virtual technologies. Despite this positive technological development, the company's stock experienced a 9.74% decline over the past week. This drop coincided with a broader tech sector sell-off driven by weak consumer sentiment and higher-than-expected inflation reports. The market saw notable declines in major indexes, with the tech-heavy Nasdaq Composite falling 2.7%, impacting Broadcom among other tech giants. This alignment of external economic pressures with Broadcom's share performance highlights investor caution amid macroeconomic concerns.

You should learn about the 3 warning signs we've spotted with Broadcom.

In the past five years, Broadcom's shareholders have seen significant total returns, combining share price appreciation with dividends, amounting to a very large increase of 724.28%. This performance surpasses the broader market and highlights Broadcom's strategy in capitalizing on technological advancements. Key elements contributing to this growth include the company's robust engagement in AI R&D, developing next-generation technologies such as 2-nanometer AI XPU packaging aimed at future revenue enhancement, along with expanding partnerships in AI with additional hyperscalers enhancing its revenue potential.

Broadcom's enhancement of its Infrastructure Software, shifting to subscription models and integrating VMware's Private AI Foundation, has bolstered recurring revenue potential. Strong financial results, as reflected in recent earnings reports, affirm rising sales and net income. Additionally, the company actively returns value to shareholders through quarterly dividends and share repurchase programs, further solidifying its commitment to shareholder returns.

Take a closer look at Broadcom's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives