- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

Assessing Amkor Technology’s Valuation After Announcing Major Arizona Expansion and Supply Chain Push

Reviewed by Kshitija Bhandaru

Amkor Technology (AMKR) just announced a substantial expansion of its Arizona campus, boosting its total investment to $7 billion for new advanced semiconductor packaging and test facilities. This move strengthens Amkor’s U.S. manufacturing presence.

See our latest analysis for Amkor Technology.

Amkor’s expanded Arizona investment comes as the company continues to build momentum with recent headlines not only on its major new facility but also a notable industry presentation last month. While the 1-year total shareholder return sits at just 0.05%, long-term holders have seen robust gains, with the 3- and 5-year total shareholder returns reaching 85% and 155% respectively. That long-term track record hints that investors are still taking the company’s growth potential seriously, especially with the fresh tailwind these expansion plans bring.

If you’re interested in where the next breakthroughs in tech manufacturing could come from, now’s a great time to scan the market and discover See the full list for free.

With shares hovering near modest yearly gains and with those major Arizona investments promising future upside, is Amkor currently trading at an attractive discount, or has the market already factored in its growth prospects?

Most Popular Narrative: 22.9% Overvalued

At $30.57, Amkor Technology trades well above the fair value implied by the most widely followed narrative. This signals market optimism that may not match fundamental forecasts. This sets up a tension between current investor enthusiasm and what analysts expect based on longer-term performance drivers.

Strategic investments in advanced packaging and test operations (notably in Korea and the US) are positioning Amkor as a preferred Turnkey partner for high-performance compute and AI customers. This is resulting in higher utilization rates, premium pricing on leading-edge solutions, and structurally higher net margins over time.

What’s fueling this premium price? The narrative banks on major shifts in Amkor’s profitability mix, with bold assumptions around capacity, pricing, and future margins. Curious about which specific growth levers and financial forecasts are shaping this valuation? The underlying numbers could surprise anyone expecting business as usual. Read on to get the full story.

Result: Fair Value of $24.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures from operational transitions and heavy capital spending could still challenge the bullish narrative if demand fails to materialize.

Find out about the key risks to this Amkor Technology narrative.

Another View: Market Multiples Signal Better Value

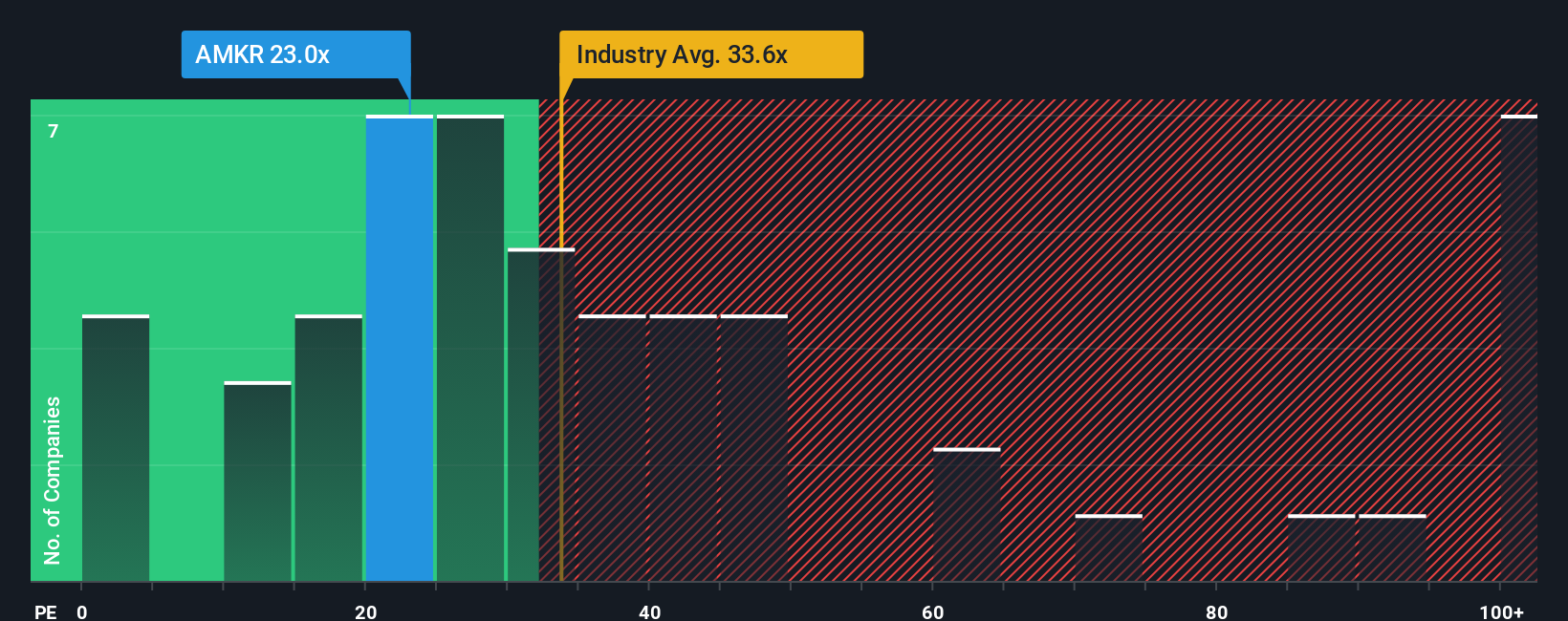

Looking through the lens of market multiples brings a different perspective. Amkor’s price-to-earnings ratio of 24.9x is not only cheaper than both industry peers at 35.1x and the broader sector average of 37x, but it also sits below the fair ratio of 31.8x. This gap suggests investors might be overlooking potential upside or pricing in more risk than the fundamentals deserve. Could the multiples-based valuation be capturing something the consensus price targets do not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amkor Technology Narrative

If you have your own perspective or want to dive deeper into the data yourself, you can easily build a personal take in just a few minutes, so why not Do it your way?

A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't wait and let new market winners pass you by. Gain your edge by checking out these handpicked ideas for your next portfolio move:

- Target real value with these 895 undervalued stocks based on cash flows. This helps you spot companies trading below their true worth before the broader market takes notice.

- Boost your income potential by checking out these 19 dividend stocks with yields > 3%. Here, you can find stocks offering robust yields above 3%, ideal for steady cash flow.

- Tap into future health tech leaders with these 32 healthcare AI stocks, which uncovers businesses transforming medical innovation through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives