Last Update 20 Nov 24

Fair value Decreased 4.58%The Latest on AMD

Data Center

- AMD reported strong third-quarter results, with revenue reaching a record $6.8 billion, an 18% increase year-over-year, primarily driven by the Data Center and Client segments.

- The Data Center segment, saw a remarkable 122% year-over-year increase in revenue to $3.5 billion. AMD can thank recent sales of its EPYC CPUs and the ramp-up of MI300X GPUs for this growth.

- AMD’s Data Center AI business is accelerating, with significant expansions in MI300X GPU adoption among major customers like Microsoft and Meta. The company raised its 2024 Data Center GPU revenue guidance to exceed $5 billion, up from the prior $4.5 billion, which was undoubtedly raised due to confidence in upcoming products like the MI325X and MI350 series GPUs, aiming to compete more effectively with Nvidia.

Client Segment Success and Market Share Gains

- The Client segment experienced a 29% year-over-year revenue increase to $1.9 billion. The recent launch of the Ryzen 7 9800X3D has been a significant success, quickly becoming a bestseller and topping the performance charts. Intel’s woes have only made this even sweeter for AMD, as AMD captured an incredible 94% of sales this week according to German retailer Mindfactory.

Challenges in the Gaming and Embedded Segments

- Things haven't been as bright in the Gaming segment, which faced a 69% year-over-year revenue decline to $462 million due to lower semi-custom and Radeon GPU sales. Good news could be around the corner though, AMD is preparing to launch its next-generation RDNA 4 architecture GPUs in early 2025, aiming to once again take the fight to Nvidia in preparation for the arrival of the RTX 5000 series.

Embedded Segments

- The Embedded segment also saw a 25% year-over-year revenue decrease to $927 million, which the company attributed to ongoing inventory normalization and softness in industrial markets. AMD is focusing on new products like the Versal AI Core adaptive SoCs to drive to try and strike the fire, though the near-term outlook remains cautious.

My Latest Thoughts

Data Center Segment

- AMD’s performance in the Data Center segment has been super encouraging. The success of the MI300X GPUs and the optimistic guidance for future GPU revenues reinforce my belief that AMD able to trade some blows with Nvidia when capitalising on the AI boom. While I recognize that some of this growth may be front-loaded, the relationships with enterprise partners that AMD has formed and the product roadmap suggest that this momentum will keep building over the next few years, provided the AI boom doesn’t run out of steam.

- I am particularly optimistic about AMD’s strategic approach with the MI325X and the flagship MI350 series. Offering a range of products allows AMD to undercut Nvidia on price with the lower-end model, while still competing on performance with the flagship product, which could attract a broader customer base.

- Original Assumption: I originally forecasted a 15% CAGR for the Data Center segment, reaching approximately $14 billion in revenue by 2028, driven by growing demand for AI-optimized hardware.

- How’s it tracking: The most recent 122% year-over-year revenue growth absolutely blow my forecasts out of the water. I understand that growth is generally explosive out of the gates and begins to taper off as the product matures, but regardless, it seems AMD has done really well at capitalizing on the AI boom. Over the last 12 months, AMD’s data center revenue totals $11.0 Billion, which makes me think I was way too conservative. Seeing as a year has passed, I will also adjust my projections with a 2029 end date in mind. I will assume $22 Billion for Data Center revenues in 2029.

Client Segment

- The Client segment’s performance has exceeded my expectations. The strong demand for Ryzen processors, especially the flagship Ryzen 7 9800X3D has been unprecedented (and undoubtedly helped by Intel’s missing the mark with their latest releases). Intel’s recent struggles seem to be providing AMD with an opportunity to gain market share more rapidly than anticipated. The Mindfactory numbers - although not representative - are a great insight into how well AMD’s products are resonating with consumers. Given these developments, I believe my original revenue projection of $13 billion by 2028 is not only attainable, but may need to be revised upward in the future.

- I am excited about AMD’s potential to become the dominant CPU manufacturer in the desktop market. The positive reception of the Ryzen 9000 series bodes well for AMD’s market position, and I anticipate that this momentum will continue.

- Original Assumption: Expected the Client segment revenue to grow to $13 billion by 2028, fueled by AMD’s competitive advantages and potential market share gains over Intel in desktop CPUs.

- How’s it tracking: The 29% year-over-year revenue growth is a strong indication that the Client Segment is on track to meet or even surpass my original revenue projection. If anything, I suspect AMD’s market position to get even stronger from here, considering their main competitor is struggling not just on the product font, but on the financial front too. I will once again extend my forecasts out to 2029, and will assume that the client segment will generate $15B Billion in revenue in 5 years time.

Gaming Segment

- The revenue decline in the Gaming segment is a concern. However, I view this period as a transitional phase before the launch of the RDNA 4-based GPUs in early 2025. I remain cautiously optimistic that AMD can regain ground by focusing on offering compelling performance at competitive prices, particularly in the value segment of the market. While I acknowledge that Nvidia’s lead in the high-end GPU market is substantial, AMD has an opportunity to attract consumers looking for better price-to-performance ratios.

- Original Assumption: Projected the Gaming segment to grow to $10 billion by 2028, assuming steady revenue growth driven by AMD’s strategy in the low and mid-tier gaming markets.

- How’s it tracking: The gaming segment is really underperforming expectations, but I am also acutely aware of where AMD is at during this point of the cycle. I am probably slightly more bearish on the gaming segment now than I was originally, and so I will hold my current assumption of $10 Billion in revenue, but I will now assume the company will achieve that a year later in 2029.

Embedded Segment

- The challenges in the Embedded segment are more grave than I initially thought. The decreased revenue and AMD’s apparent shift in focus toward the Data Center and Client segments suggest that the Embedded segment may become the ‘forgotten child’ and fail to achieve the growth that I previously expected.

- Original Assumption: Forecasted the Embedded segment to generate approximately $7 billion in revenue by 2028.

- Tracking: Given the 25% year-over-year revenue decrease and ongoing market softness, the segment is underperforming. I am revising my revenue projection for this segment down to $5 billion by 2029.

Valuation Update

- Given my updated assumptions, I’m forecasting $52 Billion in revenue for AMD, representative of 16.5% revenue growth per annum to 2029.

- I will also reduce my discount rate used from 9.7% down to 8.09%.

- I will hold my Net Profit Margin and PE assumptions as is for now.

- The impacts of the above changes will see my Fair Value rise from $182 to $194.

Key Takeaways

- AMD's focus on thermal efficiency and new node advancements will see them overtake Intel in desktop CPU sales.

- AMD pricing strategy to undercut Nvidia in the Low-Mid end GPU markets will be a huge growth driver in the gaming segment.

- The acquisition of Xilinx allows AMD to begin to compete with Nvidia in the Data Center market and target generative AI applications.

Catalysts

Company Catalysts

Competitive Advantage in power and thermal efficiency will lift AMD to the top of the consumer CPU market.

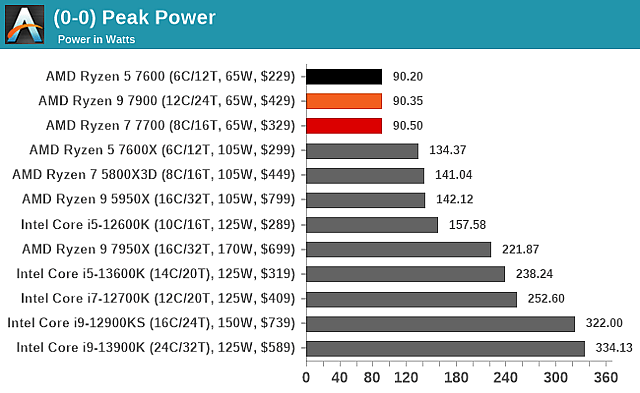

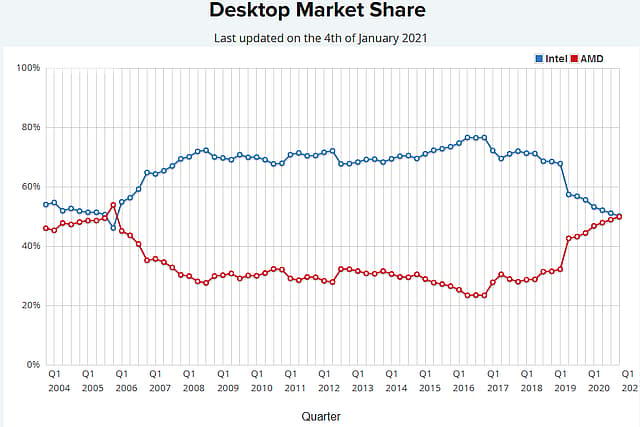

AMD has been steadily gaining market share from Intel in the CPU market, underpinned by the success of its Ryzen and EPYC Data Center processors. The company's commitment to innovation and product development offers a competitive advantage that could fuel future growth. The company’s strategy has been underpinned by the statement “deliver first and for less”. AMD delivered some of the first 7nm chips to make their way into consumer CPUs way back in 2019 with the release of the Ryzen 3000 series making use of the Zen 2 architecture. Intel is still yet to release a consumer CPU using a 7nm architecture, with the company finally set to deliver a true 7nm process with the release of their upcoming Meteor Lake generation of CPUs which is likely to be delivered in 2024. The release of the Ryzen 3000 series marked a turning point for AMD and it has since made up a lot of ground on Intel in terms of market share through a focus on cost effectiveness. While the different architectures of AMD and Intel CPUs excelled at different things depending on how certain programs made use of single-threaded and multi-threaded performance, AMD has really been able to carve out a groove since the release of Zen 2 and we’re now seeing AMD’s CPUs being lauded for providing performance at competitive pricing and with greater energy and thermal efficiency that its intel counterparts.

AnandTech: Peak Power Draw In Consumer CPUs

AMD’s meteoric rise over the last few years has been captured in their market share growth among desktop users. In Q1 2017, AMD only accounted for around 25% market share in desktop CPUs, however, the success of the Ryzen line of CPUs in a period where Intel has failed to deliver meaningful advancements has seen AMD’s market share jump dramatically to 44% in Q2 2023.

Notebook Check: AMD Catches Intel In PassMark CPU Benchmark Usage

While I don’t necessarily see AMD overtaking Intel in total CPU market share because of Intel’s dominance in the laptop market, I can realistically see AMD slowly chipping away and achieving market leadership among desktop CPUs, particularly if new AMD CPUs continue to focus on backwards compatibility with older motherboard chipsets (something that Intel doesn’t do particularly well and makes AMD more upgrade-friendly). Combine this with a general rise in PC gaming numbers, AMD should see a handy boost in Client segment revenues.

Fruitful pricing strategy in the GPU markets and better performance per dollar will spur on sales growth in tougher economies.

Much like its CPUs, AMD's GPU line strategy aims at delivering high performance at a more affordable price point. While this strategy doesn’t garner the same respect as dominating the hig-end market, it could prove effective at converting more low and middle-budget users particularly as computer component prices continue to rise. AMD's RDNA 3 architecture and the Radeon RX 7000 series may be a generation behind Nvidia in terms of features such as ray-tracing, they can compete with Nvidia on a fairly level playing field when it comes to pure rasterization performance. Some AMD cards are trading blows with Nvidia cards that are priced ~20% higher. This competitive pricing strategy could be a significant growth driver for AMD, particularly in the current high-priced computer components market.

Techspot: Cost Per Frame - AMD Dominates The Price to Performance Charts

Now, there’s more to modern GPU sales that rasterization performance alone, with other card features becoming important considerations for consumers. AMD has recognised this and has also taken the fight to Nvidia on both the adaptive sync and image upscaling fronts. Nvidia’s proprietary G-SYNC technology is a form of adaptive sync that allows the refresh rate of a user’s monitor to sync with the framerate outputted by the GPU, eliminating a phenomenon known as “screen-tearing” when the two processes aren’t synchronized. Unlike G-SYNC, which is an expensive technology that requires monitor manufacturers to license the technology from Nvidia for a fee and requires users to own an Nvidia GPU, AMD’s Freesync is free for monitor manufacturers to license and can work irrespective of a user’s GPU. Likewise, Nvidia’s DLSS AI upscaler, which takes lower resolution output and uses AI upscaling to display it at the resolution of a user’s monitors is an expensive proprietary technology that requires specific Nvidia hardware, whereas AMD’s FidelityFX Super Resolution is an open source software-driven alternative created by AMD that is able to be used with any modern hardware to deliver similar results. This is an important route for AMD to take as it effectively neutralises two of Nvidia’s biggest marketing tools in their cards and has made them free for monitor manufacturers and game developers to implement, creating an inherent bias towards AMD’s solutions in the market. The lower the barriers to enter for AMD’s solutions allow a wider range of consumers to enjoy the same things for a lower cost and AMD users can continue to purchase the more cost-effective Radeon GPUs knowing that they’re no longer being disadvantaged by not paying for expensive proprietary technology and will be solid sales growth driver among low-middle budget consumers.

Acquisition of Xilinx will give AMD the resources it needs to compete with Nvidia and ride the AI wave.

AMD’s recent acquisition of Xilinx could be a game-changer, offering AMD a chance to greatly broaden its product range and increase its market footprint. Xilinx, a known industry leader for its field-programmable gate arrays (FPGAs), adaptive SoCs, AI engines, and specialized software skills, meshes well with AMD’s strategic goals in the growing high-performance and adaptive computing markets - markets that Nvidia is performing incredibly well in. With Xilinx’s tech folded into AMD’s product lineup, AMD can better tackle the rising demands of an expanding number of AI-integrated devices and data-heavy applications like Large Language Models (LLMs) eg. ChatGPT. With the two companies joining forces, AMD is now in a strong position to take a bigger piece of the estimated $135 billion market opportunity spanning across cloud, edge, and intelligent devices.

High-performance computing is becoming a central player in nearly every major trend shaping our future. While CPUs and GPUs will continue to play key roles in these devices, with constant advancements in algorithms and emergence of new standards, we can see a rising demand for adaptive computing capabilities that are crucial to speeding up these evolving workloads.

Adaptive computing is all about silicon hardware that can be highly optimized for specific applications post-production and can be updated almost infinitely. This means operational systems can adapt to new requirements without the need for new hardware installation. Traditionally, if a system was required to undertake some new work that exceeded its current capabilities, hardware would have to be upgraded. This is an expensive exercise at the Data Center-level where componentry costs are in the millions. With adaptive computing, the system is able to adapt the current hardware and optimise the system’s operation to meet the task. This alone should be a very handy selling point for AMD’s EPYC Zynx and Versal line of adaptive SoCs.

Xilinx’s former CEO, Victor Peng, has been brought onboard as AMD President, entrusted with leading AMD’s AI strategy. AMD’s acquisition of Xilinx and its adaptive computing expertise could give AMD the upper hand, potentially revolutionizing its Data Center segment by shifting the focus to creating hardware that excels at generative AI applications. We can already see this begin to play out with the the reveal of AMD’s MI300x processor. AMD has taken aim at Nvidia’s H100 GPU introducing its Instinct MI300x AI supercomputing hybrid processor designed to support generative AI models. For the tech-heads out there, the MI300X has 153B transistors in total and up to 192GB of HBM3 memory. With that much local memory, the MI300X can run the Falcon 40-b, a 40 billion parameter Generative AI model, on just one GPU.

AnandTech: AMD CES 2023 Wrap Up

We will have to wait and see how this benchmarks with Nvidia’s data center hardware once deployment begins but seeing as AMD’s processors are making their way into the El Capitan supercomputer - which should be the fastest in the world once it’s finished - it bodes well for enterprise data center applications.

Industry Catalysts

Growing Demand for Data Centers gives the data center industry an uplift

The ever-increasing digitization of our world means one thing. There's more data to store, process and manipulate than ever before. The need for Data Centers that can support enterprise-level businesses is growing rapidly and so there will inevitably be an industry-wide uplift in demand for hardware that can support it. Even though Nvidia has a stranglehold on the market, many companies operating in the space won't need to innovate too much in order to see an appreciation in hardware sales.

Expansion in Gaming Market bodes well for future sales in PC gaming hardware

The gaming market continues to expand, fueled by emerging technologies such as VR and cloud gaming. This expanding addressable market should benefit all industry players as consumer expenditure on components increases.

Assumptions

Data Center

Based on the recent Q1 2023 results, the revenue growth for the Data Center segment appears to be stagnating. However, I believe this is a temporary situation and the growth rate will rebound and accelerate over the next five years. I attribute this expected growth to a few factors, primarily the rising demand for cloud and AI-optimized hardware, and the potential impact of the Xilinx acquisition, which I think will significantly strengthen AMD's competitive position in the market. Additionally, I see the new collaborations with Microsoft Azure, Google Cloud, and Oracle Cloud as strong growth drivers. Considering these factors, I forecast a compound annual growth rate (CAGR) of 15% for this segment, which would bring the revenue to approximately $14 billion by 2028.

In terms of operating profit, the recent dip in Q1 2023 was due to a surge in R&D expenses, which I see as a positive sign for future growth. I understand that it will likely take some time for the benefits of the Xilinx acquisition and these R&D investments to fully manifest in the company's financials. Despite this, I assume that the operating profit margin will steadily improve over the next five years as these investments start to yield returns. By 2028, I anticipate an average operating profit margin of 25% for the Data Center segment, based on the expected efficiency improvements and benefits of scale.

Client

As we look at the recent full year and Q1 2023 results for AMD's Client segment, you’ll see first-hand the short-term impacts of a PC market slowdown and supply chain adjustments. Revenues have experienced a dip and operating profit has declined significantly, primarily due to reduced unit shipments. But I am viewing these setbacks as temporary, primarily driven by transient market conditions rather than long-term structural issues.

There are a few elements that have me convinced that this is just a passing hiccup for the segment. First, there are over 250 notebooks expected to launch this year with Ryzen 7000 series CPUs, which I anticipate will stimulate a return to normality, powered largely by mobile CPU sales. Second, the launch of the Zen 4 architecture CPUs in September 2022 should yield robust returns once the PC market recalibrates, post the supply-chain induced price hikes of 2022.

As I look further into the future, I foresee an important pivot point for AMD's Ryzen - an increased focus on thermal and energy efficiency. I believe that we are reaching a point where many desktop CPUs already surpass consumer performance demands. As household energy prices continue to rise, I predict a growing consumer preference for CPUs that can deliver excellent performance with significantly reduced power draw. In my view, this is an area where AMD can distinguish itself and is going to be the key factor behind AMD finally surpassing Intel in market share for desktop CPUs. This anticipated shift in market share and consumer preferences is a key reason why I project the Client segment's revenue to grow to $13 billion by 2028.

In terms of operating profit, despite the recent dip, I predict a rebound, driven by enhanced operational efficiencies and the maturation of the Ryzen product line. By 2028, I estimate the Client segment's operating profit margin to hover around 20%, reflective of improved cost efficiencies and stronger demand for energy-efficient CPUs.

Gaming

The gaming segment has shown promising growth, as I take a closer look at the full year results for 2022 and Q1 2023. Despite the decline in desktop GPU sales, semi-custom sales for gaming consoles like the PS5 and Xbox Series X have picked up the slack, leading to an overall revenue increase.

In terms of competition, I do acknowledge Nvidia's dominance in the high-end gaming market, and with Intel joining the race, the landscape is getting more competitive. However, I see an opportunity for AMD here. The consumer PC gaming market is multi-faceted - it spans low, mid, and high-end segments. As Nvidia continues to serve the high-end market, I believe AMD can carve out a niche for itself in the low and mid-tier markets. I'm not overly concerned about Intel at the moment, as I believe it will take them a few years to become a meaningful competitor in this space.

One key aspect of my forecast hinges on AMD's strategy of making software like AMD FidelityFX Super Resolution open source. I anticipate this will pay dividends as developers optimise the product, creating an environment where AMD cards not only compete but potentially outperform Nvidia's offerings in lower-end markets, given we've already seen instances where AMD keeps pace with Nvidia at a more attractive price point. With the upcoming release of AMD’s RDNA 4 architecture GPUs in mind and the continued strong sales of current generation gaming consoles over the next few years I think AMD’s gaming segment will show improving sales, particularly with a focus that centers around offering consumers unparalleled value for money, especially in challenging economic conditions.

Based on these assumptions, I'm forecasting AMD's Gaming segment to grow to $12 billion in revenue by 2028. Despite the segment's increased competition, I anticipate steady revenue growth, driven by AMD's strategic positioning in the low and mid-tier gaming markets. I also expect the open-source approach to AMD's software to contribute significantly to this growth by improving performance per dollar metrics.

Embedded

The Embedded segment presents some unique forecasting challenges due to the recent inclusion of Xilinx in AMD's financial results. Almost all of the short-term growth metrics ae merely due to the inclusion of Xilinx in AMD’s income statements and so it’s hard to extrapolate any growth rates.

Looking ahead, the picture becomes somewhat less clear as the integration of AMD and Xilinx progresses. Still, I believe that there are significant short-term growth opportunities in security storage, edge server, and networks markets, particularly with the introduction of the AMD EPYC 9000 embedded series processors.

Given the complexities of the Embedded segment and my lack of familiarity with it, I'm leaning towards a more conservative approach when forecasting future growth. Starting with a base of $5.8 billion, which I estimate to be the annual revenue with four quarters of Xilinx included (accounting for quarterly variances), I forecast a 9.1% annual revenue growth rate which is inline with estimated growth in the embedded computing segment to 2030. Using this rate, I project the Embedded segment to generate approximately $8.97 billion in revenue by 2028.

Keep in mind, though, that this projection is made under the assumption of a steady 9.1% growth rate and does not account for any major disruptions or benefits from new product releases. While I consider this estimate to be fairly reasonable, it will have to be reviewed and updated as more information becomes available and the integration of AMD and Xilinx continues to unfold.

Risks

Risks to my narrative

Anything you can do, I can do better - Nvidia

AMD’s biggest risk to its future lies simply in the close competition it has with Nvidia. The company has officially joined the $1 Trillion market cap club and looms as a giant fish in the sea that AMD swims in. Although Nvidia has no presence in the consumer CPU space, it absolutely dominates the consumer GPU market, the Data Center and High-Performance Computing markets which are key market footholds that AMD will have to grow their presence in if this narrative were to eventuate.

Supply chain disruptions could be an obstacle for meeting sales targets

The phrases “supply chain disruption” and “global chip shortages” will probably send shivers up the spine of anyone who was invested in tech throughout 2022. Particularly those who were invested in computer hardware manufacturers who saw new supply dry up (pushing out product release timelines) and who had trouble selling older inventory due to supply-driven price hikes.

While the situation at present looks much better, there’s still the risk that supply chains could be thrown into disarray again, especially if a situation between China and Taiwan develops which will impact semi-conductor shipments globally. If we see another massive supply chain disruption, this could through my estimates of future growth out of wack as sales will inevitably decline, margins will erode and new product launches will be delayed.

Have other thoughts on Advanced Micro Devices?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Bailey holds no position in NasdaqGS:AMD. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives