- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

How Amkor’s $7 Billion Arizona Campus (AMKR) Has Changed Its Advanced Packaging Investment Story

Reviewed by Sasha Jovanovic

- Amkor Technology, in collaboration with the Trump Administration, recently broke ground on an expanded advanced semiconductor packaging and test campus in Arizona, increasing its total planned investment for the project to US$7 billion across two phases and creating up to 3,000 jobs.

- This expansion establishes the first high-volume advanced semiconductor packaging facility in the US, positions Amkor as a core supplier for leading customers like Apple and NVIDIA, and is supported by government incentives under the CHIPS for America Program.

- We'll explore how Amkor's US$7 billion Arizona campus investment could reshape its investment narrative around advanced packaging leadership.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Amkor Technology Investment Narrative Recap

To own Amkor Technology, shareholders ultimately need conviction in the multi-year global shift to advanced semiconductor packaging, particularly US-based manufacturing for leading-edge customers. The Arizona expansion solidifies Amkor’s position in this narrative, but the project's hefty US$7 billion price tag also amplifies near-term financial risk tied to cyclical end-market demand, a factor that could materially impact margins if utilization lags expectations.

Among recent announcements, Amkor's completion of a US$500 million senior note refinancing deserves attention. Reducing future interest costs supports the company’s capital requirements as it embarks on this sizable Arizona build, tying directly into the catalyst of scaling capacity for AI, high-performance computing, and mobile customers.

Yet in contrast, investors should be mindful that even with massive expansion plans, the possibility of demand shortfalls or overcapacity could place persistent pressure on net margins and returns on invested capital if…

Read the full narrative on Amkor Technology (it's free!)

Amkor Technology's outlook forecasts $7.8 billion in revenue and $569.6 million in earnings by 2028. This scenario assumes a 7.0% annual revenue growth rate and an increase in earnings of $265.8 million from the current $303.8 million.

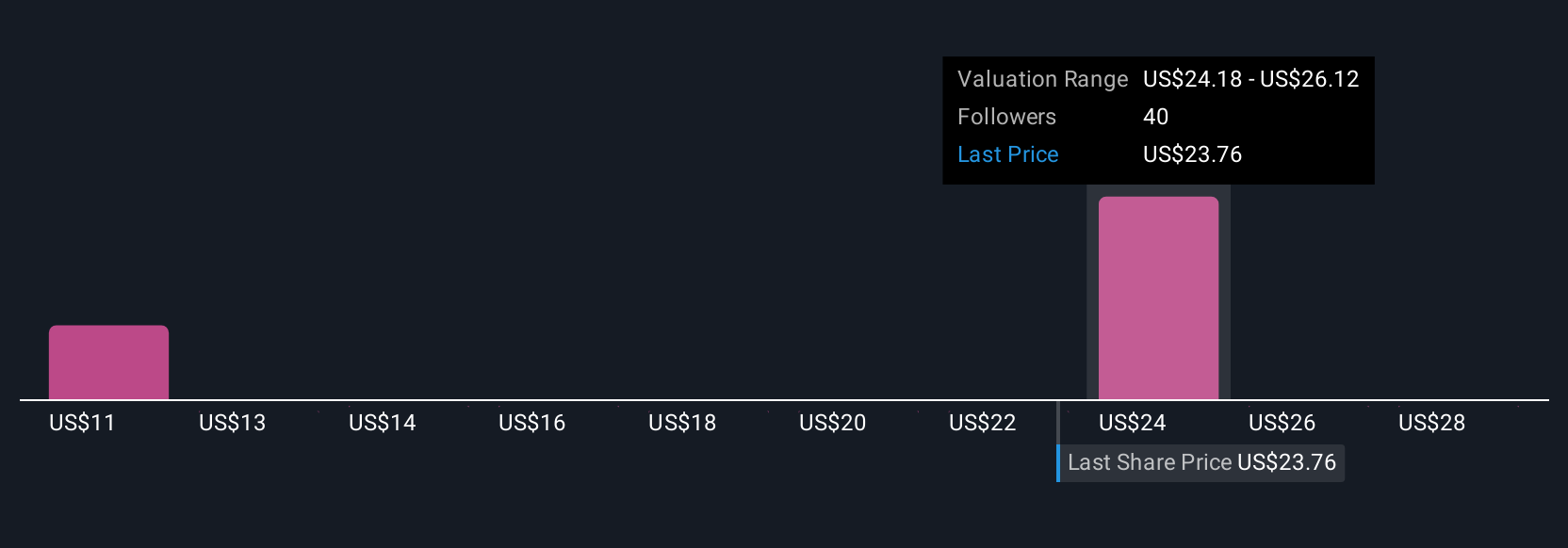

Uncover how Amkor Technology's forecasts yield a $25.38 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimate Amkor's fair value from US$7.73 to US$30 per share. While expansion in Arizona boosts US packaging leadership, heavy multi-year capital spending remains a key variable for future returns. Consider these varied outlooks as you weigh your own perspective.

Explore 6 other fair value estimates on Amkor Technology - why the stock might be worth as much as 6% more than the current price!

Build Your Own Amkor Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amkor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amkor Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives