- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (ARM): Does Nvidia's Intel Alliance Challenge a Key Pillar of the Competitive Moat?

Reviewed by Simply Wall St

- Earlier this week, Nvidia announced a US$5 billion investment in Intel to jointly develop new data center and PC products, some of which will compete directly with Arm-based solutions.

- This move comes as Arm shifts from licensing its chip architecture to designing its own chips, altering established industry relationships and raising questions about Arm's future market positioning.

- We'll examine how Nvidia's Intel partnership, at a time when Arm is directly entering chip design, may affect the company's investment case.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Arm Holdings Investment Narrative Recap

To be a shareholder in Arm Holdings, one must trust in the global expansion of Arm-based solutions across AI, data centers, and emerging markets. The biggest short-term catalyst remains Arm’s growing data center market share, while the greatest present risk is execution challenges as Arm shifts to designing its own chips. Nvidia’s US$5 billion investment in Intel introduces new competition, but its immediate impact on these key factors appears limited for now.

One of the most relevant recent announcements is Arm’s partnership with Cerence to advance AI-driven automotive solutions. As Arm ventures more deeply into new product categories and end-market applications, these initiatives could bolster its diversification beyond smartphones, supporting the catalysts tied to new vertical growth.

By contrast, investors should be mindful that growing vertical integration among major customers could reduce Arm's external licensing market and challenge recurring royalty streams, especially if...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings' outlook anticipates $7.4 billion in revenue and $2.3 billion in earnings by 2028. This reflects a 21.5% annual revenue growth rate and a $1.6 billion increase in earnings from the current $699.0 million.

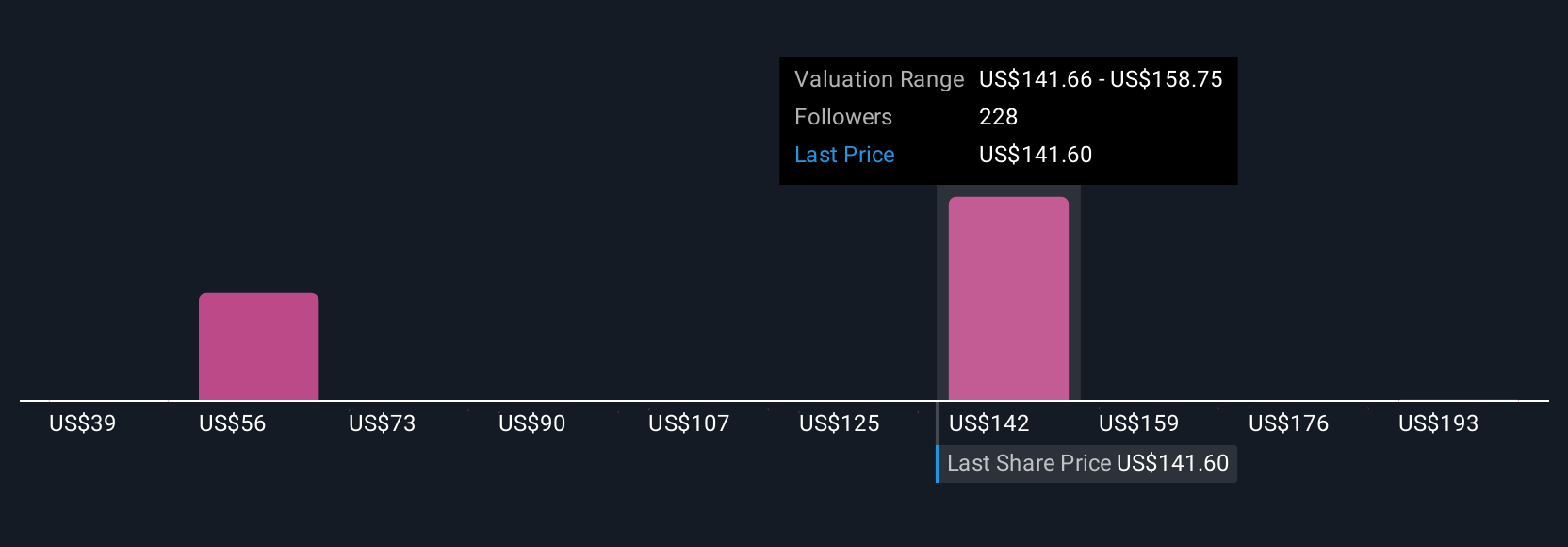

Uncover how Arm Holdings' forecasts yield a $152.59 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Some analysts were forecasting Arm’s revenue to reach US$8.6 billion and earnings US$2.8 billion within a few years. Those highest expectations hinge on Arm capturing much greater data center market share, showing how optimistic opinions can be. As new developments emerge, it is worth considering how the investment story could shift.

Explore 21 other fair value estimates on Arm Holdings - why the stock might be worth less than half the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

No Opportunity In Arm Holdings?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives