- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (NasdaqGS:ARM) Q3 Earnings Surge Despite 14% Stock Decline

Reviewed by Simply Wall St

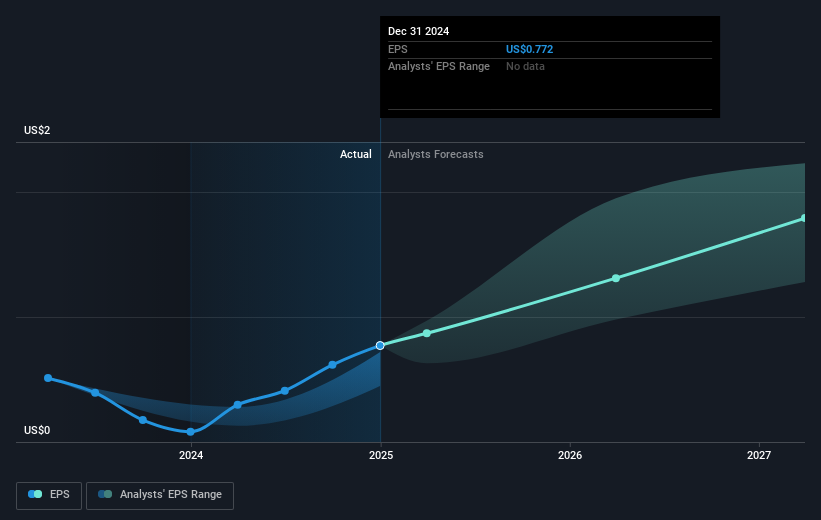

Arm Holdings (NasdaqGS:ARM) recently announced a robust increase in revenue and net income for the third quarter, up significantly from the previous year. Despite this strong performance, its stock recorded a 14% decline over the last quarter. This price movement might be influenced by broader market conditions, with global stocks experiencing fluctuations due to newly imposed tariffs and economic uncertainty. These factors have led to a tangible impact on investor sentiment, particularly in the technology sector, where companies like Arm operate. While the overall market saw a 2.5% drop over the past week, Arm Holdings' substantial Q3 earnings growth and positive future guidance suggest that external pressures, including international trade tensions and potential acquisition discussions with Ampere Computing LLC, might have played a role in the stock's recent trajectory. Investors continue to watch these developments closely as they evaluate potential implications for Arm's future returns.

Dig deeper into the specifics of Arm Holdings here with our thorough analysis report.

Over the past year, Arm Holdings experienced a total return of 12.25%. This performance stands in contrast to both the US Semiconductor industry and the broader US market, which returned 19.3% and 15.3% respectively. Notably, despite Arm’s substantial earnings growth over the same period, the stock underperformed in comparative terms.

Several factors may have influenced this outcome. Arm has engaged in significant merger discussions with Ampere Computing, reflecting strategic industry interest. Additionally, quarterly earnings releases showcased impressive sales and income growth for the segments reviewed, though their combined impact didn't translate proportionately to shareholder returns. Further, market analysts indicate Arm’s shares as trading far above their estimated fair value, potentially limiting upward price traction. Lastly, management changes, such as appointing Eric Hayes as Executive Vice President, underscore ongoing organizational shifts that may weigh on investor confidence during times of transformation.

- Get the full picture of Arm Holdings' valuation metrics and investment prospects—click to explore.

- Analyze the downside risks for Arm Holdings and understand their potential impact—click to learn more.

- Hold shares in Arm Holdings? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers rely on to develop products.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives