- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Can AMD Weather China’s Chip Trade Probe Amid Recent Valuation Concerns?

Reviewed by Simply Wall St

If you have been keeping an eye on Advanced Micro Devices lately, you are probably asking yourself what to do next with AMD stock. It is a tricky moment, and you are not alone if you are weighing the latest price moves against headlines and wondering about value. Let's break it down.

AMD has been the definition of volatility in 2024. Over the past month, shares have dipped nearly 10%, but zoom out a bit and you will see a 33% return year-to-date and well over 100% gains in the last three and five years. Short-term swings have been driven by every conceivable macro twist, including trade tensions, tariff discussions, and global chip supply drama. Recent moves, such as China's anti-discrimination probe into U.S. chip trade policies or the U.S. government's focus on tariffs and the reshuffling of CHIPS Act funding, send ripples across the entire semiconductor space. For AMD, those headlines translate into perception shifts, often faster than the fundamental picture changes.

It is easy to look at those double- and triple-digit gains and feel caught between FOMO and fear. But here is a number just as important as the share price: AMD's valuation score right now is 0 out of 6. That means under the standard checks for companies being undervalued, AMD does not get a pass mark on any of them.

Of course, valuation is more than a single score, and traditional yardsticks are only the beginning. In the next section, we will break down those valuation approaches and, later on, get to an even clearer perspective on what AMD might really be worth.

Advanced Micro Devices scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to estimate a company's value by forecasting its future cash flows and then discounting those cash flows back to their value today. This approach gives investors a sense of what the business could be worth, based on its ability to generate cash in the years ahead.

For Advanced Micro Devices, the DCF model applied uses a 2 Stage Free Cash Flow to Equity method. The company’s most recent Free Cash Flow is $4.1 Billion, and analyst projections suggest a substantial jump ahead: forecasted Free Cash Flow is expected to reach $16.3 Billion by 2029. Notably, while Wall Street analysts only issue detailed forecasts for the next five years, further projections out to 2035 are extrapolated for completeness.

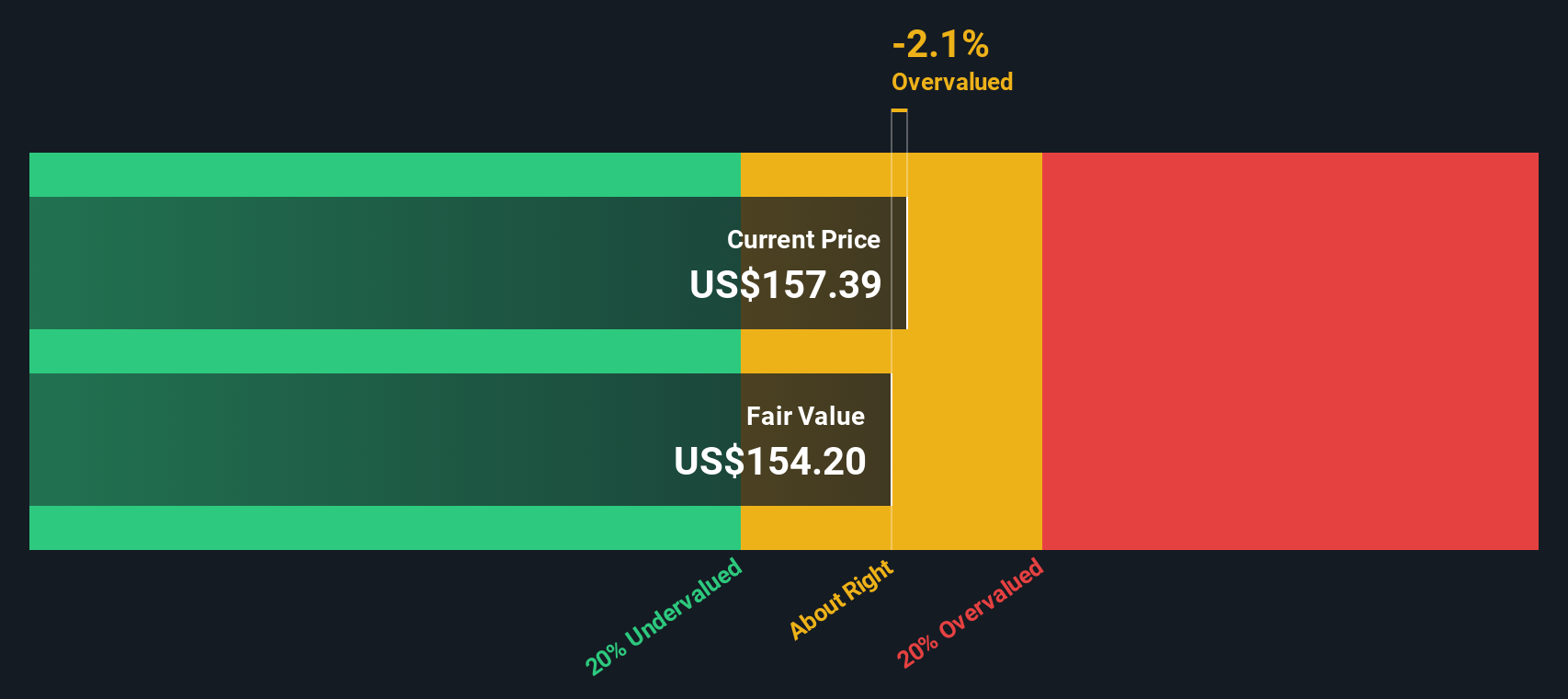

When you bring all these forward-looking numbers back to a present-day estimate, the DCF model calculates an intrinsic value of $154.27 per share for AMD. Comparing that to the current market price, the DCF suggests the stock is about 4.0% overvalued, which is within the usual margin of error for valuation models. Essentially, AMD’s share price is quite close to what the math says it should be.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Advanced Micro Devices.

Approach 2: Advanced Micro Devices Price vs Earnings

For profitable companies like Advanced Micro Devices, the Price-to-Earnings (PE) ratio is a time-tested metric that helps investors compare a company's share price relative to its earnings. This multiple is particularly relevant when a business generates consistent profits, as it reflects both the market's expectations for future growth and the perceived risks associated with those earnings.

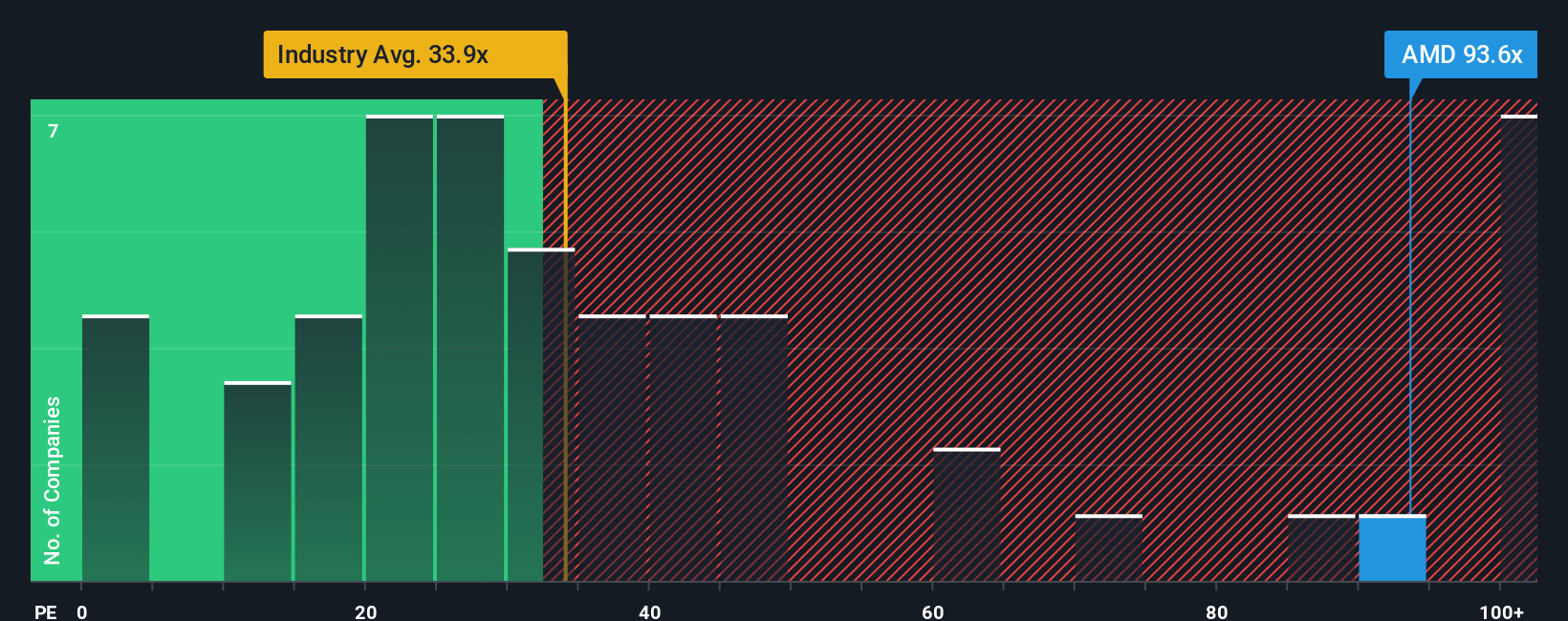

A higher PE ratio can signal that investors expect above-average growth, but it might also reflect additional risk or hype, while a lower PE may suggest modest expectations or uncertainty. Currently, AMD trades at a PE ratio of 95.39x, substantially higher than both the average PE for the Semiconductor industry of 32.20x and its peer average of 34.33x. These benchmarks set a useful context but do not always capture the nuances of AMD's specific future prospects.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio, calculated at 46.95x for AMD, weighs up factors like the company’s projected earnings growth, profit margins, market capitalization, and sector characteristics. This offers a sharper valuation lens than a simple peer or industry comparison. By accounting for how AMD differs from its competitors in growth, risk, and profitability, the Fair Ratio suggests a more individualized "fair" multiple.

Comparing AMD’s actual PE of 95.39x to the Fair Ratio of 46.95x, the stock currently trades well above what would be considered reasonable based on its fundamentals and outlook, pointing to an overvalued position relative to its unique profile.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, numbers-backed story about a company. It combines your forecast for things like AMD’s future revenue, earnings, and margins with your own estimated fair value, all linked to your view of why the business will succeed or face challenges.

This approach goes beyond standard ratios or models. Narratives help you articulate your reasoning: you choose the key drivers, lay out your assumptions, and can clearly see how your story leads to a specific fair value for the stock. On Simply Wall St’s Community page (used by millions of investors), you can easily create, update, and compare Narratives, making it simple to see if your view lines up with the market’s or differs sharply.

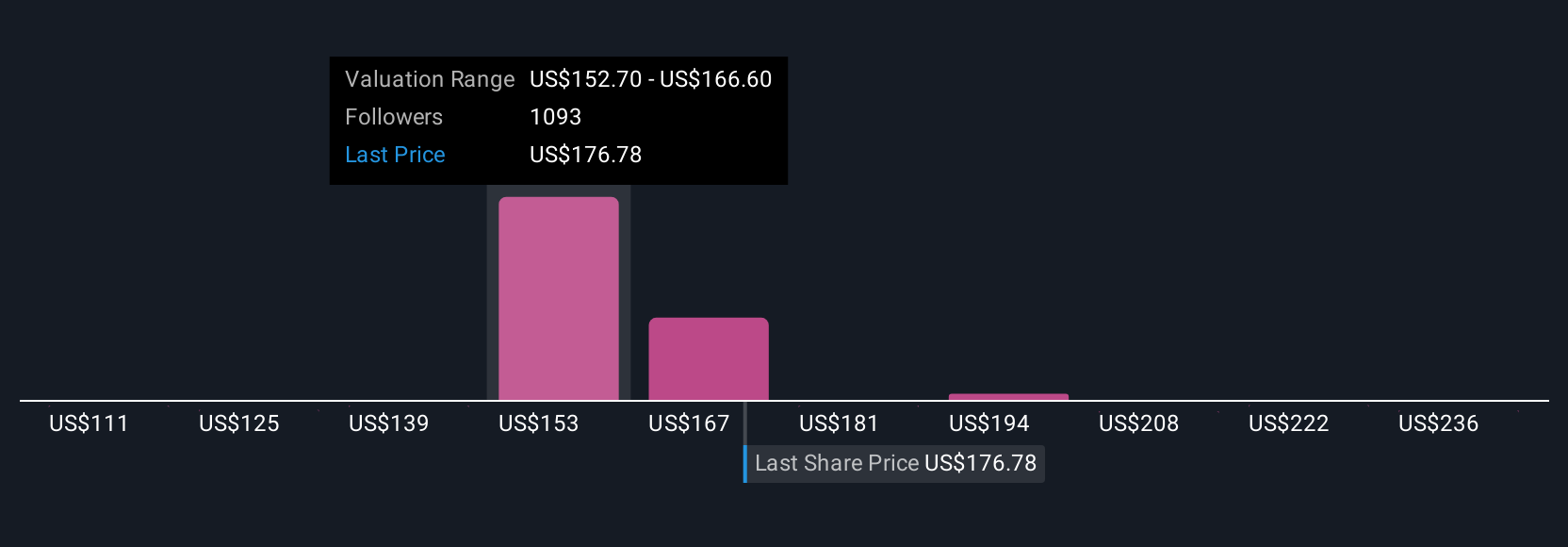

Narratives are powerful because they are dynamic. When new news or earnings arrive, your projected values and fair value update automatically, helping you react fast and continually test your conviction. Investors use Narratives to decide when to buy or sell, based on how their fair value compares with today's price. For instance, some users think AMD is set for rapid AI-driven growth and assign a fair value above $290, while others point to competitive and margin pressures and estimate fair value closer to $136, all through their own Narrative.

For Advanced Micro Devices, here are previews of two leading Advanced Micro Devices narratives:

🐂 Advanced Micro Devices Bull CaseFair Value: $180.10

Currently trading at approximately 11% below this fair value

Revenue Growth: 16.5%

- Highlights AMD’s strategy to lead in desktop CPUs through superior thermal efficiency and competitive pricing. This approach is accelerating market share gains against Intel.

- Anticipates substantial growth in the Data Center and gaming segments, supported by the Xilinx acquisition and aggressively priced, high-value GPUs for budget-conscious gamers.

- Projects that innovations in adaptive hardware and open-source software will help AMD expand in AI, which may offset risks related to Nvidia’s leadership and supply chain challenges.

Fair Value: $103.16

Currently trading at approximately 55% above this fair value

Revenue Growth: 16%

- Warns that intense competition from Nvidia and Intel may force AMD to increase R&D spending, which could erode profit margins over the medium term.

- Expects revenue growth to accelerate in the short term, but suggests growth may slow as AI investment plateaus and cyclical chip demand normalizes.

- Predicts that sustained high costs to maintain competitiveness may limit AMD’s share price multiple, resulting in a lower fair value than current levels.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026